RE:Seeking alpha article Quick overview

As a bingo led online gambling business Intertain (OTCQX:ITTNF) is somewhat different from many of its other listed peers who are often sports betting led. Sports betting is around 43% of the global online market where as bingo is a small niche at around 6%; both have attractive secular growth trends. Intertain's differences are in our opinion very virtuous. Firstly, its demographics are different, bingo led customers are more likely to be middle aged ladies who play for different pastime/leisure issues than sports driven men and they are actually stickier in that they remain loyal customers for longer than average. Low stakes are more typical, making it hard to 'lose' lots of money also helping the leisure activity label rather than higher losses and risky gambling label. Also Intertain pays a substantially lower amount to attract these customers as the cost of acquisition is much lower by the fact there is less competition chasing the players online compared to a sports gambling player. It's our understanding that payback on customer acquisition costs is around 3-4 months which is a lot quicker than most sports led online businesses. Once on the site users often stay for the social interaction (chat rooms, compares, familiarity, seeing friends online etc.) and prefer different slot games (where Intertain makes more money than the actual bingo games) compared to ones offered on sports betting sites for instance. The best slide in management's presentation (slide 12) shows the loyalty of players; 89% of 2015 revenues came from players that joined in 2014 or earlier meaning it's a loyal and regular user business where scale and liquidity as well as brands matter in holding as well as attracting customers. It's clear that whatever your views are about bingo, Intertain has got the magic mix running very well with EBITDA margins at 42.9% in the first quarter 2016 and likely to remain above 40% for 2016. It's also worth noting that bingo led gaming appears to have less seasonality when compared to the way sports led gambling businesses require big occasions and events to maintain high activity levels. The last and biggest virtue is market leadership (28% UK market share) where Intertain enjoys the largest number of players keeping waiting times to a minimum for players and allowing possible jackpots at the highest levels without any subsidies. Similar to poker, bingo market leadership creates a virtuous circle for that business which means market leaders should command a multiple premium within the stock market.

EBITDA and debt obligation estimates for 2016

Group guidance for EBITDA 2016 is set at C$175-195m. If you take 1Q 2016 reported at C$55.1m and then add 2015 actual numbers of Q2 32.8m, Q3 43.7m and Q4 53.3m on top for 2016 you get 184.9m which is bang in the middle of guidance. Hence the guidance implies no growth for the remaining 3 quarters of the year. This is highly unlikely for several reasons as only a cursory read of conference call notes (on website) helps to illustrate. The most obvious reason is growth in mobile, here roughly 60% of all new users come via mobile which is currently in the 40's percentage for current mix, depending on which brands or countries you look at meaning it should keep driving growth for at least the next 18 months or so. Mobile players that also play desktop make 2.5 times more than pure desktop players making this a very attractive profile. Spain slots were only launched in summer 2015 with small losses initially, moving into profits 2016 and the recent success of Starspins casino product is also clearly helping. The Intercasino brand has been relaunched on their in house platform cutting costs and sits alongside the very successful Vera&John business going forwards, early evidence of improvement here looks promising so far. We believe 2016 EBITDA will easily exceed 205m which is clearly above conservative management guidance and this is the number we are using in the valuation work below. EBITDA has climbed every quarter since listing and even without any acquisitions in the last 12 months this has remained the case. It could be possible to think about a super bullish EBITDA number of circa 230m+ in 2016 but this won't become clear until well after the current strategic review period is completed unfortunately, it could though be realistic if management decides offers are too low and decide on a go it alone strategy.

At Q1 2016 Intertain had 307m net debt and earn out expected payments of 402m likely due at some point in 2017. The earn out number changes each quarter mainly depending on how profitable Jackpotjoy becomes, however it's clearly in shareholders' interests for this liability to rise over the year as it means earnings are exceeding expectations whilst the bulk of the earn out payment is based on a low multiple of only 4.5*EBITDA of the amount over £63.1m. 307m+402m=C$709m which is our net debt figure for EV calculations; on a current market cap around C$850m you can see that the shares are quite geared. However a 205m EBITDA level and very little capex mean that 3.2-3.5*EBITDA 2016 is actually an easily serviceable debt number for the business for when Intertain need to fund the earn outs themselves. Note in the 1Q Intertain generated 44m of free cashflow alone, should this continue through 2016 net debt could drop towards 160m by year end making refinancing the earn out obligations even easier. They currently pay Libor+7.5% on their debt and since April 2016 have been able to look to refinance this with no financial penalty clauses.

Valuation thoughts

It's worth noting that when the Jackpotjoy acquisition was carried out shares were issued at $15 and management bought significant additional stock at this level. Given that Jackpotjoy has performed significantly better than thought since this deal it would seem only logical that management would expect a higher price than $15 plus a cost of capital for the intervening time. In 2015 they repurchased approximately 2.5m shares at an average price $12.25. This might imply at least $18 as a lowest starting point for any transaction that covers the whole company. There are also 9 analysts who follow the stock on Bloomberg and they have a range of target prices of C$21-28 in their models with some built on DCF's and others peer group multiples.

| Acquirer | Target | Date | Transaction Value U$ | EV/EBITDA |

| | | | | |

| Paddy Power | Betfair | Feb-16 | 8Bn | 23.7 |

| Gtech | IGT | Apr-15 | 6.5Bn | 9.8 |

| Scientific Games | Bally Technology | Nov-14 | 5Bn | 11.9 |

| Amaya | Pokerstars | Aug-14 | 4.9Bn | 11.5 |

| Ladbrokes | Gala Coral | ongoing | 3.6Bn | 8.7 |

| GVC | Bwin.Party | Feb-16 | 1.7Bn | 15.1 |

| Scientific Games | WMS Industries | Oct-13 | 1.55Bn | 7.5 |

| Boyd Gamin | Peninsula Gaming | Nov-12 | 1.44Bn | 12.9 |

| Bally Technology | SHFL Entertainment | Nov-13 | 1.3Bn | 15.5 |

| PartyGaming | BWIN.Party | Mar-11 | 1.05Bn | 17.5 |

| Average | | | | 13.41 |

The table above shows 10 of the more recent and largest transactions in the sector with an average EV/EBITDA multiple of 13.41, perhaps one deal is an outlier on the expensive side but equally the cheaper ones were not always 100% online businesses like Intertain. Using 13.4*205m EBITDA gives 2747-net debt/earn outs of 709m = 2038 with 70.6m shares in issue =C$28.9

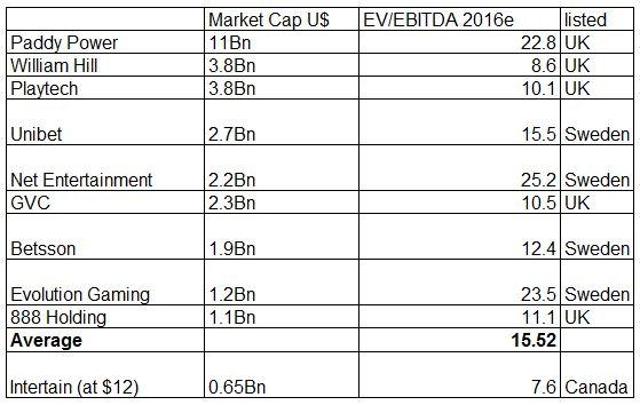

Using an EV/EBITDA trading multiple of 15.5 from the average of larger European peers (table above) and the same other previous values gives a target of C$35. Realistically the Swedish listed companies appear quite expensive for local reasons and PaddyPower has many years of successful track record plus a size advantage behind it, William Hill is dragged down by its offline shop network and recent earnings downgrades and Playtech has a lot of grey market revenues. We think a level of circa 12*EV/EBITDA 2016 might be more applicable as a trading multiple. This gives a target of C$24.8

Conclusion

Intertain management commented on their conference call that they have received offers for the whole company and will update the market by the end of June. It's possible that offers might be of an opportunistic and low ball nature given where the share price languishes, however it only takes two serious bidders and the price ought to climb above C$25, this might seem fanciful given a 100% premium to current share price levels but it can be easily justified by peer group valuations, past transaction levels and the premium quality of these online assets paired with quite high, but falling rapidly, debt obligation levels which gear the outcome for equity in the shorter term.

We think management should look to decline anything less than C$20 type level and instead pursue an organic strategy of listing in Europe, lifting shorter term earnings guidance assuming a successful Q2 result, buying back stock and appointing the new board they have been working on. Also instigating a quarterly dividend of half earnings starting at 0.25 cents would give an annual yield of at least 8.3% which should control the downside in currently volatile markets whilst debt facilities cover the 2017 earn out requirements and are due for a renegotiation anyway. GVC management pursued a dividend and acquisition led strategy very successfully in recent years and Intertain have the high quality underlying assets to do something similar if need be.