seeking...this ones for you!!

The information presented from the United Nations FOA is as factual as one can expect. They clearly outline what has to happen in order to “feed the world of the future.”

We all know that there are planned expansions from some of the current large producers and the stated goals of new producers to bring production into the market place over the next 5 years. The real question is how many of these planned new tons will actually be produced? We all also know that some mines require the price of potash to remain over $500 per ton in order to maintain profitability in the long term. So, if the world price of potash falls we should expect some of the planned Greenfield Projects put on hold…and some of the planned existing expansions also put on hold…the expansions from the existing miners will ramp up based on the real “global demand”…and ramp down to prevent overproduction and prevent a global glut of product and create a falling price for product….There appear to be a few “wild cards” in the group…BHP has stated that it plans to get into the potash business in a big way…and they have stated or at least postured their intensions of developing the Janzen Mine in Sask. regardless of the current demand structure…BHP has a clear advantage as they make millions in profits from other mineral sources they produce and can build their mine even with lower or non profitable prices and in my opinion create an environment that likely will prevent the development of other planned Greenfield Projects.. with an environment of over supply created by majors expansions and a new mine from BHP and not to mention the current development of Vale’s Rio Colorado Mine in Argentina to feed the demand from Brazil, we could see global market demands being met for many years to come…this creates a challenge for “new producers” but, does not make it impossible. You had better have the lowest costs of mine development and lowest costs of production and have a strong end user lined up if you expect to have a realistic chance of getting into production over the next 5 years. It is also important to assess whether having low capital costs and low production costs are an advantage or disadvantage if your real goal is to get into production. The major miners have the ability to expand existing operations to meet increased demand or buy up those juniors that get to production on their own merits and possess low capital and production costs. The United Nations FOA just released the following data points and I think tell a very telling tale. When you consider their research and predictions on Arable Land, World Cereal Yields, Population Growth, Global Potash Demand and Global Potash Production you can see a clear picture of things to come. Just to put things into perspective, the total fertilizer demand is expected to increase from 168 million tons in 2010 to 212 million tons by 2020. That is a 20% increase in demand or “50 million new tons” of fertilizer…

.” In an article from Seeking Alpha “Potash: An Excellent Long-Term Investment Theme” Faisal Humayun - January 20, 2012 presents the graphs and charts listed below.

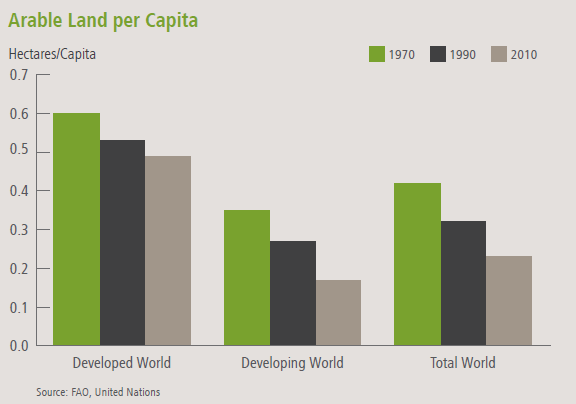

Arable land per capita is on a gradual decline and the trend is expected to continue in the foreseeable future. At the same time, the pressure on water supply is enormous with growth in population and economies. It is estimated that in the developing world, the per capita renewable water resource has declined by 50% in the last four decades.

Developed World arable land has decreased 20% and continues to decline Developing World arable land has decreased 50% and continues to decline

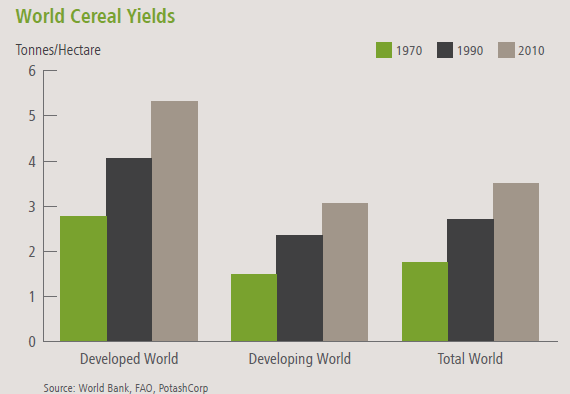

I emphasize both these critical factors here because it underscores the importance of increasing crop yield. As mentioned earlier, potash helps in improving yield and water retention. Therefore, the long-term demand is firmly in place for the fertilizer.

The yield in developing countries such as China, and India, is still significantly lower than the developed world. For the food security of nearly 2.6 billion people in these two countries, the agriculture sector needs to revamp itself. Not surprising, I expect the major demand and price drivers for potash to be emerging markets. Just to put things into perspective, the total fertilizer demand is expected to increase from 168 million tonnes in 2010 to 212 million tons by 2020. That is a 20% increase in demand or 50 millions tons of fertilizer…

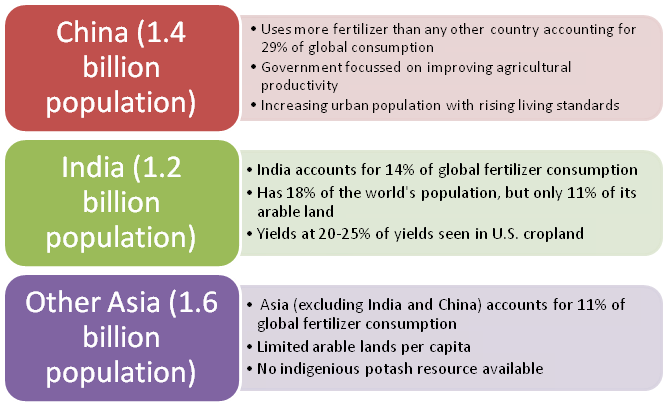

The chart below summarizes the major demand drivers for potash in the long term.

China 29% of global consumption + India 14% of global consumption + other Asian Countries 11% = Represents 54% of current Global Fertilizer Consumption

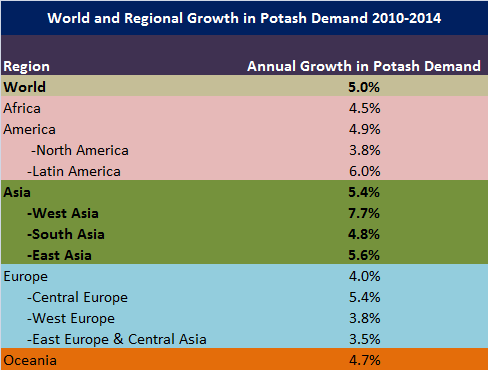

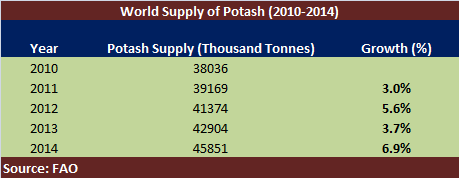

The data below from FAO further underscores the fact that Asian demand will be robust for potash in the long term.

On the supply side, high quality and economically minable deposits of potash are largely concentrated in few countries. Potash is produced only in 12 countries with Canada, and Russia, accounting for 81% of the production. This effectively means that all the major potash consuming countries are heavily dependent on imports. This gives the major potash producers a better bargaining power and ensures that potash prices would remain relatively stable in the marketplace.

2011 - 1.2 million new tons

2012 - 2.3 million new tons

2113 - 1.5 million new tons

2014 - 3.1 million new tons

From 2011 – 2014 United Nations FOA estimated that the world will increase potash supply with 8.1 million new tons of potash. That is the equivalent of 4 new mines producing 2 million tons of potash per year.