Money follows the eye balls

Using pattern recognition from the Japanese market, Meeker predicts that mobile monetization levels in the U.S. could surpass those on the desktop within one to three years.She says she thinks this pattern of dollars following eyeballs is inevitable, but “it just takes time.”

Mary Meeker Explains the Mobile Monetization Challenge

May 30, 2012 at 8:32 am PT

Looming over the Internet industry is the mismatch between the growth in mobile usage and mobile monetization.

Most recently, it was the risk factor that helped take down Facebook’s ill-fated IPO roadshow, when the company warned at the last minute publicly (and perhaps more emphatically privately) that mobile monetization really wasn’t keeping pace.

So it’s quite topical that today at D10, Kleiner Perkins Caufield & Byers venture capitalist and former Wall Street analyst Mary Meeker is delivering one of her famed Internet trends presentations by depicting the opportunity for mobile advertising.

Here’s how Meeker describes it; there are a lot of stats in here, but they actually tell a rather smooth narrative:

There are 1.1 billion global mobile 3G subscribers, which is 37 percent growth but just 18 percent penetration. That’s compared to 2.3 billion global Internet users, with growth of just 8 percent from last year.

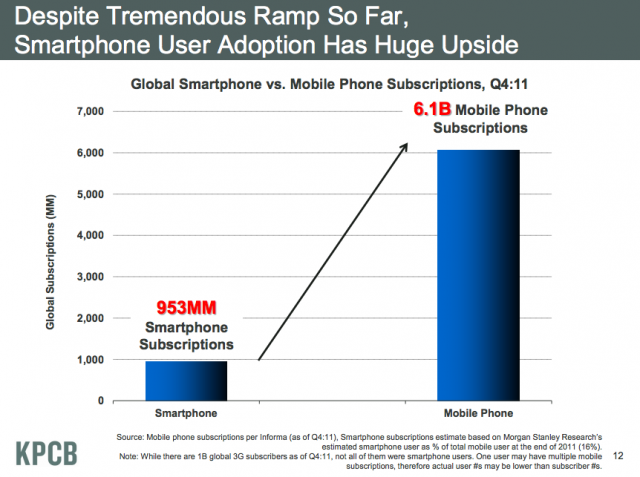

Adoption of new smart devices is happening faster than ever — the iPad and Android growth curves are way steeper than that for iPhone. But there’s still a long way to go; there are only 953 million smartphone subscriptions of the world’s 6.1 billion mobile subscriptions.

In May of this year, mobile usage hit 10 percent of total global Internet traffic, up from about 5 percent at the same time last year.

Okay, now over to the monetization side: Right now, it’s not just ads. Mobile e-commerce is 8 percent of the total e-commerce market in the U.S. Today, payments for and within applications account for 71 percent of revenue versus 29 percent for mobile advertising.

Meeker concludes there’s a “material upside” for advertising in mobile because it’s currently out of whack with the percent of total media consumption.

And that’s a pressing issue, because mobile Internet usage is replacing desktop Internet usage. In India this month, total mobile Internet was bigger than desktop Internet for the very first time.

There are lots of places to find evidence of the mobile monetization gap. Effective desktop CPMs are five times the price of mobile Internet CPMs in the U.S.: $3.50 versus

.75. And companies like Pandora, Tencent and Zynga currently report that average revenue per user is as much as five times lower on mobile. Google’s and Facebook’s financials show mobile is constraining revenue growth.

Meeker doesn’t provide solutions to those problems, but she does surface some light at the end of the tunnel. For instance, in the more mature Japanese market, mobile game maker GREE has seen rapid growth in average revenue per user, up to $24 per user per year at the beginning of 2012. Another player, CyberAgent, has seen a similar curve, and is now up to $418 average revenue per paying user on mobile, more than what it sees on the desktop.

Using pattern recognition from the Japanese market, Meeker predicts that mobile monetization levels in the U.S. could surpass those on the desktop within one to three years. She says she thinks this pattern of dollars following eyeballs is inevitable, but “it just takes time.”

Meeker believes that the current problems with mobile monetization are just a temporary issue. She believes that mobile monetization levels in the U.S. could surpass the desktop within 1-3 years. “Mobile monetization,” in her view, “has more going for it than early desktop monetization.

https://translate.google.ca/translate?hl=en&sl=zh-CN&tl=en&u=www.cnpoynt.com

https://translate.google.ca/translate?hl=en&sl=zh-CN&tl=en&u=www.cnpoynt.com

- Poynt's USA mobile search ownership along with Google, Yelp etc https://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=30949637&l=0&r=0&s=PYN&t=LIST

Juniper Research Report on Global Mobile Commerce promiently contains Poynt see link : https://www.juniperresearch.com/reports/mobile_commerce_markets

Another Global Research Report Containing Poynt : https://www.berginsight.com/ReportPDF/ProductSheet/bi-lba-ps.pdf

..