If someone who understand better can explain further that would be great!!!

Reacting To A Rebalancing Of Junior Gold Miners ETF

by: David ZurbuchenSeptember 13, 2011 | about:

GDXJ, includes:

AG, AUQ, CAHPF.PK, CANWF.PK, CGOOF.PK, EAIAF.PK, IPLRF.PK, KGN, MNEAF.OB, NXG, REMX, SSRI, VGZ

Last Friday, 4asset-management released its quarterly review of the Market Vectors indices. These changes are important because they essentially determine how Van Eck Global will allocate money within its various Market Vectors funds.

We’ve chosen to focus our efforts on the Junior Gold Miners ETF (GDXJ) because it’s a relatively large fund (~$2.8 billion) focused on relatively small companies (~

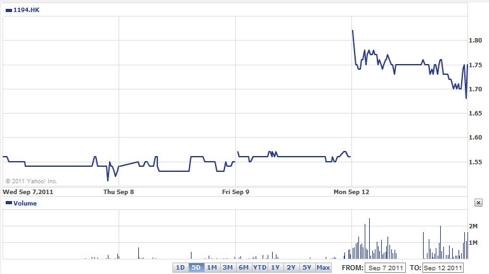

.15 to $2 billion). Significant allocation changes, especially if implemented swiftly, have the potential to overwhelm the normal trading in the market and drive share prices of constituent companies sharply higher or lower. This creates an environment ripe with speculative opportunities, and we believe there’s significant money to be made for those who understand the mechanics of the Van Eck funds. Look no further than the 3 month chart of East Asia Minerals (EAIAF.PK) to witness the level of influence GDXJ selling pressure can have on a relatively thinly traded company (detailed discussion here).

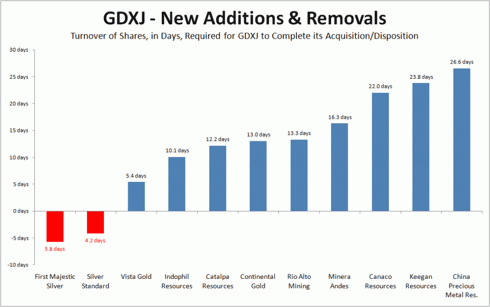

This quarter the Junior Gold Miners index is dropping First Majestic Silver (AG) and Silver Standard Resources (SSRI) and will be adding the following 9 companies:

Meanwhile new index weightings have been assigned to the 68 other companies that remain in the ETF, resulting in the fund buying and selling of their shares as well.

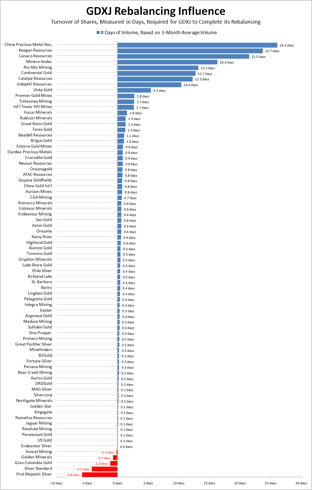

To determine which companies are likely to experience the most price volatility in the coming days, we calculated how many shares of each company the ETF will need to buy or sell to achieve the new index weightings and then compared this to the 3-month average trading volume for each company. Please note that our trading volume measurement only considers the primary exchange of each company. Since many of these companies are listed on multiple exchanges the denominator of the “# days volume” measure will tend to be somewhat understated. On the other hand, there are likely to be other funds that attempt to mirror, leverage and second-guess GDXJ and therefore the actual buying/selling pressure (i.e. numerator of “# days volume” measure) is likely to be somewhat understated as well.

(click to enlarge)

Clearly the vast majority of allocation changes can be written off as inconsequential although a few of the companies remaining in the index will see significant buying (and one with significant selling). There are 11 companies, however, that are being added to or removed from the index and the buying or selling related to these should have a much greater influence on the share prices. So let’s focus on these 11 companies:

We note that trading volume for most of these 11 companies has already been much higher than normal this Monday morning with share prices making significant moves compared to the rest of the market. Notably, all 9 additions are showing significant gains on an otherwise ugly day. Meanwhile the 2 deletions are down nearly 10% each.

GDXJ Additions - 5 Day Performance

GDXJ Deletions - 5 Day Performance

Since the GDXJ index will not officially reflect the new allocations until one week after the announcement, we believe the higher trading volumes we’ve already witnessed is primarily the result of investors and hedge fund managers pre-positioning themselves for the buying that Van Eck Global will have to do in the coming days, which will be regardless of price. In other words, there could be more to come. Even if Van Eck has in fact already commenced making the allocation changes in order to get a head start (we'll know soon enough), there should be at least another week of buying or selling before they are done.

So how would one take advantage of this information? There are a number of possibilities, some more involved than others. Here are a few ideas beyond simply going long or short individual components, which might be a solid trading idea in its own right.

- Go long GDXJ while shorting the components being removed.

- Short GDXJ while buying a basket of its new components.

- Buy puts, sell calls, initiate bear spreads, etc. on the components being removed.

- Buy calls, sell puts, initiate bull spreads, etc. on the new components.

We’ll also be considering various strategies related to the pending Northgate Minerals (

NXG) and AuRico Gold (

AUQ)

merger since as a combined entity they would have been dropped from the index (i.e. too large). Considering that 4asset-management has the discretionary power to drop companies mid-quarter due to M&A and other activity (as we saw with East Asia Minerals) there is a good possibility these two will be dropped as well, or at the very least the new AuRico’s weighting will not be raised to reflect the merger. If the index drops AuRico after the merger is completed (including the converted Northgate shares), liquidating this position would be equivalent to about 8 days of trading volume.

We plan to conduct a similar review of other Market Vectors funds — for example the Market Vectors Rare Earth/Strategic Metals ETF (REMX) — as well as a historical analysis of price action surrounding earlier GDXJ rebalancings in order to better determine what are likely to be the most powerful piggyback strategies. We also plan to build a feature on our website that automatically updates index holdings and data changes so that our subscribers can identify trading opportunities in near real-time.

Disclosure: I am long NXG, JAG, BCM, FVITF.PK, CGAFF.PK, DPMLF.PK, ATADF.PK, GBG, MFN, SVM.

Please Read:

https://seekingalpha.com/article/293249-reacting-to-a-rebalancing-of-junior-gold-miners-etf