Indian Agriculture Investments in Ethiopia

FAQs on Indian Agriculture Investments in Ethiopia

Download as a PDF

Why has the recent surge of foreign land acquisitions and leases been dubbed a “global land grab”?

Download as a PDF

Why has the recent surge of foreign land acquisitions and leases been dubbed a “global land grab”?

Since the food price crisis of 2007, there has been a rapid increase of foreign acquisition of land in developing countries by foreign governments, private agro- enterprises and private equity funds for commercial farming ventures. In 2009 alone, foreign investors acquired 60 million hectares (ha) of land – the size of France – through purchases or leases of land for commercial farming. Before 2008, the expansion of global agricultural land was less than 4 million ha annually. Nearly 75 percent of the deals are taking place in sub-Saharan African countries that have high rates of food insecurity and agricultural systems, especially small-scale farming and pastoralism, adversely impacted by decades of neglect by governments. Most of the large-scale land deals are negotiated without the Free Prior and Informed Consent of the indigenous populations living on the land. In the worst cases, people are forcibly evicted from their land with little or no compensation. In addition to farms, the land acquired by investors includes grazing land, forest, and water sources, which are all essential for the livelihoods of millions of rural people.

Which sub-Saharan African countries are attracting the most interest?

Many African countries are attracting investor interest and witnessing large-scale land grabs. Ethiopia, Liberia, Mozambique, Sierra Leone, South Sudan, Tanzania, Zambia, Uganda, Nigeria, and the Democratic Republic of Congo are among those attracting the most foreign interest. Ethiopia is one of the preferred destinations for agricultural investments in Africa. Between 2008 and 2011, 3,619,509 ha were transferred to domestic investors, state-owned enterprises, and foreign companies, including Indian agro-enterprises.

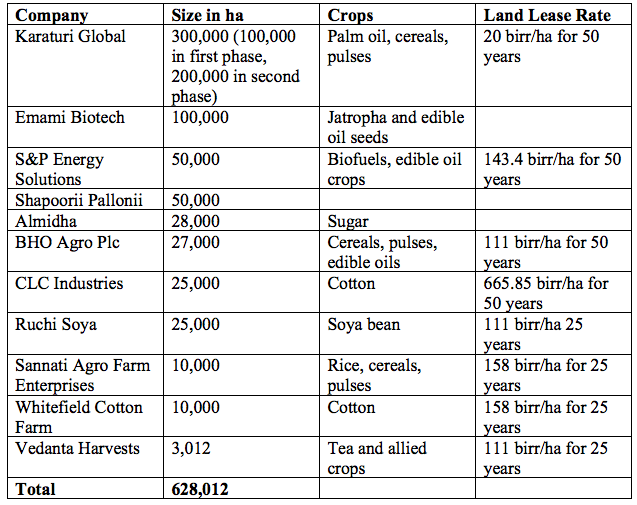

What makes land deals in Sub-Saharan African countries attractive is the supposed availability of fertile land, forests and water resources as well as the mouthwatering conditions offered by many governments in terms of cheap land leases over long-term periods, fiscal exemptions, and other incentives allowing a maximization of the profit that foreign companies can make out of their investment. India’s largest investor in Ethiopia, Karuturi, is acquiring land at a rate as low as 20 birr (Rs. 59/$1.10) per hectare. A host of other investors with significant land claims have acquired land at rates between 111 to 158 birr (Rs. 324/$6.05 to Rs. 461/$8.62)

Why are nation-states and private foreign enterprises investing so heavily in sub-Saharan African land?

The global land rush is the reaction of investor countries to the food price crisis of 2007, which was partly brought on by increased speculation in food commodities and a decline in the growth rate of world agricultural production, a result of several factors, including lack of investment in agriculture, climate change, and crops and cropland being diverted to biofuels.

In response to immediate concerns wrought by the recent financial crisis, wealthy private investors have also directed investments into offshore farmland as a way to increase profits in newly carved out biofuels and soft commodities markets.

Where in Ethiopia are investments taking place? Where are Indian firms concentrated?

The larger share of investments is taking place in five administrative regions in Ethiopia – Afar and Amhara in the North, Oromia in Central Ethiopia, and Gambella and the Southern Nations, Nationalities and Peoples Regions (SNNPR) in the South.

Indian enterprises are largely concentrated in Gambella and Afar. Karaturi Global is the largest investor in Gambella with plans to farm palm oil, cereals, and pulses on 300,000 ha of land in the region. Indian investments generally take place in regions where the government offers extra tax incentives. Incidentally, these are regions that are targeted by the villagization program.

Only a few direct Indian investments have been identified in Lower Omo, where 445,000 ha have been taken away since 2008 from local populations to grow mainly sugar and cotton. The region is primarily developed by state-owned companies for the production of sugar but India is playing a key role in this region through the Export-Import (EXIM) bank of India (see below).

Is India implicated in providing support to private Indian investments?

While the Indian government does not currently offer direct financial support to firms to invest abroad, EXIM bank, a government financial institution, has opened a $640 million line of credit to the Ethiopian government to expand the country’s sugar sector. The credit line commits Ethiopia to import 75 percent of the goods and services, such as consultancy services, from India.

Some Indian entrepreneurs, like Rana Kapoor, CEO of YES bank and a member of the Government of India’s Board of Trade, as well as the Federation of Indian Chambers of Commerce and Industry (FICCI) have championed the overall investment activity.

How much land has been acquired by the Indian enterprises in Ethiopia? What crops do they plan to grow?

Indian firms have acquired over 600,000 ha of land. Most investors plan to grow edible oils and crops while a few have plans to grow cotton.