Canada’s Brookfield makes $700m bet on leading US producer and graphite’s emerging role in new energy, defence and nuclear markets

> Free battery supply chain seminars

> Join our new Linked In Group

>Benchmark Twitter

An affiliate of Brookfield Asset Management Inc has launched a takeover bid for GrafTech International Ltd, one of the world’s leading producers of steel electrodes and value-added graphite products.

An offer of $5.05 per share, a 26% premium on GrafTech’s average trading price on the 60 days up to 28 April 2015, has been “unanimously accepted”, which sees Brookfield value the company at $692.8m.

While on the surface it could be seen as a foray to acquire a world leading steel anode and refractory producer, Benchmark Mineral Intelligence believes the long term value lies in its research into new energy storage and advanced material markets.

GrafTech manufactures one of the world’s widest ranges of graphite products for use in industrial, aerospace, defence and new energy markets. The company predominately manufactures products based on synthetic graphite, but also buys smaller volumes of natural graphite for its refractory, foil and expandable graphite products.

GrafTech’s primary revenue driver is its Industrial Materials division which produces synthetic graphite electrodes (capacity: 195,000 tpa) and refractory products for the steel industry. The business, which also has a 140,000 tpa needle coke production facility, generated sales of $840m in 2014, down from $909m a year before. This division equates to 77% of the company’s income.

Its secondary source of income is from the Engineered Solutions division which manufactures advanced, graphite-based materials for aerospace, defence technologies, nuclear energy applications, batteries and solar power (high purity silicon). The division’s revenue in 2014 stood at $245.2m, 23% of net sales.

Takeover rationale: Advanced materials not steel

Although Brookfield has not yet gone on record to explain their rationale for purchasing GrafTech, Benchmark Mineral Intelligence anticipates it is more to do with the company’s leading research into new markets and less about its number one business, steel electrodes.

While sales to steel or industrial-orientated customers equated to $840m last year, long term concerns over the health of this sector persist. China, the driver of the steel market, has spent the past 18 months attempting to correct the huge overcapacity and overproduction that has beset the industry.

This long term plan to bring the country in line with real demand for steel leaves many believing that the sector is settling a new lower demand equilibrium with less steel being produced from now on, and less raw materials needed as a result. This was also flagged by the company in its Q1 2015 results.

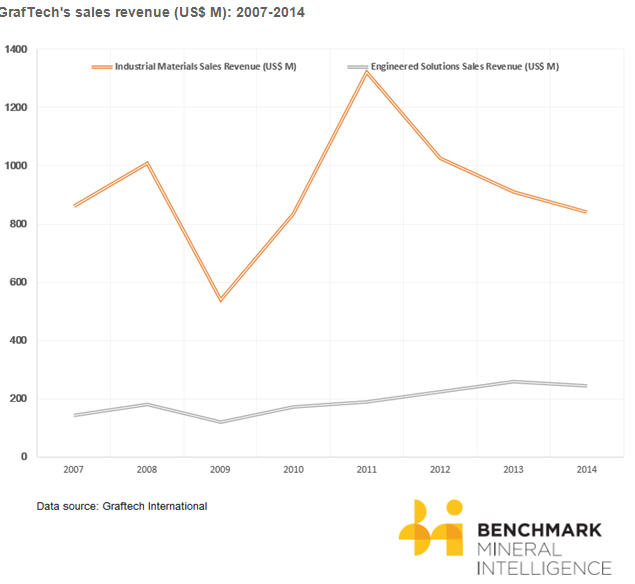

GrafTech’s sales numbers in its Industrial Materials division back this up.

While sales reached a peak of $1.32bn in 2011, they have continued to fall since and now stand at $840m. Revenues now are 2% lower than they were 7 years ago in 2007, the furthest back data is available from the company.

With such a huge demand gap unlikely to be filled, even by a more buoyant and hopeful India, this leaves many fearful over steel’s medium term future and searching for new growth markets.

Meanwhile, GrafTech’s Engineered Solutions business has had quite the opposite experience.

Steady and secure growth has allowed GrafTech to build its advanced materials business which receives 71% more revenue than it did in 2007. While these markets were not insulated from the financial crash in 2009 and the industry slowdown of the last 12 months, the impact of such events were far less severe and have not altered the long term growth trend which is demonstrated on the chart below.

GrafTech's sales revenue (US$ M): 2007-2014

Market opportunity

Another important point is the market opportunity available to GrafTech. The below statistics show that the Engineered Solutions market is already worth roughly half of the value of industrial markets with its strongest growth is yet to come.

- Industrial Materials Market Size: $5bn / GrafTech revenue $840m

- Engineered Solutions Market Size: $2.4bn / GrafTech revenue $245.2m

In the last five years in particular, GrafTech has developed one of the industry's leading R&D businesses to focus on the growth in advanced materials demand. Last year R&D spend peaked at $14.8m and coincided with the opening of a new facility in Ohio, US.

GrafTech explained: “A significant portion of our research and development is focused on new product development, particularly Engineered Solutions for advanced energy applications such as solar silicon manufacturing, electronic thermal management, energy storage and generation.”

In simplified terms, the company’s research focus is on batteries and solar power, much the same as Tesla Motors Inc which recently announced a new line of commercial and home battery packs, optimised for use with solar energy sources.

Meanwhile GrafTech also have a highly specialised business in aerospace, defence materials and nuclear energy sectors. The company sells high purity (>99% C) and ultra-high purity (99.998% C) graphite products to strategic customers such as the US Department of Defense.

Strategic customers are usually served on private, long term contracts that are lower in volume but significantly higher in value requiring high purity graphite products such as blocks, shapes and foils.

Today, Graftech has fundamentally two business: a mature, steel orientated business that could have peaked and an immature, advanced materials business that is just getting started.

Should Brookfield aggressively target the new energy and strategic markets that GrafTech’s Engineered Solutions division serves, then the serious growth could be yet to come.