The Tule Valley playa with Barn Hills in the background (picture by Scott Smith)

Today, Umbral Energy Corp. announced to have started its initial exploration plan of identifying anomalous zones to determine the presence and composition of lithium bearing brines at its Tule Valley Lithium Project in Utah, USA. Planned exploration activities include geological mapping, surface sampling of the playa and outcropping bedrock in proximity, and if the aquifer is accessible at shallow depths a fluid sample will be taken and analyzed. A surface sampling program in 2009 has identified lithium grades of up to 1,690 ppm, hence the property is highly prospective for lithium. Pure Energy Minerals Ltd. successfully delineated a maiden NI43-101-compliant resource estimate in the Clayton Valley, Nevada, averaging 102 ppm lithium carbonate equivalents at a cut-off grade of 20 ppm. The Tule Valley is similar to the Clayton Valley as both have similar horst and graben structures, and are endorheic/closed basins (i.e. the basin retains water but does not allow any external outflow, which enables elements like lithium to concentrate in an aquifer below surface).

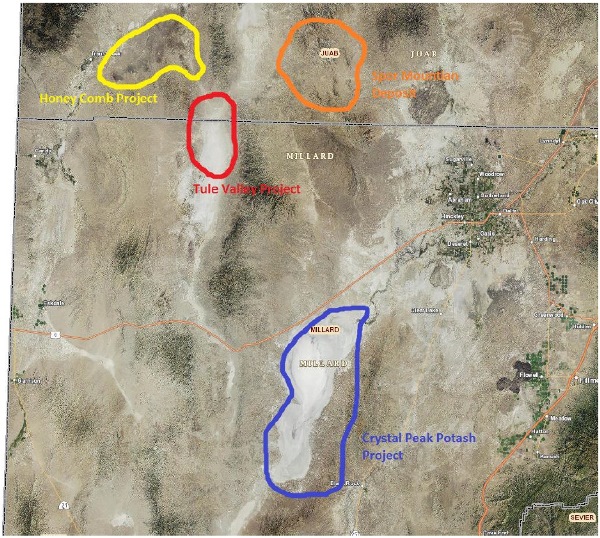

The Tule Valley is surrounded by 3 other lithium rich areas. The Honey Comb Project, located 20 km north of Tule Valley, reported surface sampling assays between 1,500-1,700 ppm lithium from a rhyolite dome in 2011. The Spor Mountain Beryllium Mine from Materion Corp. is located 30 km northeast of the Tule Valley. Both the Honey Comb and Spor Mountain projects indicate that the volcanics surrounding the Tule Valley are rich in lithium and therefore may have acted as a source of lithium for enriched brines in aquifers below the surface.

The Sevier Lake Project from Crystal Peak Minerals Inc. is located 60 km southeast of the Tule Valley and is a brine based potash, lithium and magnesium project. Its November 2013 NI43-101 report states lithium values in post-production brine solution (after potassium-sulphate extraction) ranges from 50 to 200 mg/l lithium. The Sevier Lake Project is located within an evaporite basin similar to the Tule Valley. Crystal Peak (see picture on the bottom; source) is composed of the 35-million-year old Tunnel Springs Tuff – an volcanic ash-flow deposit that erupted from a large caldera to the east. The cavities (tafoni) eroded out of the tuff and show that a lot of rainfall has washed minerals out of the tuff concentrating in nearby closed basins. According to Branson Hamilton from Calyx Capital Advisors in December 2015:

“Crystal Peak is completing its engineering work in preparation for final permitting and initiation of the construction phase of the project. Included in this work will be its plan for processing lithium. As a by-product of the primary product delivered from the Sevier Lake, adding lithium production will be less costly from both a capital and operating perspective than building out a facility from scratch (as is being proposed by those only focused on lithium)... The engineers conducting the study calculated that the amount of lithium in annual production equates to over 6,799 tonnes per year of lithium carbonate equivalent... For example, process testing at other brine sites by Tenova Bateman Technologies indicates the possibility of up to 99-percent capture of lithium from less concentrated brine.”

Above: The Tule Valley Hardpan holds water from a recent rain storm (Barn Hills in the distance;source)

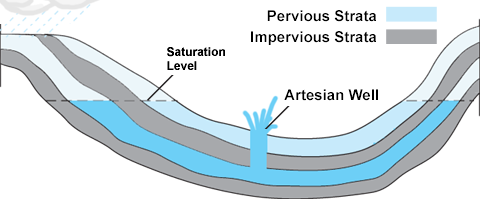

Above: Artesian wells to the west of Umbral Energy’s Tule Valley Lithium Property. An artesian aquifer is a confined aquifer containing groundwater under positive pressure. This causes the water level in a well to rise to a point where hydrostatic equilibrium has been reached. A well drilled into such an aquifer is called an artesian well. If water reaches the ground surface under the natural pressure of the aquifer, the well is called a flowing artesian well. As such, no pumping may be required to get the brines to surface once a well has been drilled.

Above. Geological strata giving rise to an artesian well. The major advantage of a so-called “flowing artesian well”: No pumping may be required as the brine flows to surface under the natural pressure of the acquifer.

Above: The Tule Valley Hardpan with volcanic rocks in the background (source).

The Tule Valley Property

Size: 1,943 hectares (4,800 acres)

Location: 190 km southwest of Salt Lake City in Utah (USA), crossing over the Juab and Millard counties.

Access: By all-weather, hard surface road from Delta and from Wendover, or by paved road to the south. Further access is by gravel roads in fair condition.

Infrastructure & Power: The terrain is readily amenable to the construction of the necessary infrastructure related to mining operations. This includes, but is not limited to, potential tailings storage sites, potential waste disposal areas, heap leach pad areas and potential processing plant sites. It would be necessary to access electrical power from Gold Hill or Callao (Lee, 2003). Surrounding area is sparsely populated, with ranching and livestock being the primary economic activities.

Climate: The basins in this area are defined as arid, generally receiving less than 8” of precipitation per year. Evaporation exceeds precipitation. Hot dry summers and cold dry winters.

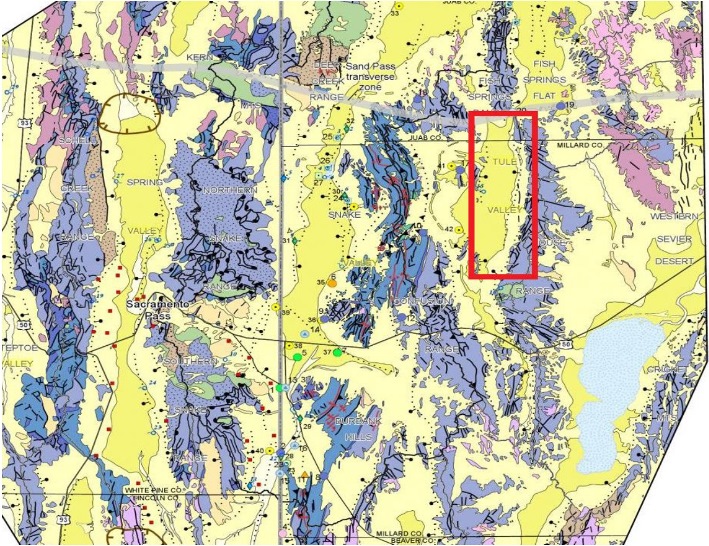

Local Geology: Similar to that of Clayton Valley, the Tule Valley is also closed basin and has what is called a horst and graben structure, whereas it is down faulted by normal faults on both sides of the valley. Those are key characteristics for confining brines so mineralization cannot escape.

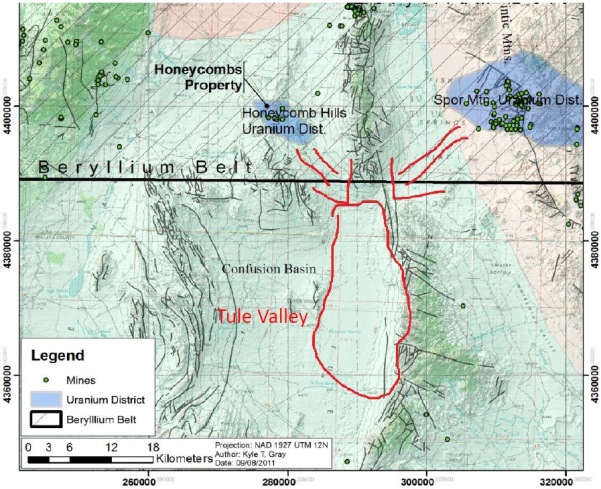

Regional Geology: The area to the north of the Tule Valley contains volcanic rocks such as rhyolite flows and tuffs ranging in age from 3.4 to 4.7 Ma, and are known to contain significant values of lithium, beryllium, rubidium and REEs. Chemical and mineralogical studies of samples from shallow excavations and drill holes revealed abnormal quantities of cesium, rubidium and lithium in the beryllium-bearing tuffs (Stonehouse, 1985). Results from the soil grid suggest that lithium, beryllium, rubidium and TREO (total rare earth oxides, including lanthanum to lutetium plus yttrium) mineralization may be present under shallow cover to the east flank of the Big Honey Comb Hill.

Red arrows outline possible fluid mobilization from hard-rock lithium sources:

Blue represents volcanic rocks which could be the source of lithium build-up in the Tule Valley:

Company Details

Umbral Energy Corp.

929 Mainland Street

Vancouver, BC, V6B 1S3 Canada

Phone: +1 604 628 1767

Email: jbal@umbralenergy.com

www.umbralenergy.com

Shares Issued & Outstanding: 54,004,972

Canadian Symbol (CSE): UMB

Current Price: $0.04 CAD (May 18, 2016)

Market Capitalization: $2 million CAD

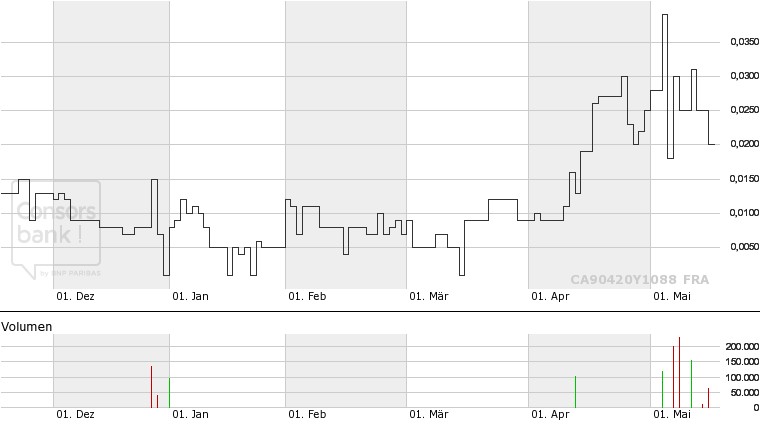

German Symbol / WKN (Frankfurt): 2UE / A118T0

Current Price: €0.02 EUR (May 18, 2016)

Market Capitalization: €1 million EUR

Analyst Coverage

Research #2: “Umbral Energy Acquires Gerlach Lithium Brine Project in Nevada“

Research #1: “Umbral Energy to explore for lithium brines in Utah“