RE: RE: RE: RE: Power Plant"To expand on this, why drill for more coal, spend more money doing so, when PCY hasn't even sold any of its stockpiled coal yet?"..."Money well spent? I think not."

Hey Jack Ass,

PCY acquired a property and agreed to pay x amount. The decision to spend money on drilling was rooted in an effort to determine whether or not to continue making payments on the same. As it turns out, the property is more than just highly prospective and worth more than what PCY agreed to pay given certain synergies and potential reserves as it applies to Ulaan Ovoo. That said, PCY will keep the property. The minimal cost to drill was money well spent.

Honestly, would you have agreed to buy a property and NOT check it out to determine if additional payments should be made on the same? I didn't think so.

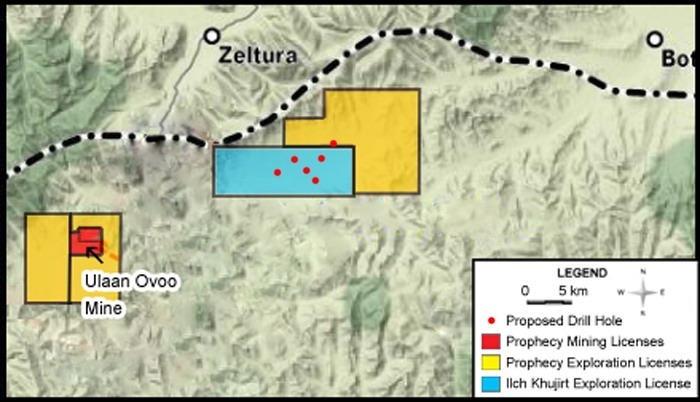

Prophecy Acquires Prospective Claims Near Its Ulaan Ovoo Mine In Mongolia

Vancouver, British Columbia, May 4, 2011: Prophecy Resource Corp. (“Prophecy” or the “Company”) (TSX-V: PCY, OTCQX: PRPCF, Frankfurt: 1P2) announcesthat it has entered into an Option Agreement ("Agreement") with aprivate Mongolian company ("Seller") holding an exploration licensenear Prophecy’s Ulaan Ovoo mine, pursuant to which Prophecy has beengranted the right to acquire 100% ownership for US $2 million within thefirst year, or US $4 million in the second year of the execution ofthe Agreement.

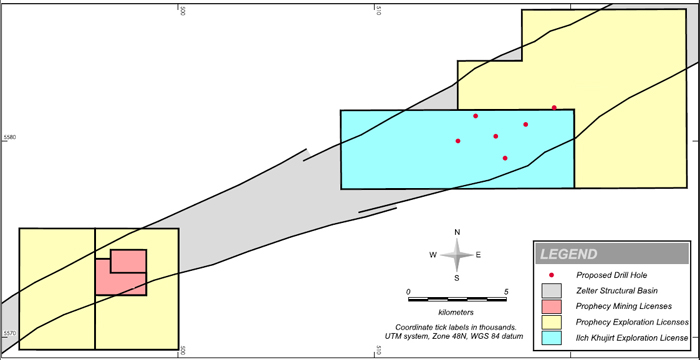

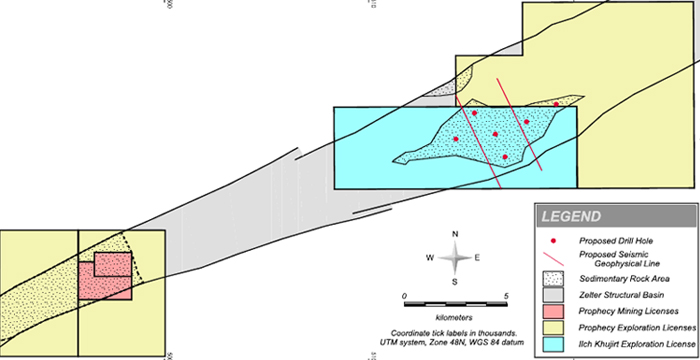

The 4,773-hectare property has an existing, fully transferableexploration license located 17 km northeast of Prophecy’s producingUlaan Ovoo coalmine. It is contiguous to Prophecy’s existing exploration licensecovering 7,392 hectares. These exploration licenses are located in thesame structural basin as the Ulaan Ovoo Mine. Recent reconnaissanceprograms including geophysical work to date indicates the presence ofshallow sedimentary rocks up to 100meters in thickness, which demonstrates the potential for coal discovery. Prophecy plans to commence drilling operations on the 4,773 hectare property in June 2011.

Pursuant to the Agreement, Prophecy has the right to acquire 100% ofthe property by making the following payments to the Seller:

US$200,000 on agreement signing (paid); and

US$1,800,000 before April 21, 2012, 50% payable in Prophecy shares.

Or

US$200,000 on agreement signing (paid);

US$500,000 on April 22, 2012; and

US$3,300,000 before April 21, 2013, 50% payable in Prophecy shares

A 2% net royalty on production from the Property is payable to theSeller, which can be purchased at any time at Prophecy’s discretion forUS$1,000,000 on or before April 21, 2013. Half (½) of the royaltypurchase price shall be payable through the issuance of common sharesof Prophecy.

The transaction is subject to regulatory approval, including theapproval of the TSX Venture Exchange. This news release has beenreviewed and approved by Christopher M. Kravits, PGeo who is a QualifiedPerson as defined in NI 43-101. Mr. Kravits has 34 years of US andinternational relevant coal geology experience. He has been active in Mongolia since 2007.

Structure Trends

Sedimentary Rock Trend

(Click to Enlarge)

Prophecy Resource Corp. is an internationally diversified companyengaged in developing energy, nickel and platinum group metals projects.The company controls over 1.4 billion tonnes of surface minablethermal

coal resources in Mongolia. Prophecy's Ulaan Ovoo

coalmine is fully operational and its Chandgana mine mouth power plant iscurrently being permitted. In Canada, Prophecy owns the Wellgreen PGMProject in Yukon and Lynn Lake Nickel Sulphide Project in Manitoba,both of which it has agreed to sell to Pacific Coast Nickel Corp.Prophecy also owns equity stakes in Victory Nickel Inc. and ComplianceEnergy Corp. Mineral resources that are not mineral reserves do not havedemonstrated economic viability.

ON BEHALF OF THE BOARD OF DIRECTORS Prophecy Resource Corp.

"JOHN LEE"

John Lee

Chairman

Telephone 1.800.851.1528

Email: john@prophecyresource.com

Mineral resources that are not mineral reserves do not have demonstrated economic viability.Neither the TSX Venture Exchange nor its Regulation Services Provider (asthat term is defined in the policies of the TSX Venture Exchange) acceptsresponsibility for the adequacy or accuracy of this release.