Summary

Valeant guided down this morning with revised EPS and revenue estimates for Q4 and FY 2016.

While a major mark down, it's not as bad as it could have been and it falls in line with our estimates for 2016.

We believe there's still 20% upside in early 2016.

By Parke Shall

The last article that we wrote about Valeant (NYSE:VRX) looked at some of the trading that Bill Ackman had gotten involved in over the last month. As many of you know, Mr. Ackman increased his position in the company using stock and derivatives while the company was trading in the $80-$90 range. It was our conclusion that Mr. Ackman thought the stock would appreciate up to the $130 level, a conclusion that we also agreed with and therefore concluded by saying that we still saw 20% to 30% upside from levels that the company was trading at. We drew these conclusions in late November and early December.

VRX data by YCharts

Today is VRX's investor day, and they started off the morning by readjusting their guidance for the fourth quarter and for a full year next year. As WSJreported,

The Canadian company said it now expects to earn an adjusted $2.55 to $2.65 a share for the fourth quarter, down from an earlier range of $4.00 to $4.20 a share and far short of the $3.47 a share analysts have expected. Valeant sees quarterly revenue of $2.7 billion to $2.8 billion, lower than its earlier guidance of $3.25 billion to $3.45 billion. Analysts surveyed by FactSet expected sales of $3.07 billion.

These new numbers fell right on top of the conservative guidance that we had come up with in-house. If you read our last few articles you can see that we predicted the company would post EPS next year of between $12 and $14. We used this reasoning when we were trying to come up with a price target. Here is our exact quote,

We believe this is exactly what will occur on December 16. We believe if the company can reasonably do between $12 and $14 per share in EPS next year, that with regulatory risk, the stock should be trading somewhere between $110 and $130, based on a conservative multiple. This would leave about 10% to 30% upside from current levels until VRX rids itself of its regulatory worries. From that point, it's contingent on what action is taking place.

Also in the news yesterday was that VRX had replaced its specialty pharmacy company with a newly minted deal with Walgreens (NASDAQ:WBA), that would result in some price drops, but an extremely robust distribution network and a powerful partner in one of the industry's biggest names. This was enough to send the stock up almost 20% yesterday, as the narrative we have tried to push forward seems to finally be coming clear to the market. That narrative is that while major risks still loom, VRX is going to make it out of this crisis.

And it is not all sunshine and rainbows for the company. They still have a fair amount of criticism and challenges that they are going to have to answer to. For instance, VRX is going to be expected to have to answer to Congress with regards to how they are pricing drugs that they acquire. Increased scrutiny from the public is also a detriment to the company, however, we have said from the beginning that the company's main consumer base for its everyday products will likely not be affected.

The company has had a chance to take several months and look at the effect of recent changes to their model and how it could adversely affect the company.

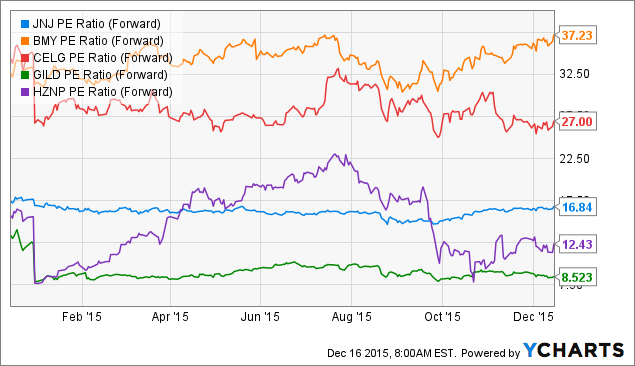

We are hoping that the company has drawn up a worst-case scenario for earnings next year, and we still believe there is upside from this morning's dip. When VRX was growing exponentially, it traded at a multiple of over 20. Some of the most highly respected peers in pharmaceuticals trade between 10 and 30 times earnings.

JNJ PE Ratio (Forward) data by YCharts

VRX, with its increased scrutiny and with a temporary ban on acquisitions, we believe should trade at a multiple of 10x next year's earnings, which would reiterate our price target of about $130-$135 per share. Based on Mr. Ackman's selling of February 2016 $130 calls, it seems that he agrees. We think as the smoke clears and the bad press dies down heading into 2016, that we could see VRX trade in this area in the first two quarters of 2016.

Again, it is important to know the risks.

There is always the risk of more questionable activity being uncovered, although we believe the worst is over as signaled by the main short seller closing his position. We also believe that you are essentially getting a call option for the company when you purchase shares, because if the company can return to growth by the end of 2016 and it clears its regulatory hurdles, you may be able to see it trade 15x 2017 estimates, which we believe is a conservative path for the stock once again potentially trading over $200.