Gold stocks remain the pariah of the investment world. Despite gold's strong early-year gains, the stocks of its miners have slumped to new secular lows. This whole forsaken sector continues to languish at fundamentally-absurd price levels, an extreme anomaly that is long overdue to start unwinding. The gold miners will be bid massively higher to reflect their impressive profitability even at today's dismal gold prices.

Just this week, the flagship HUI gold-stock index plunged to a major new secular low. On Tuesday as gold merely slid 0.3%, the HUI plunged 5.6% to 100.7. This was an astounding new 13.5-year secular low, reeking of capitulation since gold's price action certainly didn't justify such a disastrous reaction in its miners' stocks. That left already epically-bearish gold-stock sentiment even worse, which is hard to believe.

The gold stocks are ultimately leveraged plays on gold, because prevailing gold prices determine their profitability. And all stock prices eventually migrate to some reasonable multiple of their underlying corporate earnings, gold stocks are no exception. Gold's overwhelmingly-dominant role in gold-mining profits has led this sector to amplify gold's price moves, typically by 2x to 3x in major gold-stock indexes like the HUI.

So Tuesday's extreme 21.9x downside leverage was wildly outsized. Gold stocks actually got off to a strong start in early 2016, surging 9.9% in this year's first 4 trading days compared to gold's 4.7% gain. But as soon as gold pulled back, the gold stocks got sucked into the bearish maelstrom of the plunging general stock markets. So by Tuesday, the HUI was down 9.4% year-to-date compared to gold's 2.5% rally.

But this horrendous performance leading to calls for deep new lows is maskingan ongoing bottoming. Back in mid-July, gold was blasted by an extreme gold-futures shorting attack explicitly executed to manipulate gold prices lower by running long-side stop losses. In the aftermath of that, the HUI dropped to 104.9 in early August. That would prove major new support near 105 that held strong until this week.

Despite the vast bearishness arrayed against them, gold stocks held their ground for 5.5 long months. Despite gold slumping to 7 new secular lows in November and December, the HUI didn't fall materially under 105. Despite the Fed's first rate hike in 9.5 years in mid-December that was universally expected to obliterate gold, that support held. And that continued into 2016 despite plunging global stock markets.

Even as of Tuesday's new low, the HUI had only lost 4.0% since its initial early-August bottom. Gold's price edged 0.2% higher over that span, while the benchmark S&P 500 stock index plunged 10.4%. With so many excuses to continue dumping gold stocks in the past half-year, their relative strength is a telltale sign of selling exhaustion. Pretty much everyone who wants out has already long since sold and exited.

So this week's abrupt plunge to crazy new secular lows despite flat gold pricesfelt like a capitulation, which has been long overdue. The gold miners' stocks are radically undervalued fundamentally, they have been pounded for years technically, and the extreme bearishness long plaguing them couldn't possibly get any worse sentimentally. Everything is in place for gold stocks to carve a major secular bottom.

While ironclad technical and sentimental arguments can be made for gold stocks reversing and mean reverting sharply higher, the fundamental case trumps everything else. Despite this sector's endless slide and universal antipathy, the gold miners' underlying profit fundamentals are what's going to turn around this left-for-dead sector. Gold stocks are truly trading atfundamentally-absurd price levels today!

Since the vast majority of mining costs are effectively fixed during mine-planning stages, the dominant variable driver of gold-mining earnings is the price of gold. And the relationship between these profits and gold is leveraged, not linear. This reality is easy to grasp. Imagine a gold miner producing gold for $850 per ounce. In a $1050 gold environment, December's secular low, this miner earns a $200-per-ounce profit.

The miners' costs don't change as gold rallies, so all those gains amplify the bottom line. Since those Fed-rate-hike lows, gold has climbed back over $1100 in 2016. At $1100 even, that's a 4.8% gold-price rally. Yet it still costs our miner $850 per ounce to produce, while selling that gold at $1100 now yields a $250-per-ounce profit. That's a 25% increase on less than a 5% increase in gold prices, excellent leverage!

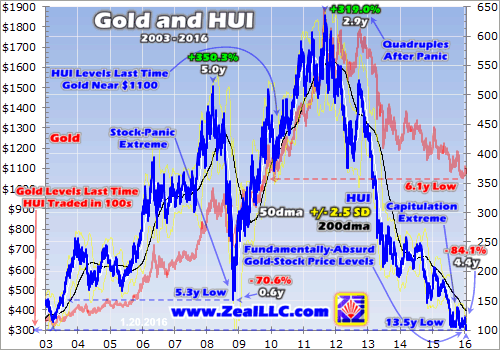

Since profits ultimately determine stock prices, essentially all that matters for the gold miners is the price of gold. Thus they have always moved in lockstep with gold, amplifying its price moves. But as this first chart of gold and the HUI reveals, a radically-unprecedented disconnect emerged in early 2013. And it has only worsened in recent years. The gold miners' stock prices are no longer reflecting prevailing gold levels.

This week's bizarre capitulation selling pummeled the HUI to an extraordinary 13.5-year secular low. It was the lowest HUI close since all the way back in July 2002. Back then gold was trading near $305, and had yet to exceed $329 in its young secular bull. This Tuesday, gold closed near $1087 or 3.6x higher. Yet gold stocks were trading at levels last seen around $305. Does that make any sense at all?

Absolutely not! Such an extreme pricing anomaly in any other sector would lead to a stampede of new buying. Imagine if Apple's stock was trading as if it could only sell its iPhones for 3/11ths of their actual selling price. Investors would rush in to buy this epic bargain, rapidly bidding up Apple's stock price until it reflected actual underlying cash flows. Only in ignored gold stocks can such a radical disconnect exist.

The ludicrous magnitude of this deviation is confirmed looking the other way, through the lens of gold. Just after the Fed finally ended its 7-year-old zero-interest-rate policy in mid-December, gold fell to a deep 6.1-year secular low. Where was the HUI the last time gold prices closed near $1050? Trading way up over 390, 3.7x higher. Gold-stock prices are so low that they need to quadruple merely to reflect gold today!