RB Energy (RBEIF) is engaged in the acquisition, exploration, development, and mining of mineral resource properties in Canada and Chile.

|

Number of shares (May 13, 2014)

|

230,889,877

|

|

Number of warrants (May 13, 2014)

|

10,277,819

|

|

Number of options (May 13, 2014)

|

12,883,820

|

|

Fully diluted number of shares (May 13, 2014)

|

254,051,516

|

|

Share price

|

$0.33

|

|

Market cap

|

$75.0 million

|

|

Enterprise value

|

$216.9 million

|

|

P/S

|

15.6

|

|

P/B

|

0.3

|

|

Tickers

|

RBEIF,TSX:RBI

|

1.1 History

RB Energy was originally formed on July 21, 1995 as Black Pearl Minerals which was subsequently changed to Canada Lithium. On January 31, 2014 Canada Lithium acquired all of the issued and outstanding shares of Sirocco. After this deal, the combined company changed its name to RB Energy.

1.2 Assets

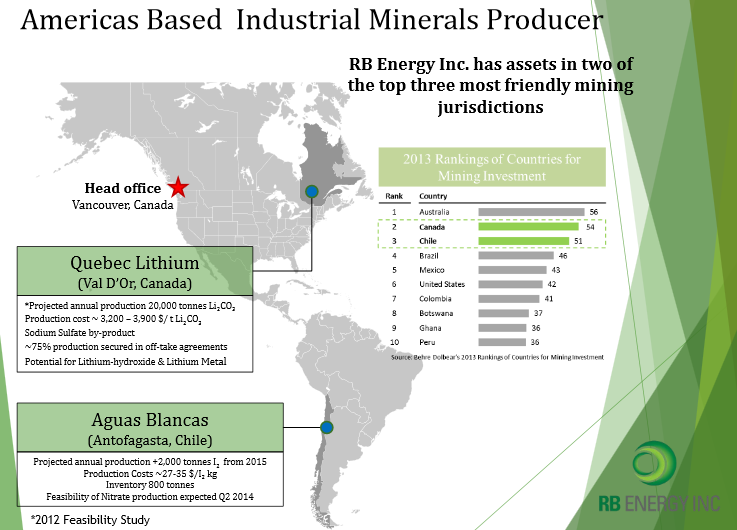

RB Energy has two assets located in Canada and Chile.

(Source: Investor presentation)

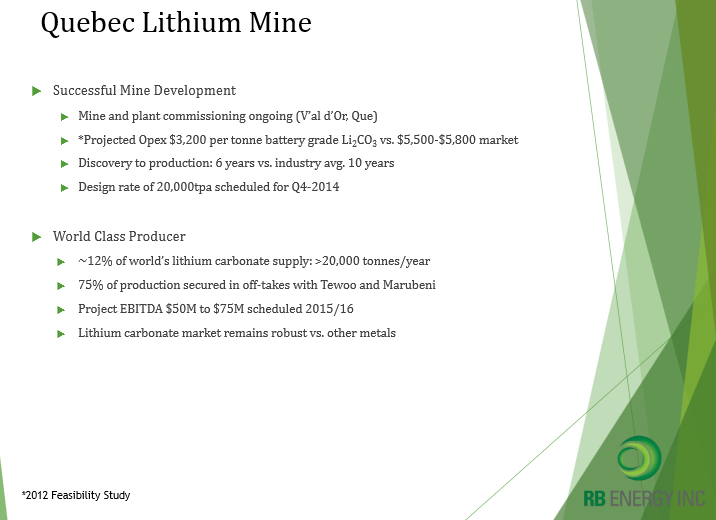

1.2.1 Quebec Lithium Project

The Quebec Lithium project is located near Val d'Or, Quebec.

(Source: Investor presentation)

The Quebec Lithium project will be a mid-level lithium carbonate producer with approximately 12% of the world market.

(Source: Investor presentation)

1.2.2 Aguas Blancas Iodine Mine

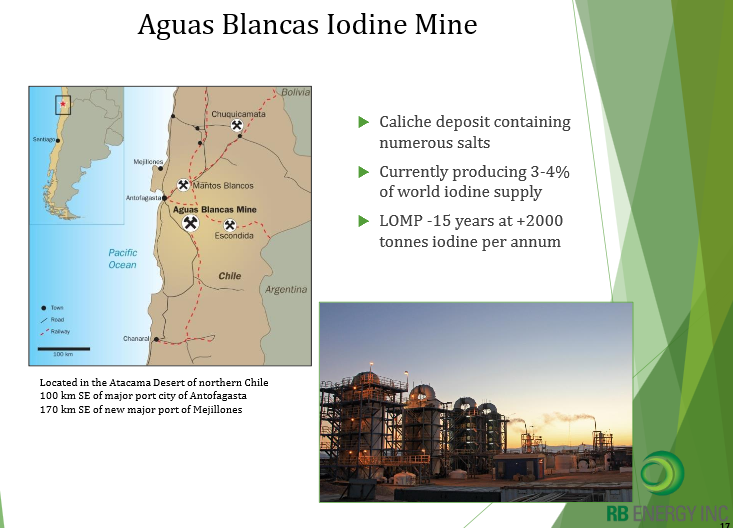

Aguas Blancas is located approximately 1,600 km north of Santiago, Chile, and 75 km southeast of the port city of Antofagasta. The mine is currently producing 3-4% of world iodine supply.

(Source: Investor presentation)

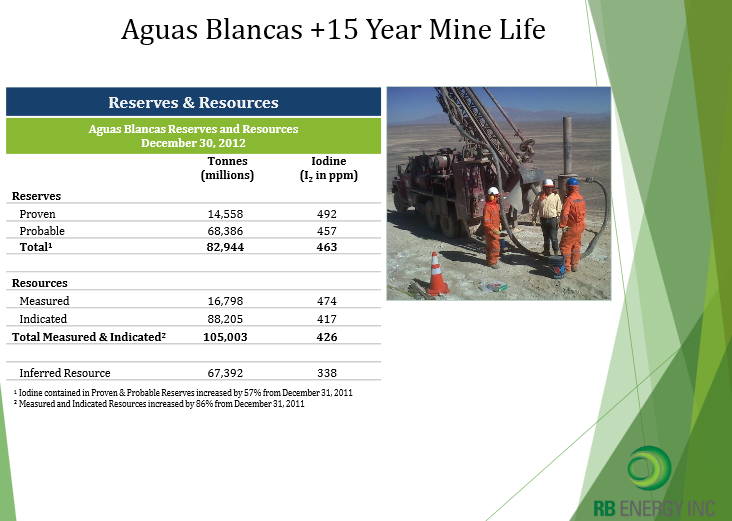

Aguas Blancas has more than 15 year mine life.

(Source: Investor presentation)

2 Management

The CEO Richard Clark has more than 15 years of mining industry experience. Richard Clark became CEO of Sirocco in October 2011. Collectively, RB Energy’s management team has over 120 years of mining industry experience.

2.1 Insider Ownership

RB Energy’s directors and executive officers own 3.2% of the company.

Here is a table of RB Energy’s insider activity by calendar month.

|

Insider buying / shares

|

Insider selling / shares

|

|

July 2014

|

0

|

0

|

|

June 2014

|

1,810,588

|

0

|

|

May 2014

|

1,470,588

|

0

|

|

April 2014

|

0

|

0

|

|

March 2014

|

0

|

80,000

|

|

February 2014

|

364,000

|

120,000

|

|

January 2014

|

0

|

0

|

|

December 2013

|

0

|

0

|

|

November 2013

|

3,175,000

|

0

|

|

October 2013

|

365,000

|

0

|

|

September 2013

|

0

|

0

|

|

August 2013

|

325,000

|

0

|

|

July 2013

|

0

|

0

|

|

June 2013

|

500,000

|

0

|

|

May 2013

|

450,000

|

95,000

|

|

April 2013

|

0

|

100,000

|

|

March 2013

|

3,943,000

|

0

|

|

February 2013

|

55,000

|

0

|

|

January 2013

|

40,000

|

0

|

(Note: There have been also 400,000 options exercised since January 2013)

There have been 12,498,176 shares purchased and there have been 395,000 shares sold by insiders since January 2013.

2.2 Compensation

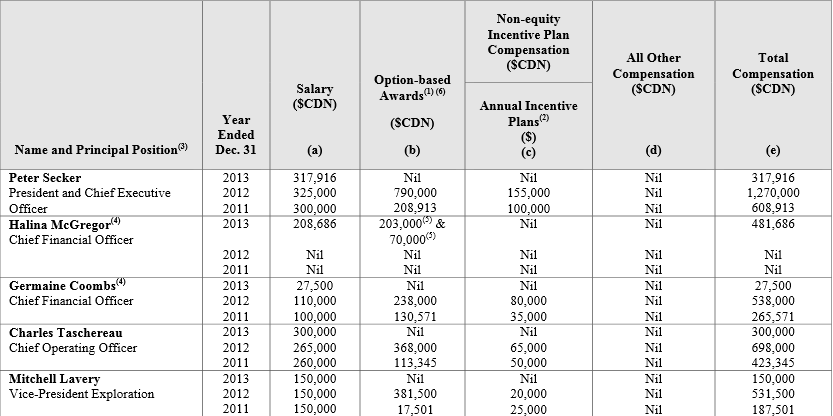

Here is a table of the management’s compensation during the last three years.

(Source: Management Proxy Circular)

The management’s total compensation peaked in 2012.

3 Operating Summary

The Aguas Blancas mine has been in operation since 2001. Here is a table of Aguas Blancas’ annual iodine production since 2002.

|

Year

|

Annual iodine production (tonnes)

|

|

2002

|

711

|

|

2003

|

756

|

|

2004

|

726

|

|

2005

|

646

|

|

2006

|

891

|

|

2007

|

1,075

|

|

2008

|

844

|

|

2009

|

1,096

|

|

2010

|

1,256

|

|

2011

|

1,122

|

|

2012

|

1,202

|

|

2013

|

above 1,000

|

Production has exceeded 1,000 tonnes of iodine in the last five years.

4 Financial Summary

4.1 Current Situation

RB Energy reported the first-quarter financial results on May 13 with the following highlights:

|

Revenue

|

C$5.0 million

|

|

Net loss

|

C$7.5 million

|

|

Cash

|

C$15.0 million

|

|

Debt

|

C$168.7 million

|

RB Energy closed a C$22.0 million financing on May 21.

(Source: Earnings release)

This was RB Energy’s first quarter with revenue.

4.2 Historical Developments

Here is a table of RB Energy’s revenue and earnings since 2010.

|

Year

|

2010

|

2011

|

2012

|

2013

|

|

Revenue (C$ millions)

|

0

|

0

|

0

|

0

|

|

Net loss (C$ millions)

|

3.5

|

4.7

|

6.6

|

8.2

|

This year will be RB Energy’s first year with revenue.

5 Shares

Here is a table of RB Energy’s number of shares since 2010.

|

Year

|

2010

|

2011

|

2012

|

2013

|

|

Number of shares (millions)

|

47.2

|

165.9

|

195.2

|

218.8

|

RB Energy’s number of shares have grown 364% since 2010.

6 Outlook

6.1 Quebec Lithium Project Outlook

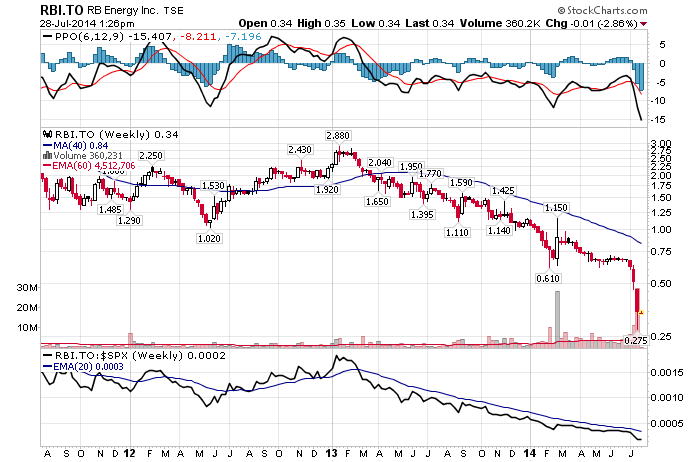

On June 5, RB Energy confirmed that it had achieved continuous production of battery grade lithium carbonate at its Quebec Lithium operation. The company also told that it was on track to achieve commercial production levels by the end of the third quarter and "name plate" production by the end of 2014.

Forty six days later, on July 21, RB Energy provided an update on the Quebec Lithium project. The company told that the Quebec Lithium plant was back in operation followed by a scheduled maintenance and upgrade shutdown.

The company also told that the unexpected commissioning issues encountered had extended the commissioning timelines and delayed production of commercial volumes of lithium carbonate for sale. As a result, RB Energy does not expect to reach its original production targets for 2014. It is now anticipated that commercial production levels will not be realized until fourth quarter of 2014 and that name plate production may be delayed until first quarter of 2015.

The delays in the ramp up of production have also accelerated the depletion of RB Energy’s treasury to a greater extent than anticipated. As a result, the company is working to secure additional sources of funding to complete commissioning, achieve commercial production and realize positive operating cash flow.

The Quebec Lithium mine’s projected EBITDA is between $50 million to $75 million in 2015/2016.

(Source: Investor presentation)

6.2 Aguas Blancas Iodine Mine Outlook

Aguas Blancas’ three year production guidance is as follows:

|

Year

|

Production (tonnes)

|

|

2014

|

~1,000

|

|

2015

|

~1,400

|

|

2016

|

~2,200

|

(Source: Investor presentation)

7 Risks

The main risks are negative earnings, the price of lithium, and the price of iodine. The lithium carbonate price has been relatively stable since 2007.

(Source: Investor presentation)

Iodine prices were largely stable around $32/kg throughout 2010 and the beginning of 2011. In March of that year, prices went from $33/kg to $97.5/kg on the spot market because of the Japanese earthquake and later some seasonal production drop off in South America. In the first quarter of 2014, Aguas Blancas produced 318 tonnes of iodine at a cash cost of $25 per kg and sold 256 tonnes at an average price of $38 per kg.

(Source: Investor presentation)

RB Energy is also a penny stock.

8 Conclusion

RB Energy is currently trading at a P/B ratio of 0.3. RB Energy’s goal is to achieve commercial lithium production in the fourth quarter of 2014, which could act like a catalyst for the stock.