Introduction

Nevsun Resources (NYSEMKT:NSU) is a Canadian mining company headquartered in Vancouver, British Columbia. The company currently operates a single mine, the Bisha Mine, in Eritrea, Africa. Nevsun Resources has a 60% stake in this Bisha Mine, while the country of Eritrea has a 40% stake in this mine.

Nevsun Resources Bisha Mine - Asmarino

Nevsun Resources offers a $0.16 annual dividend amounting to a very respectable 4.78% yield. However, despite the company's potential and dividend yield, Nevsun Resources's stock price has not done much these past years. The company's stock is close to where it was four years ago when it was trading at $3.25 per share. The company's shareholders have not been rewarded much for these past few years.

The past, though, is no indicator of the future. I continue to believe that Nevsun Resources is a high-conviction play with the potential to become a ten-bagger in the coming years. The following article dictates why.

Nevsun Resources - Bisha Mine Valuation

With Nevsun Resources's recent acquisition of Reservoir Minerals, the company will soon have one more producing asset with huge potential -- the Timok Mine located in eastern Serbia. However, in our attempt to prove that Nevsun Resources deserves a $6 billion valuation, we will start with the mine that supports the present company -- the Bisha Mine.

The Bisha Mine is a VHS deposit, or a volcanogenic massive sulfide ore deposit. These deposits are formed by undersea volcanoes in mid-ocean ridges. Overall, these deposits are known for their impressive copper-zinc holdings and represent a significant source of many of the world's mineral holdings.

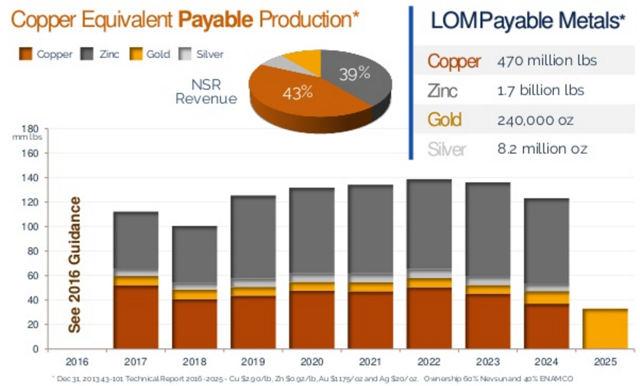

Nevsun Resources Bisha Mine Reserves - Nevsun Resources Investor Presentation

The above image provides an overview of the current envisioned Bisha Mine life. Nevsun Resources plans on producing a combination of copper and zinc from the mine for the next 8 years before monetizing any remaining gold stockpiles. Overall, the mine is expected to have payable mineral reserves of 470 million pounds of copper, 1.7 billion pounds of zinc, 240,000 ounces of copper, and 8.2 million ounces in silver.

Now it's no secret that commodities are in a bear market. Most minerals (iron, copper, gold, etc.) saw their prices peak in 2011 before trending down. Oil prices peaked in 2014 and since then have dropped more than 50%. Due to the cyclical nature of commodity prices, most expect at least a partial recovery in the next few years. However, for simplicity purposes and to make sure our estimate is on the fair side of things, we will assume that over the next 8 years mineral prices will remain constant.

Taking current prices for the above metals, we can calculate the reserve valuation for the Bisha Mine.

| Mineral | Current Mineral Price | Quantity | Total Mineral Value |

| Copper | $2.10 / lb | 0.470 billion lbs | $0.99 billion |

| Zinc | $0.83 / lb | 1.700 billion lbs | $1.41 billion |

| Gold | $1209 / oz | 0.240 million oz | $0.29 billion |

| Silver | $16.25 / oz | 8.200 million oz | $0.13 billion |

| Total | | 2.171 billion lbs | $2.82 billion |

While the company remains relatively tight-lipped about its operating margins for different minerals, looking at its recent financial report we can see that in Q1 2016, the company's net cash generated to revenue ratio was 23.76%.Applying this to the company's $2.82 billion of resources gives us a total value of $0.67 billion for these resources, in line with the company's present market cap.

However, one very important assumption needs to be discussed when talking about this $0.67 billion valuation for the mine. This assumption is that the above resources encompass the total amount of resources available in the mine.

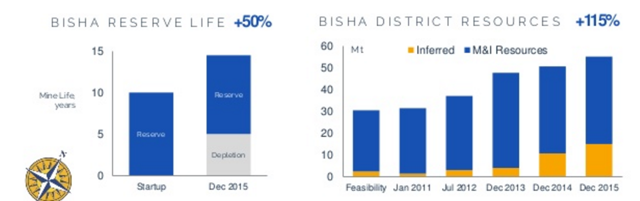

Nevsun Resources Reserve Changes - Nevsun Resources Investor Presentation

The above graph is one of my favorites for highlighting the potential of the Bisha mine. While the Bisha mine has been operating for five years, its reserve life remains the same as it was when production first started in 2010; the mine continues to have a 10 year reserve life. The reason for this is that the Bisha Mine deposit is enormous and new resources continue to be discovered every single year. Since the mine's original discovery the overall amount of resources in the Bisha mine has more than doubled in just five years.

The more difficult part of this, however, is valuing future discoveries. Obviously, as history has shown, new discoveries mean that much more than $0.67 billion of mineral profits can be extracted from the mine. However, to assume the rates of discovery continue at their previous rates means that each year more resources are discovered than what is taken down.

For simplicity purposes, we will assume that because beyond the Bisha District, Nevsun Resources has two other districts -- the Noranda and Flin Flon Districts -- the total amount of resources in the region is 3x the $0.67 billion, giving the total region a potential to generate $2 billion for Nevsun Resources. It is important to take into account that the resources of the region vary widely and that this estimate is subject to fluctuations.

Nevsun Resources -- Reservoir Minerals Valuation

Now that we have determined the Bisha Mine has the potential to generate $2 billion of profits for Nevsun Resources, it is now time to value the company's recent Reservoir Minerals acquisition.

Nevsun Resources is providing Reservoir Minerals with the funding ($135 million) to acquire 100% of the Upper Zone in Reservoir. In this acquisition, every share of Reservoir Minerals will be exchanged for two shares of Nevsun Resources, meaning that Reservoir Minerals shareholders will own 33% of the combined company. Nevsun Resources' current $0.3 billion cash pile will provide the funding to get this high potential project off the ground.

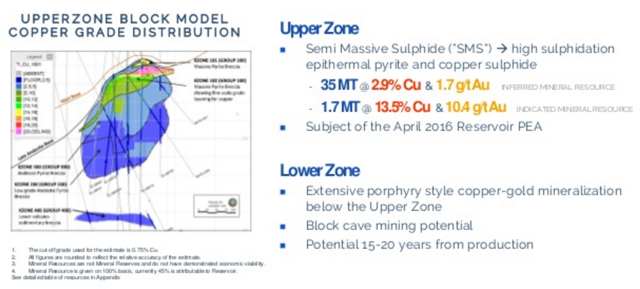

Nevsun Resources Timok Mine Reserves -- Nevsun Resources Investor Presentation

The above graphic gives an overview of some of the enormous resources in the Upper Block of the Timok Mine. The Timok Mine has some enormous resources and with the $135 million funding from Nevsun Resources to acquire the entire project, along with $300 million of extra cash, the combined company will have the resources to take advantage of this project.

Based on the numbers given above, the 35 million tons of reserves contain a total of 1.0 million tons of copper and 2.1 million ounces of gold. The 1.7 million tons of ultra-high-grade-indicated mineral resources contain 0.2 million tons of copper and 0.6 million ounces of gold.

| Mineral | Current Mineral Price | Quantity | Total Mineral Value |

| Gold | $1209 / oz | 2.7 million oz | $3.26 billion |

| Copper | $2.10 / lb | 2.4 billion lbs | $5.04 billion |

| Total | | 2.4 billion lbs | $8.30 billion |

Since mining has yet to start in the Timok Mine, we have yet to receive numbers on the company's net cash generated to revenue ratio. As a result, for our purposes, we will assume it remains the same as the Bisha Mine ratio at 23.76%. Multiplying the $8.30 billion in mineral value by the ratio and we get a total profit potential from the mine of $1.97 billion.

More importantly, the Lower Zone has significant earnings potential with large amounts of copper-gold mineralization below the Upper Zone. While the region is a potential 15-20 years from production, it is safe to assume that the region has significant resources. For our purposes we will assume that the Lower Zone resources are equivalent to the Upper Zone resources.

Doubling the $1.97 billion of minerals and we get a total of $4 billion. Adding this to the $2 billion from the Bisha Mine valuation and we get a total valuation of $6 billion. With Nevsun Resources' current market capitalization of $0.6 billion, that points to potential ten-bagger status should Nevsun Resources' collect the profits from all of its existing resources.

Conclusion

Nevsun Resources has had a difficult time recently with the company's stock price, dropping below its cash valuation in January 2016. The company has additional business risk as it operates in Eritrea -- a country not known for superior treatment of its people or workers.

Despite this, Nevsun Resources, especially with its recent acquisition of Reservoir Minerals, is a very high potential company. Taking the company's 23.76% profit margin on the total value of its mineral resources, and we get that the company has the potential to generate $6 billion of profits. This $6 billion in cash generation is worth more than 10x the company's present market cap.

Disclosure: I am/we are long NSU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.