The gold price on Friday lifted slightly off three-week lows struck yesterday trading around $1,173 an ounce in quiet and directionless trade.

After briefly topping $1,300 an ounce in January gold is now back below its 2015 opening levels and down 11% over the past 12 months.

The strong dollar and money rotating out of gold and other hard assets into equity markets can take much of the blame for gold's weakness.

US equity markets continue to trade within shouting distance of all-time highs. At the same time investors continue to pull money out of gold-backed ETFs and gold coin sales have plummeted.

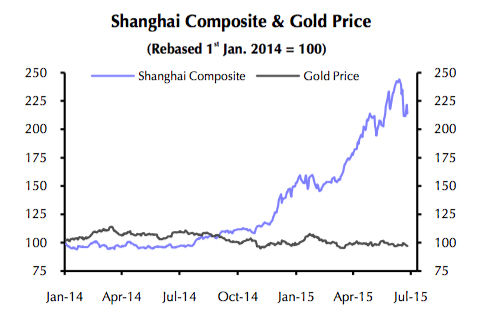

Nowhere has the rotation out of gold and into stocks been more visible than in China.

Gold imports declined by 83 tonnes during the first four months of the year. Over the same period the Shanghai Stock Exchange has more than doubled.

But that trend could now be reversing.

Investors are becoming increasingly worried about a more pronounced correction in China’s stock market and will return to gold to diversify their portfolios

Chinese investors nervous after the past year's amazing run have sent stocks 12% below the recent peak after a few dramatic one day drops during the past two weeks.

A growing sense that the rally is unsustainable are forcing Chinese investors back to the relative safety and stability of gold.

Data released from the Hong Kong Census and Statistics Department revealed that China’s imports of gold via Hong Kong surged in May – rising by more than 35% compared to April and this time last year.

According to the Swiss Federal Customs Administration, China’s imports via Switzerland in May also jumped. Imports were up 24% month on month and rose 800% compared to May 2014.

Capital Economics, an independent research house, says investors "are becoming increasingly worried about a more pronounced correction in China’s stock market and will return to gold to diversify their portfolios."

The volatility on the Shanghai and Shenzen markets (and to some extent the wildly fluctuating gold imports) can be ascribed to the high percentage of retail investors.

A whopping 80% of investors buy and sell stocks using their own accounts. On US stock markets that figure is less than 14% and even when including indirect ownership it's less than half.

Source: Capital Economics