CanAm Reports Q2 2014 Coal Sales and Revenue of 186,000 tons and $17.5 million respectively via Thenewswire.ca

(via Thenewswire.ca)

Calgary, AB / TNW-ACCESSWIRE / September 2, 2014 / CanAm Coal Corp. (TSXV: COE) ("CanAm" or the "Company") has filed its condensed interim consolidated financial statements and related MD&A for the period ended June 30, 2014. Definitions of commonly used non-IFRS financial measures (EBITDA from operations and Free Cash Flow) are included at the end of this press release.

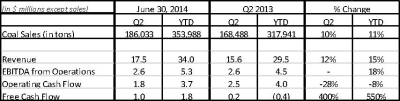

The Company announced its second quarter 2014 financial results for the period ending June 30, 2014. Revenue and EBITDA from operations for the quarter were $17.5 million and $2.6 million respectively as compared to $15.6 million and $2.6 million in the prior year. Loss for the quarter was $1.6 million as compared to $1.5 million in the prior year. Sales for the quarter were 186,000 tons as compared to 168,000 tons in Q2 2013 or an increase of 10%.

For the six month period ended June 30, 2014, revenue and EBITDA from operations were $34 million and 5.3 million respectively as compared to $29.5 million and $4.5 million in the prior year. Loss for the first half of the year was $3.2 million as compared to $3.4 million in the prior year. Sales for the six month period were 353,000 tons as compared to 318,000 tons or an increase of 11%.

Click Image To View Full Size

Note: Refer to the definition of EBITDA from operations and Free Cash Flow on the last page of this press release.

Sales and Customer Highlights

Q2 was characterized by strong sales volumes and revenue and volumes continued their upward trend and were up 18,078 tons (+11%) compared to Q1 2014 and up 17,545 tons (+10%) as compared to Q2 2013. Increased sales volumes were the result of strong coal shipments to the utility company as they are rebuilding inventory following the harsh winter conditions in January and February of this year. This performance was partly offset by reduced shipments to one of our industrial customers as a result of an extended shutdown of one of their furnaces. Revenue for the quarter was $17.5 million, an increase of approximately $1 million (+6%) over Q1 2014 and $1.9 million (+12%) over Q2 2013. This increase was mainly the result of increased sales volumes and the appreciation in the US dollar. This increase was partly offset by lower average realized pricing as a result of the mix of coal shipments (utility versus industrial customers) during the quarter.

Operational Highlights

The second quarter was challenging operationally as a number of issues impacted production volumes which in turn put pressure on the Company to meet it production cost targets. First, the Company experienced geological inconsistencies at the Old Union 2 and Powhatan mine which resulted in overall lower coal recovery rates and therefore lower coal production. Secondly, and more importantly, the Company had forecasted 14,000 tons of production from the Gooden Creek 2 mine in Q2 but the Company was unable to secure all of the necessary permits to open up this mine despite its efforts to fully comply with all the regulatory requirements including the proposed purchase of stream mitigation credits. As a result, overall coal production was lower than forecasted and average production cost targets of >US$50/ton were not met. Operating cost for the quarter, including the cost associated with purchasing coal, were $10.8 million or $58/ton as compared to $9.3 million in Q2 2013 or $55/ton. Despite the production challenges, this increase was mainly the result of the appreciation in the US dollar and Q2 operating cost in US dollar terms were actually slightly lower than in Q2 2013 ($53/ton vs $54/ton).

The Company continues to aggressively pursue the Gooden Creek 2 permit and is confident that the permit will be issued in the near term.

Corporate Reorganization

In order to further streamline its operations and drive cost savings, the Company is implementing a number of organizational changes that will result in the relocation of the head office from Calgary, Alberta to Birmingham, Alabama. The relocation reflects the reality that the Company's principal operating assets are located in North Western Alabama and is expected to save the Company approximately $500,000 per annum. The Company will maintain a presence in Calgary.

In conjunction with the relocation, Robert Lewis will assume the title of President & Chief Operating Officer of the Company and will be directly responsible for all operational aspects of the business. Jos De Smedt will, in addition to his role of Chief Executive Officer, assume the Chief Financial Officer role, replacing Scott Bolton. Jos will be directly responsible for all governance, strategy, finance, regulatory and investor relations aspects of the business. Scott Bolton remains as an advisor and director of the Company.

Liquidity and Financial Position Highlights

As at June 30, 2014, the Company had a working capital deficit of $7.9 million as compared to $25.3 million at March 31, 2014 and $22.8 million at December 31, 2013. The significant improvement of the working capital is the result of improved financial results in the first half of 2014, the refinancing of the May 2014 debentures with a new $14 million secured non-convertible debenture and the additional US$3 million financing by a major US financial institution. Also, during the quarter the Company initiated a debt to equity conversion transaction of $7.6 million in order to address its capital structure and debt to equity ratio. This transaction was completed on August 1, 2014. Further details on each of these transactions are provided in the Company's MD&A.

The impact of improved financial results, the additional equipment financing, the extension of the equipment financing loan term, the successful refinancing of the May debentures, the debt to equity conversion and other measures taken by the Company have significantly improved the financial position and capital structure of the Company:

-

-Working capital improvement of approximately $17.4 million as compared to March 31, 2014;

-Net debt decrease of $7.6 million; and

-Debt to equity ratio improvement, on a proforma basis at June 30, 2014, of 76:1 to 6:1.

Also, over the remaining term of the August 2016 debentures, the debt to equity conversion will reduce the Company's interest cost by approximately $1.4 million, including approximately $0.3 million in 2014.

In addition, the Company signed into an agreement with certain directors and officers (the "insiders") of the Company to defer interest owed on the May 2016 debentures to such insiders to October 1, 2015. The amount of the deferred interest is approximately $713,000.

The Company continues to focus on improving its working capital position and capital structure and evaluates on an ongoing basis a number of potential measures including maximizing customer coal shipments, improving operating efficiencies and implementing cost reduction opportunities, accelerating the sale of current coal inventories, selling excess equipment and identifying additional sources of funding.

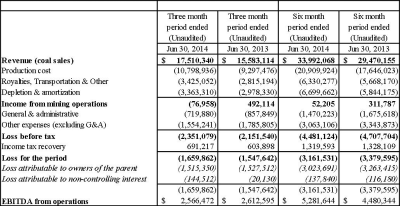

First Half 2014 Financial Results

Click Image To View Full Size

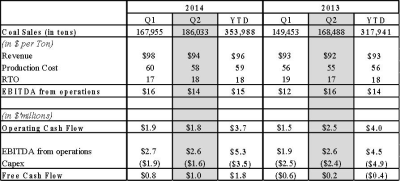

Key statistics are as follows:

Click Image To View Full Size

Note: Operating cash flow is before changes in non-cash working capital

-

-.Sales for the quarter were 186,000 tons, an increase of 10% over Q2 2013 sales. Improved sales are mainly attributed to the fact that the Company has a higher contracted customer sales base and that shipments to the utility company were extremely strong following the harsh winter. Sales for the first half of 2014 were up 11% as compared to the prior year.

-

-.Long term off-take contracts continue to enable the Company to achieve better than market pricing for our high quality coals. Average realized sales price per ton was $94 (US$86/ton) compared to $92 (US$91/ton) as a result of the appreciation of the US$ vs. the Cdn$. In US dollar terms, the lower price is mainly the result of the mix of our coal shipments as higher utility shipments have a lower average sales price. Consistent with the first quarter, the average sales price for the first half of the year was also lower at US$88/ton vs. US$91/ton in the prior year.

-

-.Average production cost per ton was $58 per ton (US$53/ton) compared to $55 per ton (US$54/ton) in Q2 of 2013. Although this represents a slight improvement from last year, the geological issues at Old Union 2 and Powhatan and the lack of production from Gooden Creek 2, and therefore the need to purchase coal from third party producers, have prevented us from achieving our target production cost of US$50/ton. For the six month period ended June 30, 2014, cost of production was $59 per ton (US$ 54/ton) compared to $56 per ton (US$ 54/ton) in 2013.

-

-.Operating cash flow for the first half of 2014 of $3.7 million was fairly consistent with the prior year.

-

-.Investment in equipment and mine development was $1.6 million as compared to $2.4 million in the prior year. In Q2 2014, the Company invested $0.7 million ($0.6 million in Q2 2013) in mine development in conjunction with moving to a new mine increment at the Knight mine and expanding its footprint at the Old Union 2 mine complex. Equipment capital repairs were $2 million ($1.3 million in Q2 2013) in the quarter offset by equipment sales of $1.1 million ($0.7 million in Q2 2013). In Q2 2013, the Company also purchased $1.2 million of new equipment. For the first half of 2014, capex (net of equipment sales), was $3.5 million as compared to $4.9 million in 2013.

-

-.Free cash flow at $1 million for the quarter is significantly up from $0.2 million in Q2 2013. On a YTD basis, free cash flow was $1.8 million compared to ($0.4) million in the prior year.

-

-.Repayment of equipment financing obligations continues at a healthy pace and in Q2 the Company repaid $2.2 million of these obligations. On a YTD basis, the Company has repaid $4.2 million.

Company CEO, Jos De Smedt commented: "The second quarter was a mixed one with continued strong sales volumes, significant progress on the improvement of our working capital and capital structure but disappointing at the production level. The inability to put Gooden Creek 2 into production combined with geological inconsistencies at our Old Union 2 and Powhatan mine has challenged our Company from a production point of view. Some of these operational challenges are now behind us and we are aggressively pursuing the start-up of operations at GC2 and are evaluating options to maximize production at our other mines. As to our working capital and capital structure, good progress has been made but more work is required and our team will remain focused on this issue and look at additional options and measures that the Company can take to further improve the financial position of the Company. With production fully contracted for and strong demand for our high quality coals, we remain confident for the remainder of 2014.

Outlook for remainder of 2014

The Company is optimistic about the remainder of 2014 as it relates to the local coal markets. Demand from our customers remains strong, additional sales opportunities are becoming available and some supply has been taken out of the local market. That having said, the Company requires production from the Gooden Creek 2 mine in order to deliver on its plan for the remainder of 2014. Although we believe the permit will be issued soon, the timing of such is uncertain and therefore the Company will have to continue to purchase coal from third party producers.

The main focus of the Company for the remainder of the year will be:

-

-to maximize production at the existing mines and aggressively pursue the start-up of operations at the Gooden Creek 2 mine;

-to continue to improve the working capital position of the Company and evaluate on an ongoing basis a number of potential measures including maximizing customer coal shipments, improving operating efficiencies and implementing cost reduction opportunities, accelerating the sale of current coal inventories and selling excess equipment; and

-to continue to improve the capital structure of the Company by identifying and attracting additional sources of funding.

For Further Information:

CanAm Corporate Office:

Jos De Smedt, Chief Executive Officer