BNN and Reuter reported that Blackstone is in talks with Concordia Healthcare (NASDAQ:CXRX) for a potential bid. I am not sure how serious the deal is. But as a shareholder myself, I am putting some numbers together around Concordia to get an idea how much equity holders should expect from such a deal.

Concordia Valuation

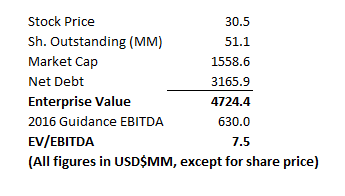

To begin with, I started to look into Concordia's valuation. I calculated company's EV/EBITDA multiple as this is the standard valuation method when it comes to takeovers.

So based on current stock price of $30.5 USD, the company is trading at 7.5x EV/EBITDA multiple. To put things into perspective, the pharma sector is trading at around 10x EBITDA at the moment. Things were rosier in the summer of 2015 when trading multiples ran up to over 13~14x before the US presidential candidate Hilary Clinton made her infamous drug pricing tweet. Concordia is clearly undervalued.

Look at recent deals

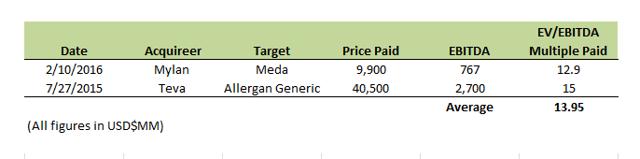

The deal market and the stock market typically trade with their own set of multiples. The deal market offers a premium for control. Below are some of the recent deals that took place:

The two most recent deals in the table have an average EV/EBITDA multiple of 14x. However, buyers of these two deals are pharmaceutical companies with strategic intention. For a financial buyer like Blackstone, it will be more like an investment. Traditionally, financial buyers pay less than strategic buyers.

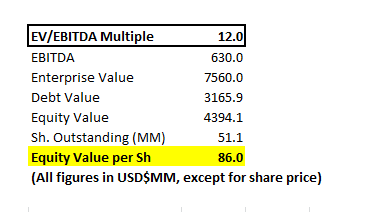

Base Case for a Concordia Buyout

I would use a 12x EBITDA to figure out the buyout price. This is below the 14x from the recent deals for reasons mentioned above.

The base case scenario indicates a buyout price of $86USD or around $112CAD for each Concordia share.

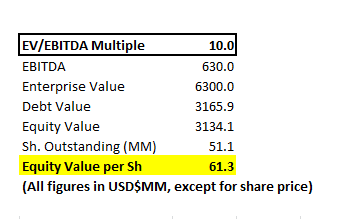

Worst Case for a Concordia Buyout

I think the worst case scenario would be a 10x EBITDA multiple. 10x would be considered a great deal for a private equity firm taking control of an entire company. We haven't seen such a low multiple since the last financial crisis.

$61USD or $80CAD is likely to be the floor that Blackstone would pay for Concordia shares.

Other considerations

An acquisition deal is often very complicated as it involves multiple players. For example, some large investors may have gotten their shares for over $60 through previous private placements or transactions and they would not approve a deal under certain price point. Competing bids are always possible as well. Concordia's European generic assets are very attractive to pharmaceutical companies who would like to diversify outside of the US.

Disclosure: I am/we are long CXRX.