If you thought lithium was big last year—you were right. It was. But it’s huge today, and by most accounts, it will continue to get bigger, as spot prices for battery grade lithium in China indicated earlier this year.

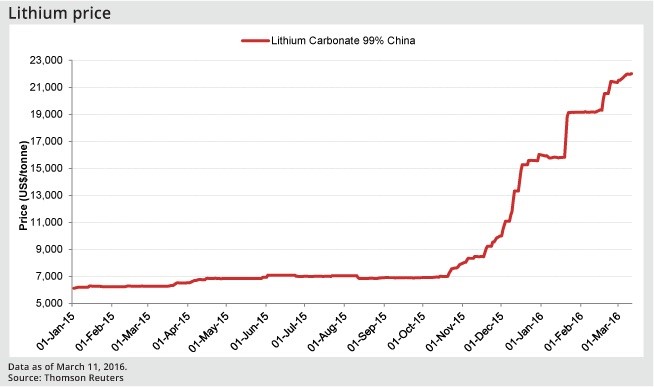

Spiking from $7,000 per ton to over $20,000 per ton, the floodgates were suddenly opened for a new game on a new playing field, with a commodity that isn’t even traded like a commodity—for now.

Welcome to the lithium boom, the spawn of a technology-driven revolution that knows no bounds.

And as this segment undergoes a major overhaul, the lithium oligopoly will come to an end, making room for new entrants who are making their presence felt. And as the game changes, and the evolution takes shape, investors will be looking for new lithium projects on highly prospective land. More to the point, they’ll be looking for projects put out there by companies with lower market caps but strong, intuitive management with the right track records.

Amid the land rush in the lithium space that is unfolding at intense pace in the U.S. state of Nevada, one new entrant stands out as it casts a much wider net over this state’s prospective ‘white petroleum’, figuring that there’s much more under the ground that we ever imagined.

It’s not just about getting in on the lithium ride right now, before it’s too late; it’s about how you get on it without taking too much risk: This just might be how...

4 Reasons to watch Umbral Energy (CSE:UMB)

1. The lithium boom is already here. According to an article by Goldman Sachs, the lithium market could triple by 2025—EVEN WITHOUT considering the already steadily rising demand for consumer electronics and even without considering our massive power storage needs. With each small 1% jump in electric vehicle market share, lithium demand just for this segment will increase by 70,000 tons. And EVs are about to hit the mainstream irrevocably now that Tesla (NYSE:TSLA) has launched its affordable Model 3.

2. Major land rush intensifying as Tesla’s battery gigafactory nears completion: Demand for lithium—now THE hottest commodity on the planet—is going up. It’s been called the new gasoline—our ‘’white petroleum’’. There is a battle raging right now for lithium market share, and everyone’s on the front line: major tech players, investment gurus, and resource exploration companies. Right now, it’s all about getting hold of prospective lithium-rich acreage, fast-tracking exploration and securing new supply. The land rush is on in full force, and Umbral Energy is one of the most aggressive project generators out there.

3. Bullish prices: The price catalysts don’t get much better than this: This is our new gasoline, and fundamentals here are clear and impressive. While other commodities are plummeting, lithium is defying the market. In 2014, lithium prices grew 20%. And in 2015 battery grade lithium spot prices in China surged from US$7,000 per ton in the middle of the year to a whopping US$20,000 per ton earlier this year.

4. A euphorically tight supply situation for lithium: The surge this year in spot prices in China, the ravaging hunger for lithium batteries and power storage solutions has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants. Supply as it is can’t come close to meeting potential future demand, and that brings us to...