Summary

50% of VRX's shares outstanding are held by well-regarded hedge fund titans.

These funds have sizable assets under management and a strong performance track record.

They also have a sticky capital base with no signs of panic, yet.

Tuesday will likely not be the end to this very interesting saga.

Introduction

With just a day to go until Valeant (NYSE:VRX) releases its preliminary fourth quarter earnings, shareholders are no doubt nervous. This is particularly the case for some of the largest hedge fund managers in existence today, whose support for Valeant have been unwavering over the past 12 months.

Let's take a look again to see who they are, and why the stakes are especially high for them.

A Hedge Fund Hotel?

Valeant sounds like a classic case of a hedge fund hotel, but it is in fact a very different type if one digs deeper. Hedge fund hotels are dangerous when it is occupied by short-term, low quality tenants. From our observations however, half of this hotel is occupied by high quality, long-term tenants.

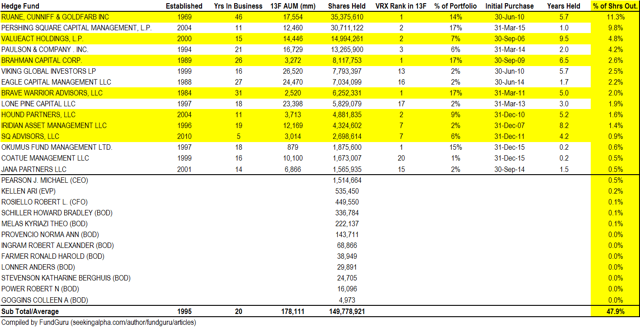

Approximately 45% of VRX's shares outstanding is held by a group of hedge funds well-regarded in the industry. Most of these hedge funds have been in business for 20 years and are run by some of the greatest investment minds in the industry:

- The largest shareholder, Ruane, Cunniff & Goldfarb (manager of the Sequoia Fund) have been managing money for 46 years. The firm was founded by a friend of Warren Buffet. The Sequoia Fund is one of the oldest equity funds in existence.

- The third largest investor, ValueAct, is an established activist fund that engages constructively with company management. The firm recruited Valeant's current CEO, Mike Pearson and structured his unusual compensation package deeply tied to share price performance. ValueAct invests over a multi-year time horizon and also sits on the Board of Microsoft and Rolls Royce.

- Brave Warrior and Brahman are both value-oriented hedge funds that have been in the business since the 80's.

- Iridian is a special situations mutual fund that invests in corporate change. It was one of the earliest investors in Valeant. The firm has been around since 1996.

- Viking, Lone Pine and Coatue are three of the most prominent "Tiger Cubs". Their founders used to work for the once highly successful Tiger Management, a pioneer in long/short equity investing.