Ran across this article from November 2010. Wondering whether this is what has delayed approvals from Romania.

Sterling Resources has announced that following the immediate cessation of the Farm-in Agreement with Melrose Resources, the Company has withdrawn the 32.5% assignment request made on May 22, 2009 with the National Agency for Mineral Resources (NAMR) for Melrose Resources on Sterling’s Pelican and Midia Blocks, offshore Romania. The effective date of this withdrawal request to NAMR, the regulatory agency responsible for mineral resource administration on behalf of the Government of Romania, is November 1, 2010.

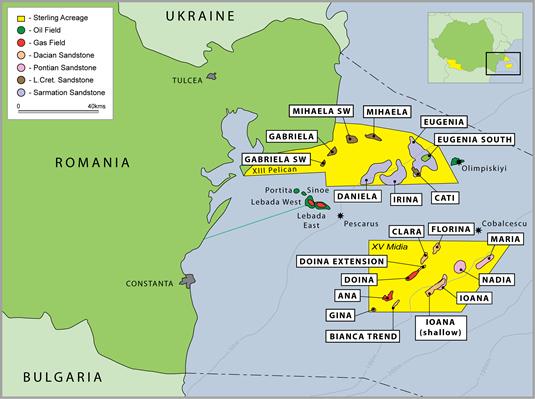

Sterling Resources' Pelican XIII and Midia XV Blocks

The inability to obtain assignment approval has impeded progress on the Ana and Doina discoveries, as well as further exploration and appraisal activities on the Blocks. Sterling now intends to proactively move forward with offshore activities in concert with its other intended assignees, PetroVentures Europe and Gas Plus International.

Melrose said in a statement:

Melrose Resources was notified this morning by Sterling Resources that Sterling has withdrawn the request previously made to the Romanian National Agency for Mineral Resources to assign a 32.5 percent working interest in the Pelican and Midia blocks to Melrose. The Company is currently reviewing the implications of this unforeseen event on its future business plans.

Commenting on the update, David Thomas, Melrose's Chief Executive said: 'We understand that this recent development is in response to the protracted delay experienced securing the assignment approval, which has impeded development and exploration activity on the concessions. Whilst it is a disappointing outcome, we retain a positive outlook on our other Western Black Sea initiatives and will be providing an operational update on these and other areas in the near future.'

Background

In early December 2008, Sterling signed a Heads of Agreement with Melrose Resources relating to the Pelican XIII and Midia XV Blocks. In exchange for a cash consideration and a carry on future expenditures, Melrose will acquire a 32.5% working interest in the Pelican XIII and Midia XV Blocks.

An initial advance of US $12-million was to be made to Sterling on closing by Melrose. Melrose also agreed to carry Sterling for a proportion of their future development costs. The amount of the cost carry was to be up to US $90-million, depending on the prevailing gas price at the time the field commences production. Sterling was to retain a 32.5% working interest in the Pelican and Midia Blocks.

Melrose was to become operator of the development projects, initially associated with the recently appraised Doina and Ana fields on the Midia XV Block. Sterling was to retain operatorship for the exploration of the significant prospects in the remaining parts of the blocks. During 2009 Exxon farmed into the Petrom Block, East Neptune, and shot 3,000 sq kms of new seismic to explore for potential in the deepwater area of the Western Black Sea.

On February 3, 2009 resolution of the Maritime Boundary Dispute between Romania and the Ukraine was announced by the International Court of Justice (ICJ)in the Hague with approx. 80% of the disputed territory awarded to Romania. Concurrent to the announcement media reports in Romania surfaced questioning the validity and extent of certain concessions granted to Sterling by the Romanian government. On February 5, 2009 Sterling issued a Statement of Facts outlining Sterling’s history of operations in Romania and confirming the validity of the concessions in place.

During the remainder of calendar year 2009 subsequent political events delayed the approval of the transfer of the offshore licences to Melrose, Petro Ventures and Gas Plus. Sterling recently said that it was 'guardedly optimistic that the transfer of the offshore licence to our partners will be approved early in 2010'.

Source: energy-pedia