The insatiable demand for energy has caused an oil and gas boom worldwide. Companies are searching the world over for natural resources that can be extracted, refined, shipped, and eventually sold into the marketplace. The search for natural resources has never been so intense. The vast demand for these fossil fuels has investors clamoring to get in on the action. With energy sector filled to the brim with companies of all sizes, the task of finding which ones to invest in can be daunting. These three companies represent three unique ways to invest in the oil & gas boom. Each company has different attributes that make them attractive. One thing is the same, these companies should profit greatly from the worldwide demand for energy.

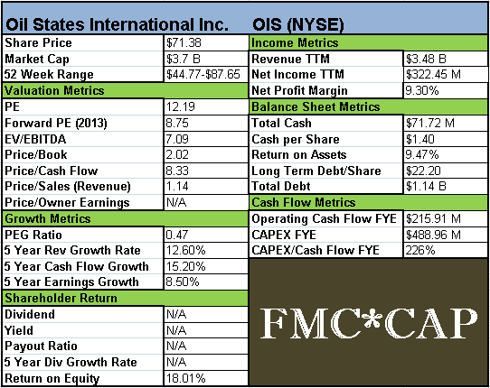

Oil States International (OIS)

Oil States International provides products and services to the oil & gas industry worldwide. The company supplies tools, tubing, bearings and drilling services to oil and gas drillers. Oil State's largest source of revenue comes from its accommodations segment, which provides on-site accommodations, laundry and food service to oil & gas workers. At the end of 2011, the company had about 17,000 rooms. Oil States plans to continue expanding its room count in Australia, Canada and the United States. Its other segments are offshore products, well site services, and tubular services. The company's offshore products segment recorded record revenue in 2011 and ended the year with a record $535 million backlog.

At a recent $71.38, Oil States trades at just over 12 times earnings and less than 9 times expected 2013 earnings. The stock has a price-to-earnings growth ratio of 0.47. The company has a lot of debt and has had to spend at high rates to keep up with demand. This has concerned some investors and limited the stock. As long as the global search for energy continues, Oil States International should benefit.

(Click to enlarge)

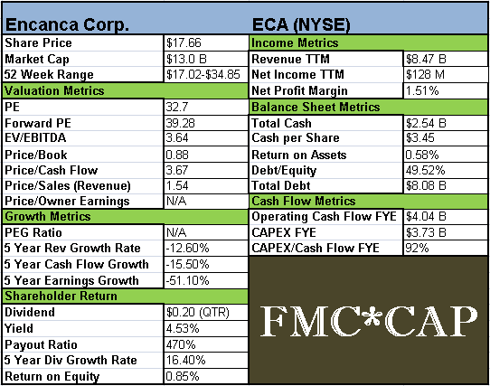

Encana (ECA)

Encana is the second largest natural gas producer in North America, behind Exxon Mobil (XOM). This fact hasn't earned Encana any bragging rights. As natural gas prices have fallen below the $2.00 per million British thermal units mark, shares of Encana have collapsed more than 40% in the last year. Even though Encana's natural gas production is hedged at prices above current gas prices for 2012, investors are expressing their concerns about future prices. Encana is responding by selling underperforming assets and focusing production on oil and natural gas liquids, which are far more profitable.

Encana trades at 32 times earnings and about 39 times 2013 estimates. Encana's fundamentals deteriorated alongside its stock price over the last year. However, when natural gas prices rebound, Encana has the most to gain - and the most potential upside surprise of all three stocks. Encana was the subject of a positive article on Barrons.com last week. One big attraction to the stock - a 4.5% dividend yield.

(Click to enlarge)

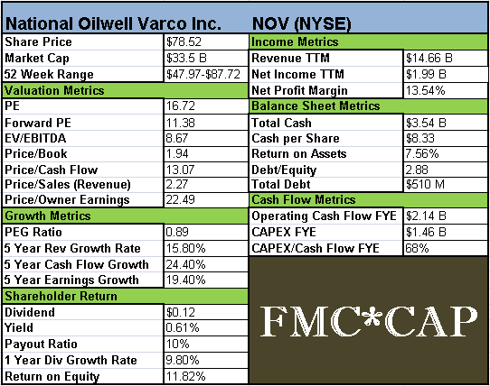

National Oilwell Varco Inc. (NOV)

National Oilwell Varco designs, constructs, and sells components and products for oil and gas drilling. National Oilwell offers both onshore and offshore drilling rigs. The company provides ongoing maintenance and repair to drillers. Most recently, the company has benefited from some rigs being converted from natural gas drilling to oil drilling. National Oilwell's parts and components are in 90% of all rigs.

National Oilwell has the highest quality fundamentals of any of the three companies mentioned here. They have a clean balance sheet with little debt. Revenue, earnings, and cash flow are all growing nicely and they have $8.33 per share of cash on the books. Trading at less than 12 times expected 2013 earnings, shares look like a bargain. National Oilwell pays a small dividend, just 0.61%, but has plenty of room to raise it.

(Click to enlarge)

These are three different ways to invest in the oil & gas boom. It doesn't appear that the hunt for fossil fuels is going to go away any time soon. Oil States International offers investors a unique way to profit from the drilling boom. Accommodations and related services account for half of their revenue. Encana is the stock that is most tied to the price of natural gas. That makes it a little riskier given the performance of natural gas prices over the last several years. When natural gas prices turn around, Encana could be a very profitable play. National Oilwell Varco is the only large-cap of the group. Given its size and array of products, it is likely the most stable investment. As current natural gas prices remain depressed, National Oilwell will continue to benefit from converting rigs to oil drilling. Whichever way you invest in oil & gas, one thing is certain - the world needs more energy. Fossil fuels are here to stay.