Negative Impact On The Economic Fortunes (Not Good For TRQ)

Summary

Analysts rate the stock between a strong buy and a moderate sell.

Liberum downgrades Rio Tinto to sell after steel industry contraction in China.

1-month performance shows uptick in Rio Tinto stock price of 12.40%.

Year-to-date performance for Rio Tinto stocks on the NYSE is -20.32%.

How China Factors into the Mining Equation

(click to enlarge) Rio Tinto (NYSE:RIO) like other mining stocks in Anglo American (OTCPK:AAUKY), BHP Billiton (NYSE:BHP) and Glencore PLC (OTCPK:GLNCY) has had to endure a tumultuous year to date. The global economy is attempting to soak up the effects of China weakness vis-a-vis the 20.4% decline in imports in September year-on-year and the 3.7% decline in exports in China in September, year-on-year. China is central to the fortunes of emerging market economies and developed economies alike. What we are seeing is a strategic shift in direction in China away from an export-driven economic model to one that is consumer-centric.

Rio Tinto (NYSE:RIO) like other mining stocks in Anglo American (OTCPK:AAUKY), BHP Billiton (NYSE:BHP) and Glencore PLC (OTCPK:GLNCY) has had to endure a tumultuous year to date. The global economy is attempting to soak up the effects of China weakness vis-a-vis the 20.4% decline in imports in September year-on-year and the 3.7% decline in exports in China in September, year-on-year. China is central to the fortunes of emerging market economies and developed economies alike. What we are seeing is a strategic shift in direction in China away from an export-driven economic model to one that is consumer-centric.

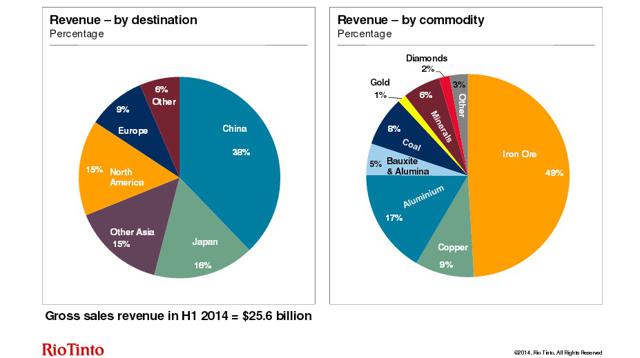

The Chinese economy is now focused on building up its infrastructure, urbanizing hundreds of millions of people, and reinvigorating an economy that has just slipped to 6.9% GDP growth. China is the number-one trading partner for the vast majority of emerging market economies involved in the manufacturing and production of energy and metals. Multinational conglomerates around the world with operations in developing countries have seen a sharp decline in production, revenues and profitability since Q2 2015. This has been brought on by oversupply, weak demand, dollar strength and high levels of anxiety in global markets. The sharp contraction in steel manufacturing and production in China during September has had a dramatic effect on the economic fortunes of mining companies like Rio Tinto which are front and center in this equation.

Every time the Fed is ready to make a decision vis-a-vis interest rates, speculators come out to play with emerging market currencies. For the remainder of 2015, we can expect the Fed to stay away from hiking rates, thereby keeping the dollar from appreciating, but only for so long. A stronger dollar is bad for US companies attempting to export more, but it allows for greater domestic consumption of foreign goods. In any event, the likelihood of a rate hike this year is slim, but come 2016 we are all but assured of a 0.25% hike in interest rates. This will weaken emerging market currencies, and place stress on the demand for dollar-denominated commodities like iron ore, coal, copper, nickel and crude oil.

How is Rio Tinto PLC ADR Performing?

(click to enlarge)

As at the 29 October 2015, the price of Rio Tinto PLC was $36.70 per share. The stock is trading 0.84% lower, but its one month performance has been boosted by 12.40%. The stock's 52-week price range recorded a low of $31.97 on 28 September 2015 and a high of $50.07 on 20 February 2015. On Thursday, 29 October, Liberum made the decision to downgrade Rio Tinto to a sell rating, from a hold. This was brought about by the recently released data on steel manufacturing production in China which is at multi-year lows. Further, China's sharp decrease in demand for many commodities, notably iron ore is going to have a negative impact on the economic fortunes of companies like Rio Tinto, BHP Billiton, Glencore PLC and Anglo American.

The prosperity of mining companies is not dissimilar to that of the gold sector where plunging prices, declining profits and mass layoffs are taking place. Commodities like iron ore and copper are facing similar challenges in the markets. High levels of volatility over the past couple months have had a marked impact on demand for these commodities. For Rio Tinto, the ranking commodity is iron ore, and this is a vital component in the production of steel. On the upside for Rio Tinto, the actual figures reported have beat consensus forecasts by a substantial margin. Q1 and Q2 profits for 2015 dropped by 43% on the back of weak iron ore prices. However they beat forecasts at $2.9 billion. Rio Tinto is unlikely to change its guidance for the remainder of 2015.

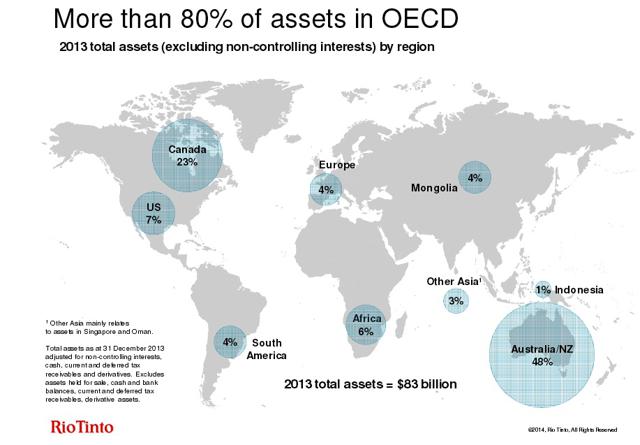

All major iron ore producers like Rio Tinto are aiming for low-cost production over a prolonged period of time. It is this type of economic model that these multinational conglomerates are targeting. Rio Tinto has a huge base of operations in Western Australia, but declining exports to China are hurting operations in a big way. Rio Tinto and other mining companies find themselves at an uncomfortable crossroads because there are so many diverse products that they are extracting from the earth, including copper, iron ore, coal, nickel and so forth - that a streamlining of operations is essential to maintain viability over the long-term.

(click to enlarge)

Rio Tinto however remains focused on its essential commodities in aluminum, coal, copper and iron ore. There are also concerns that there will be consolidation in the mining industry, with major mining companies swallowing up smaller mining companies. This would be done in an effort to lower costs, reduce competition and boost production. However, talk of Glencore PLC taking over Rio Tinto has all but evaporated, as the former company has become the worst performing entity on the FTSE 100. The price of Glencore PLC has plummeted dramatically, but there is a little bit of a more positive outlook for Rio Tinto.

Rio Tinto has several things working in its favor, notably the fact that it is a low-cost mass volume producer of iron ore. Before Rio Tinto exits the stage, many of the higher cost producers will have to shutter their operations, which will in turn save companies like Rio Tinto from following in that same direction.

Key Performance Indicators

- Rio Tinto 3-year performance -26.54%

- Rio Tinto 1-year performance -25.51%

- Rio Tinto 3-month performance -2.86%

- Rio Tinto current earnings per share 1.58

- Rio Tinto earnings per share 1-year ago 3.53

- Rio Tinto dividend yield 5.67%

- Rio Tinto market capitalization $67.02 billion

It is clear that the pressures facing this company are great, but it is certainly better poised than many others in the mining sector, owing to its lower cost of operations. The consensus estimate regarding the number of analysts who are considering buying or selling Rio Tinto is largely unchanged week on week in October. On a scale of 1.0 (strong buy) - 5.0 (sell), Rio Tinto's mean recommendation for the weak is 2.3. This places it squarely in a buy/hold range. The stock's higher target price is $61.77 and its lower target price is higher than the current trading price, at $37.60.

Prior to Liberum's downgrade of Rio Tinto on October 29, the same research firm upgraded Rio Tinto from a sell to a hold on 5 August 2015. There is no doubt however that the mining sector is in all sorts of trouble at this juncture. Investors may be looking for value in the stock, and it is certainly there, provided we can see the bottom. When we compare the performance of Rio Tinto to the industrial metals and minerals sector, there is cause for concern. Rio Tinto is trading below the industrial metals and minerals sector averages, but this is not surprising given recent developments. In terms of buying or selling the stock, when the number of buyers exceeds the number of sellers we can be pretty confident that the stock will be bottoming out. Are we there yet? Not quite!