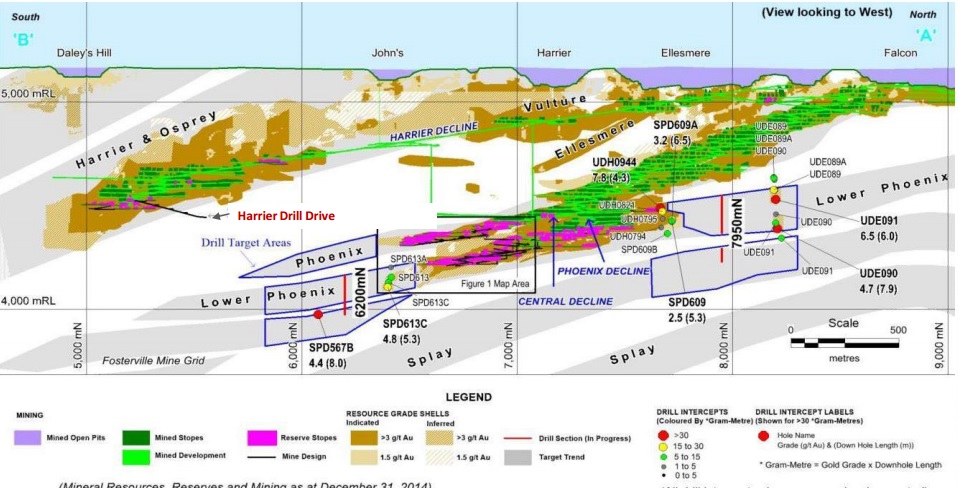

Excerpt from Caesars Report weekly roundup Newmarket Gold strikes it rich at Stawell and reduces its interest expenses by C$2.8M per year

on in Blog

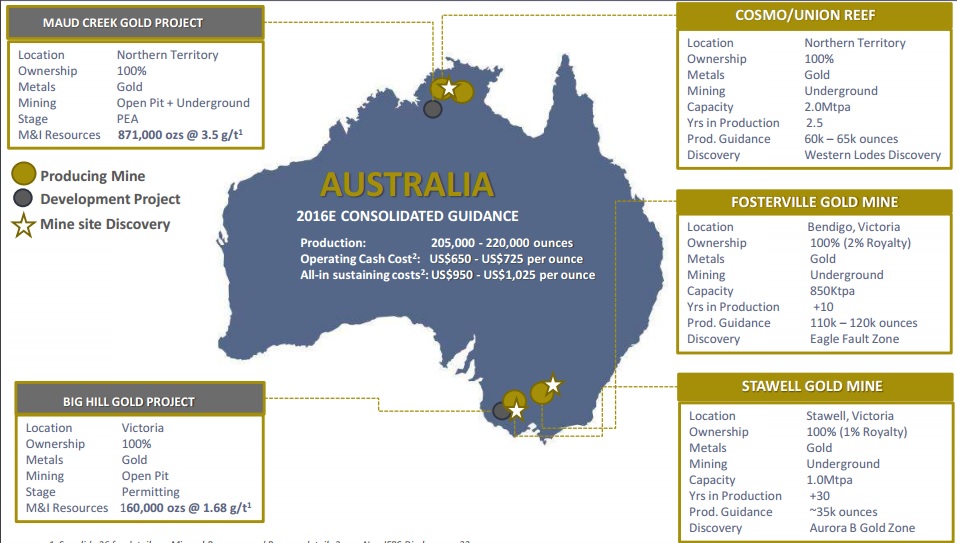

Newmarket Gold (NMI.TO) is continuing its exploration efforts at the Stawell gold mine in Australia, where it has been focusing on the Aurora B zone, it’s main exploration target. The company has completed 13 holes on that prospect for a total of almost 5,000 meters. Newmarket’s interest in this zone was triggered after having discovered the Hampshire lode which seems to be quite a sizeable potential high grade gold structure, and the company designed a Phase 3 drill program to try to define the mineralization.

10 of the 13 holes that have been drilled have successfully intercepted this lode and it increases the company’s confidence in the geological model and structure of the lode with a narrow (0.65m true width) intercept containing in excess of half an ounce of gold per tonne of rock as well as almost 5 meters (still true width) of almost 8 g/t gold.

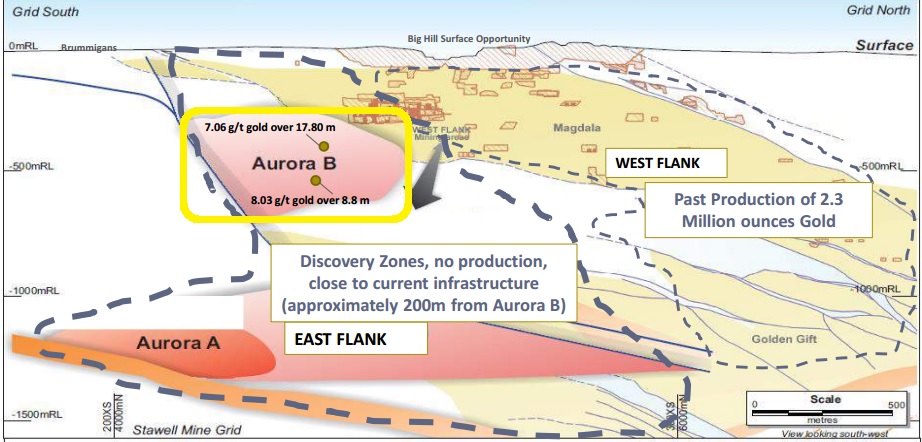

Exploration potential at the Cosmo-mine

Additionally, Newmarket Gold has pushed forward its underground development at Stawell and completed 327 meters of underground workings. It has now relocated two drill rigs to this underground drill station and the company will now drill an additional 3,000 meters in no less than 7 diamond drill holes, so let’s hope Newmarket can strike it rich again.

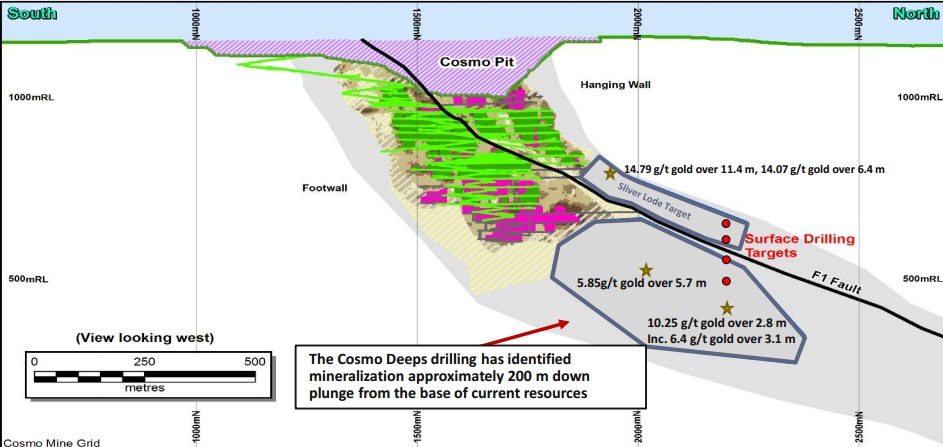

Exploration potential at Fosterville

Earlier today, Newmarket also announced it intends to redeem all of its convertible debentures that are currently still outstanding. Newmarket will settle the convertible bonds in new shares, and this redemption will save the company C$2.8M in annual interest payments.