The problem is that there are pictures with tables and projections which are pretty key to the article. Not sure how it will look if I just copy and paste (I doubt the pictures will show up), but here you go:

Valeant In Good Position To Pay Debt Obligations And Bounce Back [Edit or Delete]

May 6, 2016 9:23 AM | about stocks:

VRX These past few months have been a roller coaster ride for Valeant (NYSE:VRX), but that's behind us. Lets talk about where the company stands now. Gaining a sense of the strength of the company has been difficult by average investors due to the sludge of words thrown around by Wall Street elites like Jim Chanos, Warren Buffett, Charlie Munger, and of course, Bill Ackman. I have found myself to favor Ackman's sentiment about the company over the rest, as their statements / positions have been backward looking while Ackman's comes from a position as an insider. One particularly good sign is that Ackman could have easily packed the tent up and sold, but instead decided the company is worth his time and effort.

As if billionaires fighting with completely opposing language didn't obfuscate the situation enough, the analysts on the street can't seem to make up their minds either. Mizuho has a price target of $18 on Valeant while S&P Capital IQ puts forward $90 per share, J.P Morgan has a buy rating and Rodman & Renshaw released a target of $103. RBC has Valeant at "hold" with a price target of $65. Most of these recommendations are generally north of the current trading level but seem to be all over the place.

To take the confusion out of the situation, lets take a look at what's actually going on with bottom line numbers vs projected debt service obligations, which can be tricky but meaningful if you can wrap your head around it.

Valeant debt service obligations are no doubt high, but also certainly manageable. Below is their obligation schedule (from the most recent 10-k) which pays down the majority of their debt quickly through the next five years.

(click to enlarge)

Now that we have an understanding of what they will need to pay to bond holders, lets figure out how much Valeant is actually able to scrape up over the next 5 years to pay these obligations. Net income is a terrible way to understand usable cash that Valeant actually generates each year. A better way is to understand the situation is to look at what Valeants unleavered cash flows are for a year of normal operations and compare that to their debt obligations going forward.

Valeant generated $274,700 in bottom line free cash flows in fiscal year 2015 and -277,000 in fiscal 2014. Of course these numbers were obfuscated by certain activities. In fiscal 2014, Valeant paid down approximately $2.26 billion in debt, and in fiscal 2015 they borrowed $12.64 billion and made an acquisition. These activities brought their free cash flow down from what they would have been without paying off debt principal or raising debt and making an acquisition. In fact, if Valeant were to have a year where they were not making acquisitions or paying off principal, their financing and investing cash flows would be relatively flat, leaving the operating cash flows able to flow to the bottom and leave total free cash flow intact.

(click to enlarge)

Valeant has great operating cash flows. In fact, they have brought in approximately $2.2 billion in fiscal 2015 and $2.3 billion in fiscal 2014. This is the real cash generating potential of the company as it stands right now. But the story gets better. Free cash flow, as we all know, comesafter debt service is paid. So when the current year fiscal 2015 debt service is added back, this $2.2 billion that Valeant can generate today actually increases to about $3.8 billion. In other words, in fiscal 2015, Valeant (if you take out acquisition costs) generated about $3.8 billion bottom line free cash flow, and then paid their $1.563 billion debt service. Had they not had acquisition related cash flows out, their excess operating cash flows would have remained intact and Valeant would have realized an excess free cash flow bottom line of $2.2 billion after debt service expense.

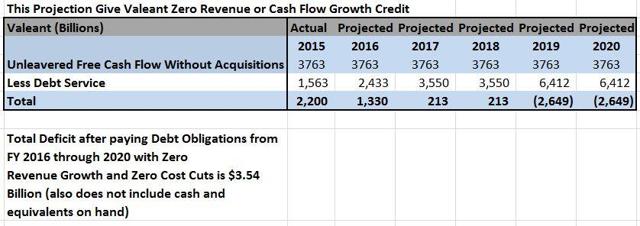

From here I have deduced that realistically, Valeant currently can generate approximately $3.8 billion per year to dedicate to the payment of debt service. This $3.8 billion number is likely to grow going forward, however, for the sake of a very stressful situation lets make our projections with zero FCF growth which means no revenue growth and zero cuts to expenses (which is unlikely).

(click to enlarge)

As shown in the simple projection above (which is quite stressful), Valeants free cash flows are only offset by $3.54 billion through fiscal 2020. This is with zero growth, no cuts to expenses, no utilization of cash and equivalents on hand, no refinancing of debt, and no asset or product line sales.

The picture painted above is a baseline worst case scenario. It is not meant in any way to represent how profitable Valeant can be, it is only to show how reasonably Valeant can pay its debts. Valeant is likely to increase sales volume going forward (and they have already recently raised prices on many of their products before senate hearings which will show in the financials going forward).

If Valeant can generate cash flow beyond their obligations, even if just a couple hundred million per year, this will be huge for a company with a current market cap of about $12 billion. Valeant will need to roll up the sleeves for the years ahead, but it is no doubt in shape to continue as a company and potentially be very profitable while demanding a share price that is far above current levels.