Lithium, discovered in 1817, (Greek for “stone” - symbol “Li” - atomic number ‘3’) is a soft, light silver-white metal which in its pure state is reactive, flammable and easily corrodes when exposed to moist air. In its natural state it is found in compounds, generally bound up in aluminum and silica. It must be handled carefully to avoid skin contact or breathing it in, which can cause irritation to the nose, throat and lungs.

Source data shows that lithium, the lightest and least dense of the solid elements, has the highest specific heat of any solid element (melting at c. 357 degrees F.). It is so light it can float on water and soft enough to be cut with a knife.

The going rate for lithium in commercial use is currently around $6,500/ton, versus less than one third of that amount a little over a decade ago. A fact to consider is that the “price” is not determined through “discovery” of buyers and sellers in an open market, but rather by way of user-supplier negotiation. Bruno del Ama, CEO of Global X Management and portfolio manager of the lithium ETF remarks:

“The price of lithium is an industrial clearing price, which is established between the industrial users and producers. It is very much a bilateral market.”

Where is It Found?

Lithium is “mined” primarily from brine lakes, clays, salt pans and from less commonly from Spodumene, asilicate of Lithium and Aluminum. It is also found in many igneous rocks and mineral springs.Lithium is measured as a portion of the earth’s crust in parts per million - believed to be c. 17 ppm. While there are some occurrences in the U.S., Australia, Russia and China, the majority of global lithium mineral deposits are found in one region of South America - in the Andes Mountains of Chile Argentina and Bolivia. In fact, more than one-third of the world’s known lithium reserves are believed to be found in Bolivia alone.

Chemical & Mining Co. of Chile (Sociedad Quimica y Minera de Chile) is the world’s largest lithium producer. It trades as an ADR (SQM) on the NYSE.

How Much is Available?

The USGS estimates that there is a “Global Lithium Reserve Base” of about 11 million tons.The reserve base includes not only resources that are currently economic (reserves), but also those which are marginally economic (marginal reserves) and currently sub-economic (sub-economic resources).

“Reserves” are defined as that part of the reserve base which can be economically extracted or produced at the time so desired.

The USGS pegs the primary sources of lithium as Bolivia (5.4 million extractable tons), Chile (3 million tons), China (1.1 million tons) and the U.S. (410,000 tons).

William Tahil, Research Director for Meridian International Research, stated in a report in 2007 that:

“If the world was to exchange oil for Lion (lithium-ion) based battery propulsion, South America (which accounts for 75% of current lithium production) would become the new Middle East.Bolivia would become far more of a focus of world attention than Saudi Arabia ever was. The U.S. would again become dependent on external sources of supply of a critical strategic mineral while China would have a large degree of self sufficiency.”

(It is important to note that the above statement, as with virtually any comment pro and con on the topic of the lithium supply/demand matrix, has not gone unchallenged. It is therefore in the interest of those who perform “due diligence” on this topic to read widely from publicly available sources, and then reach conclusions based upon their own “considered opinion.")

Why we Need Lithium

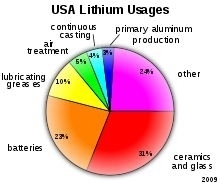

Lithium ions can be administered as a lithium salt (Lithium carbide), taken as a mood-stabilizing drug (in the treatment of bipolar disorder). But the primary interest to investors has to do with its commercial applications – in the production of lubricants, heat-resistant glass (e.g. space telescopes) and ceramics as well as high strength-to-weight aircraft alloys, as fuel for torpedoes, and even as a coolant in nuclear reactors.

It is also used to produce lithium and lithium-ion batteries, this being currently the major focus of investors, producers and end-users. Global warming (now more often referred to as climate change) is a hotly debated topic. But regardless of one’s position on the issue, a major move is underway to begin the transition from carbon-burning gasoline engines in cars and trucks, to some other - hopefully more friendly to the environment – form of propulsion. Hybrid vehicles, which are powered by a combination of gasoline and rechargeable batteries, and straight electric powered vehicles (EVs) all need batteries as a vital component of their operating systems.

By now a well-known item, the Lithium-ion battery has a relatively short history, having been developed only in 1994. Batteries made from lithium are easier to dispose of and cheaper to build than traditional lead batteries. Prior to this time, lithium was used extensively for lubrication, and also found applications in pharmaceuticals, ceramics and aluminum.

By now a well-known item, the Lithium-ion battery has a relatively short history, having been developed only in 1994. Batteries made from lithium are easier to dispose of and cheaper to build than traditional lead batteries. Prior to this time, lithium was used extensively for lubrication, and also found applications in pharmaceuticals, ceramics and aluminum.

The Case for Considering Lithium as an Investment

As mentioned above, a primary “driver” in the demand equation for Lithium for the foreseeable future, will be its increasing use by the auto industry in batteries, for the production of hybrid, plug-in hybrid, and electric vehicles. Arguably no less important, lithium’s use (storing three times the energy of most other competing materials) in cell phones, laptops and other portable consumer electronic products is growing by leaps and bounds as well.

And finally, there is currently a nascent demand – which over time could become quite large – for lithium use in the batteries employed in the power grid infrastructure of solar and wind power systems.

The demand curve for these combined uses is projected to increase to the point where, over the next decade alone, industrial need for Lithium could grow by anywhere from 3 – 10 times above what is being consumed today.

Current global demand is estimated to be in the neighborhood of 80,000 - 110,000 metric tons. Producers and market analysts believe that claims on the metal could outstrip supply within the next few years, with producers being unable to ramp up Lithium production to meet the expected demand.A recent Bloomberg news article quotes the CEO of lithium miner Orocobre Ltd. (OROCF.PK) as stating:

“You could very easily see by 2020 the need to triple production or even more just to accommodate the auto sector.”

Estimates from several sources as to the projected number of EVs on the road globally by 2015 run the gamut from 4 million to over 7, or even 10 million vehicles. Toyota, demonstrating the auto producer sector’s interest in obtaining a reliable supply of lithium for construction of its hybrids and electric vehicles (EVs), has reportedly taken a 25% stake in one of Orocobre’s Argentinian properties.

The amount of lithium required for use in the construction of each EV runs from 6 to 24 kilograms, depending upon the size and kind of vehicle being built.To cite one specific example of demand ramp-up, in late 2010, General Electric (GE) announced that it intends to buy 25,000 electric vehicles within the next five years, converting approximately half of its company car fleet to EVs in the process.

The amount of lithium carbonate required in a given commercial application runs from 5 grams for the average cell phone (reputedly now used in 60% of them), to 10 grams for a lap top computer (powering over 90% of), in addition to its use in lithium-ion batteries in many other electronic applications.

Investor Options

A relatively small number of publicly traded companies offer opportunities for investors, running the gamut from battery manufacturing and auto company end-users, to producers, who often have lithium as just one facet of their production, to exploration companies either looking for or trying to delineate identified lithium deposits. At present (subject to change?) lithium does not presently trade on any public exchange or futures market, making it very difficult to physically acquire or to directly invest in it.

Click to enlarge

Exchange Traded Funds (ETFs) - investment funds made up of a basket of commodities, stocks or bonds and traded on major exchanges in the same fashion as stocks - have increased in popularity with investors to the point that over 1,200 are now available. Some ETFs track an index; others follow a specific sector, a specific commodity, or even target a particular country.Not surprisingly, there is now one for lithium too.

Click to enlarge

Listed for trading in July 2010, the Global X Lithium ETF (LIT) tracks the Solactive Global Lithium Index - an index designed to reflect performance of the largest and most liquid lithium exploration/mining, producing and end-user battery production companies in the world. LIT is not a “pure play” like one would achieve by trading a futures contract (which at the present time, does not exist), but gets close, by tracking many “best of breed” players across the lithium space.The largest weighting (24%) goes to previously mentioned SQM, followed by American-based producer FMC Corp. (FMC) at 17%, Rockwood Holdings (ROC) and Advanced Battery Technologies (ABAT). The three top holdings - global dominators in lithium production - are also diversified chemical/mining concerns with operations which operate outside of the lithium space.

This fund is comprised of 19 companies, about equally divided between lithium miners and lithium battery manufacturers.In its relatively short time in existence, LIT has amassed over $100 million in assets, demonstrating during its first few months an investment return approaching 20%.

LIT is not a pure play on lithium, but it’s probably as close as investors who are either unable or unwilling to invest in specific individual (and by definition, higher risk) company stories will be able get for quite awhile.

Investor Reward Factors

At some point in the discernible future, it is possible to envision that most or all of the world’s auto production – estimated at 60 million vehicles per year – could be replaced with electrified vehicles. Lithium demand under this scenario ... well, just do the math. The question then arises as to whether or not there would even be enough recoverable lithium to meet such a demand – which would lead inevitably to price rationing (at vastly higher lithium prices.)

The “investor risk” factor noted above could become an “investor reward” factor, should Bolivia decide to nationalize its lithium resource extraction and production industry - leading to supply disruptions and sharply higher lithium prices. A leader of Frutcas, a group of salt gatherers and quinoa farmers has stated, “We know that Bolivia can become the Saudi Arabia of lithium.”

Chris Berry, in Dr. Michael Berry’s Morning Notes writes:

“This market may grow in fits and starts based upon global automotive demand but developments in battery technology in the electronics and transportation world should push lithium demand forward significantly.If you’re a believer in the eventuality of the 'green economy' we submit that the discovery future is now.”

When seen in the broader context of what could be shaping up as the largest, most sustained and demand-driven commodities/resource sector bull market of the last 200 years, consideration about “covering the bases” by having some “lithium exposure” becomes compelling.

Based solely upon its own supply/demand fundamentals, a strong case can be made for suggesting that, at the very least – over the near to intermediate term ( 5 years +?) investors would do well to take a serious look at lithium as a component of their investment portfolio.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.