Overview

Ucore (OTCQX:UURAF) recentlyannounced that two of its royalty investors have decided to convert their royalties into common equity as per the royalty agreements. Recall that the company has entered three royalty agreements giving the holders the right to a royalty on the company's first major MRT separation plant. They can also be converted into stock. All three agreements have similar terms, which can be found in the relevant PRs--here's the initial one. We note that the third investor only had to pay half of his $5 million cost up front, and that the other half isn't due until April 30th, 2016. Ucore has not reported that it has received the second payment for this royalty.

Ucore (OTCQX:UURAF) recentlyannounced that two of its royalty investors have decided to convert their royalties into common equity as per the royalty agreements. Recall that the company has entered three royalty agreements giving the holders the right to a royalty on the company's first major MRT separation plant. They can also be converted into stock. All three agreements have similar terms, which can be found in the relevant PRs--here's the initial one. We note that the third investor only had to pay half of his $5 million cost up front, and that the other half isn't due until April 30th, 2016. Ucore has not reported that it has received the second payment for this royalty.

The royalty-to-equity conversion in itself has been interpreted positively by Ucore and by retail investors, thanks to some supportive statements from one of the converting shareholders--Orca Partners. Orca feels that the equity offers better value than the royalty at the current valuation. We don't have access to their internal numbers or their internal data regarding the most recent test-work done on REE-separation using Ucore's separation partner's technology--molecular recognition technology (or "MRT"). However investors have read this development as a positive endorsement of MRT.

We're Not Buying It

Based on the information available to the public we still cannot put our weight behind MRT. In April, after talks with Ucore and its chemical engineering partner IBC Advanced Technologies fell apart, we put out an articlequestioning the strong conviction of management and Ucore shareholders. We didn't conclude that it couldn't be done, but we did raise some issues and pointed out that any new technological application would be inherently risky and take years to develop and optimize.

Since then Ucore has been able to convince three large investors to put up at least $1 million each for a total investment of more than $10 million. In fact many of our subsequent critical remarks regarding Ucore and MRT have been met with rebuttals citing the company's ability to raise money. We certainly applaud Ucore's success in raising money and note that other companies have had tremendous difficulty in doing so (e.g. see our recent article on Northern Minerals (OTC:NOURF). Of course the ability to raise money hardly legitimates a project: consider that Midway Gold, Rubicon Minerals, Luna Gold, Colossus Minerals...etc. were all able to raise large amounts of money from highly reputable sources.

Again, we don't know the specifics of MRT to the extent that Orca's and Ucore's insiders do, but we can infer two troubling things from Ucore's public statements. The first is that, based on their own logic they cannot demonstrate MRTs superiority either economically or with respect to its environmental friendliness. We think this reasoning can be used to argue that other alternatives have higher likelihoods of reaching commercial production. The second is that they deduce MRT's superiority using false statements.

Conveniently, our three primary issues with Ucore's public statements regarding MRT can be found in one Q&A exchange in an interview with Peter Epstein, whose website was sponsored by Ucore at the time of its publication.

It seems every country and aspiring REE producer knows that energy and pollution intensive Solvent Extraction (SX) methods are coming to an end. What will replace it and how soon?

That's a great question. Most now agree that the days of widespread use of SX are numbered. The feeling is that SX will not be tolerated in most countries outside of China (and indeed within China over time), as carbon emissions and environmental waste from processing come under increasing scrutiny. We believe MRT is likely to become the go-to replacement for SX, both economically and environmentally. MRT represents far fewer process steps, (simpler flow sheet), far less waste, limited tailings, faster production runs, and REE recoveries and purity levels above 99%. Other technologies that might also achieve environmentally & economically viable results are welcome to share in this massive market opportunity.

That said, we believe we are the de facto front runner, given that MRT has more than 25 years of successful history, whereas other would-be SX killers are fresh out of the gates, yet to be proven at pilot scale. It will probably take 10+ years to make a significant dent in China's huge SX dominance. This is a key goal of Ucore, the Military,"USDOD" and Department of Energy, "DOE," as well as innumerable REE users in the West. Having multiple sources of refined material, security of supply, from environmentally sound jurisdictions is of paramount importance. (Epstein's/McKenzie's emphasis)

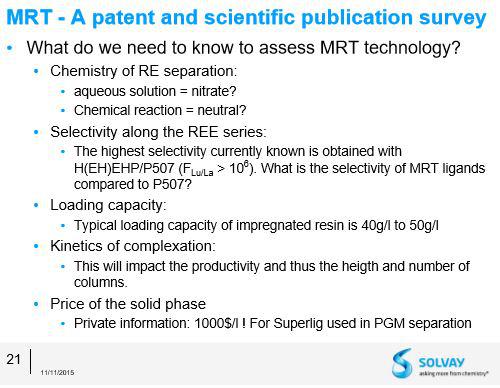

First, McKenzie says that most people agree that SX is a thing of the past. There is no way to verify this without taking an actual survey, so this is just nonsense. We know for a fact that some of the smartest people in REE separation would disagree. Alain Rollat of Solvay/Rhodia recently gave a damning presentation in Singapore highlighting the hurdles that MRT will face. More importantly he highlights the lack of information available to the public regarding the process' efficacy and efficiency.

None of this means that MRT isn't viable (although we suspect the resin cost might), but without this information how can investors make an educated decision? Maybe the large investors have answers to these questions, but we find it highly unlikely that they have the specialized hydrometallurgical separation experience and knowledge that Solvay/Rhodia possesses, having been in the business for nearly a century (since 1917).

Lynas' (OTCPK:LYSDY) senior executives are skeptical as well, having cited SX overcapacity as an economic argument against new technologies, or even new SX plants. Keep in mind that any new separation plant will have to be built, meaning the initial capex will likely be higher than the cost of increasing the production of a plant running under full capacity, of restarting an idle plant, or expanding an existing one. For instance, while Molycorp (OTCPK:MCPIQ) is in chapter 11 right now it will come out of bankruptcy and continue to use SX (although we aren't sure which ore and concentrate it will be processing given that Mountain Pass is on care/maintenance). This means Lynas' claim is even stronger since there is latent capacity that will almost certainly come online before MRT begins producing commercially viable quantities of REEs.

We do note that there are counterarguments to each of these and wonder why Ucore isn't pushing them more aggressively--especially the first. With respect to Rollat's presentation, one of the difficulties with solvent extraction is that the input material has to meet stringent specifications regarding their REE distribution and the level of certain deleterious impurities. We suspect that MRT will not face this problem, meaning that Ucore could theoretically use a "lower quality" feedstock for its MRT plant and wind up with separated REEs where a solvent extraction plant could not.

With respect to Lynas' remarks we note that the bulk of the overcapacity in solvent extraction is in China. We can easily imagine a scenario in which Western buyers cannot access REEs out of China, thereby making separation capacity outside of China more valuable than one would expect given the aforementioned overcapacity.

Second, the environmental impact claims are questionable as well as they can hardly be proven considering that Westerners have no idea what SX processes are being used in China--the innovations over the decades have been numerous and are kept close to the vest. While environmental concerns may not have been at the forefront until recently, many economic improvements result in environmental improvements (e.g. efficiency in reagent consumption). That isn't to say that SX is great for the environment, but we would need to see a relative study between SX and MRT that takes into consideration the environmental impact of producing all of the custom equipment (e.g. custom resins) required to implement the latter commercially. Without one there is no way to verify McKenzie's statement.

Third, we think that the worst offense in this answer is in McKenzie's statement that of all the "new" REE separation technologies that MRT has the richest history of industrial applications, while others are "just out of the gates." This is blatantly false. MRT has been used in a few mining operations, and it is not frequently used as the sole separation mechanism. Other technologies have much richer histories, and we cite a couple of examples of companies developing technologies that are far more ubiquitous in industry today than MRT. First, the process being explored by Texas Rare Earth Resources (OTCQX:TRER) and its engineering partners K-Technologies has been used in a myriad of industrial applications from metallurgy to water purification to the separation of organic compounds from one another in food and drug applications. Ion exchange and ion chromatography have been used in REE separation experiments going back to the 1940's. Even the innovation that K-Tech wants to add--making the process continuous--goes back to the 1980's and is used today in industry [e.g. Calgon Carbon (NYSE:CCC)] where larger quantities of material need to be handled. We also note that another company--REEtech/Scatec--has publicly displayed their progress and are utilizing a similar technology. Scatec is a major company with substantial resources compared with the REE juniors--Ucore included. Second, while we can't discuss the details, the technique that privately owned Rare Earth Salts is developing has been used in the mining industry for metal separation in innumerable projects. Consequently, if "rich history" can be used to rank new separation technologies then MRT would rank near the bottom with Geomega's (OTCPK:GOMRF) electrophoresis.

The Bottom Line

Again, we don't know whether the people at Orca have adequate explanations to our concerns. As far as the public is concerned MRT has no demonstrable advantage to SX or other separation proposals. Ucore tries to argue that there is an advantage through the aforementioned claims, which we've seen are questionable at best and outright false in one case. A bet that they have internally demonstrated such an advantage may not be a losing one, but it cannot be justified by anything other than blind faith.