Trading right at Cash R$2,15/share , Possible upside, the sky is the limit with billions of barrels of oil

Since the shorters love to see HRT trade at cash levels, what is the downside from here?

Final Cash Q1/13 was R$829mio (R$2,8/share)

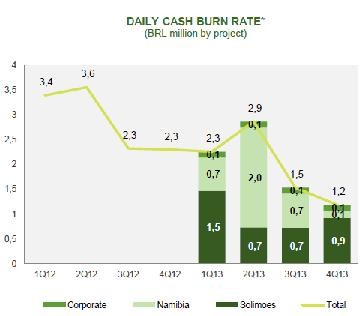

if we assume a CashBurn Rate in Q2 of R$2,9mio/day *66days

Todays Cash should be R$637,6mio (R$2,15/share)

if we assume a CashBurnrate in Q2 of R$2,9mio/day * 91days +

if we assume a CashBurnRate in Q3 of R$1,5mio/day * 42 days

Cash 11th of august (72 days from spud in Murombe) should be R$502,1 (R$1,69/share)

...does not include any revenues from the sale of Air Amazonia... R$130mio (R$0,44/share)

possible worst case scenario: -21,76% with murombe results from yesterdays prices