Is The Cobalt Cliff Coming?

There has been a growing expectation that Cobalt supply could drop off a cliff in the face of rising demand.

Increasing scarcity of cobalt supplies would cause issues for battery manufacturers.

Significant supply hits could come as soon as the end of 2016 and continue into 2017.We could see a cobalt shortage as high as 25%.

As the largest consumer of cobalt and the most price sensitive, battery manufacturers will need to compete for marginal supply through high prices.

Investors should look into holding a low-cost copper play with substantial cobalt credits to profit from rising commodity prices.

There has been a growing concern that cobalt supply could drop off a cliff in the face of growing demand. This article looks to shed some light on the theory and analyze the effect it could have on the future of Tesla (NASDAQ:TSLA).

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId5.png

Cobalt Supply

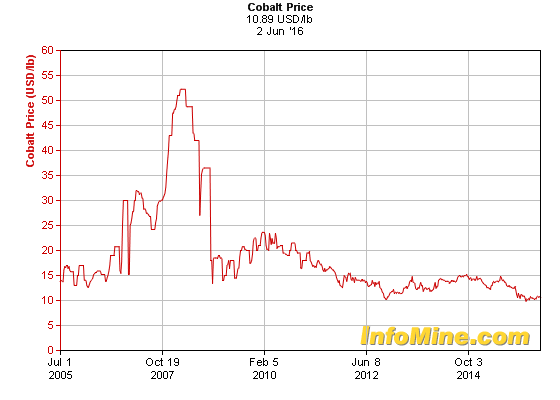

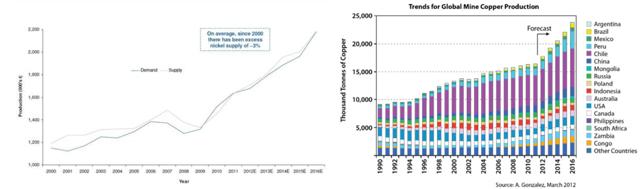

The cobalt cliff refers to a sudden shock to the market where cobalt demand significantly outstrips supply. Cobalt supply is set to fall below demand as a byproduct of nickel and copper mining - both of which are under substantial price pressure. Due to the economics of cobalt being a byproduct, production is controlled by the primary product (i.e., copper or nickel) and therefore supply can not ramp up with the price. As a result, cobalt supply is price insensitive over short periods.

Over the recent bull run in commodities, production of nearly all products rose to meet global demand. Fuelled by China, copper and nickel production nearly doubled. With double the primary production, you get a doubling of cobalt production. As cobalt became more available the price of cobalt dropped to where it sits today. However, Cobalt is key to high energy density batteries, a reality that is unlikely to change soon, as a result of increased battery demand, Cobalt demand will grow faster than supply.

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId6_thumb.jpg

Source: Mining.com (left) and Oracle Mining Corp (Right)

Cobalt Supply Disruptions

As I pointed out in When You Find Yourself In A Hole Stop Digging, copper grades have been declining for decades. More ore is being mined for a single deposit to produce flattening copper supply, and the result is that copper production could be coming to a small shortage. At Escondida, the world's largest copper mine, declining grades have required BHP to increase throughput substantially to offset a substantial 27% ore grade decline.

The Melbourne-based firms said production guidance for Escondida remains unchanged at approximately 940,000 tonnes for the 2016 financial year "as increased throughput, enabled by the completion of the Escondida Organic Growth Project 1 and operational improvements, will only partly offset an anticipated 27% decline in grade.- Mining.com

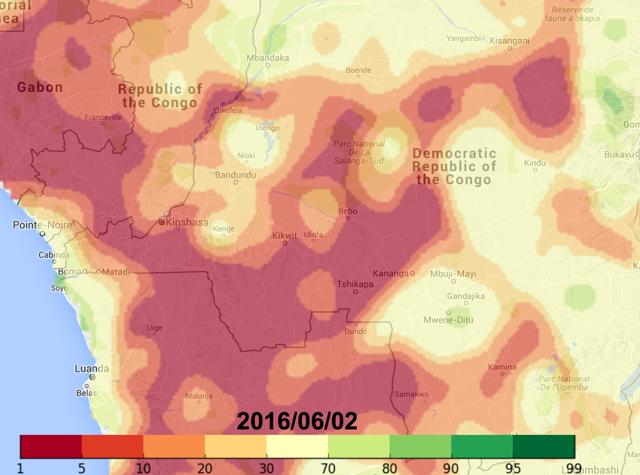

As copper prices languish, we are unlikely to see capital projects to ramp up capacity. BHP's water shortages will continue, and likely impact capacity in August-October as El-Nino continues to bite the continent. While I do see a copper recovery this year and have predicted that the bottom is in, it will take some time for production to ramp up. In the DRC where significant water shortages threaten a substantial chunk of the cobalt market, we have seen a distinct lack of investment from the highs seen during the price boom.

Furthermore, the DRC has a history of dire energy shortages. The Recent drought has resulted in decreased availability of hydropower, which is causing a reduction of available grid power to producers. A lack of power means companies must revert to diesel-fired generators, meaning a substantial increase in cash cost of production. Many producers will react by scaling back production, an outcome that will hit both copper and cobalt supply. One factor that could help stem the tide is China

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId11_thumb.jpg

Source: Princeton African Flood And Drought Monitor

According to the Financial Times, DRC Accounts for more than half of the world's cobalt supply and 93% of China's cobalt is originated in the DRC. That makes the DRC the largest, as a percentage, to any sole resource exported to China. As a result, China is likely to work with the DRC to smooth out any upcoming challenges.

I have a view that China will prop up investment needed to maintain cobalt and copper supply, and will assist the government in upcoming elections to ensure stability in the market. However, the issue is unlikely to be solved before supply disruptions bite.

It needs to be mentioned that there is a risk that China could circumvent international sanctions to prevent artisan cobalt production, an outcome that could bring supply back to the market - especially if a supply shortage crops up and prices skyrocket. Nonetheless, the supply picture for Cobalt looks increasingly concerning. A statement from Investor Intel provides an excellent overview.

In 2015, global cobalt production was 92,900 MT. Based on closings that have already occurred, Darton expects 2016 cobalt production to fall by 5,900 to 10,400 MT. It also cautions that Glencore has openly discussed a potential closure of Minera Resources (2,900 MT per year); Queensland Nickel (1,900 MT per year) recently went into voluntary administration and could be closed within a few months; and several other large cobalt producers are weighing their loss minimization options. Therefore, production declines from future mine closures could be much larger. See more at: Investor Intel

Cobalt Demand

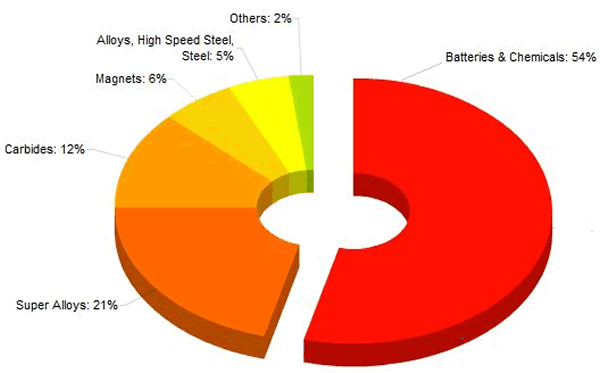

As a more important aspect of the equation, investors need to understand how demand links into supply. Outside of battery and chemical uses, cobalt is both a smaller percentage of costs and produces very high-value end products. In magnets, super alloys, and carbides, the use of cobalt is a necessity. Conversely, battery manufacturers utilize between $5 and $29 of cobalt for each kWh of battery capacity depending on the technology used.

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId17.png

Source: SFP Metals (NASDAQ:UK) Limited, Cobalt Metal Consumption

According to Fortune.Com, Tesla utilizes NCA batteries which are between 10% and 20% cobalt. This represents a cobalt density of 0.2-0.4 kg/kWh. For a 85 kWh battery, there is between 17 and 34 kg of cobalt. To get an idea of scale, a doubling of cobalt prices would increase the cost between $425 and $850 per vehicle.

If supply indeed drops below 15-20% of demand, a doubling of prices would just be the start. Due to the necessity of cobalt in a wide range of high tech industries, a price war could set in for cobalt rocketing the price up to decade highs of over $50/lb. The battery pack going into a typical car could increase dramatically. Tesla bulls would argue that at some point, the manufacturers of batteries would look at alternative technology, causing a quick demand hit and a reversion of prices. However, there is a distinct lack of an equivalent alternative.

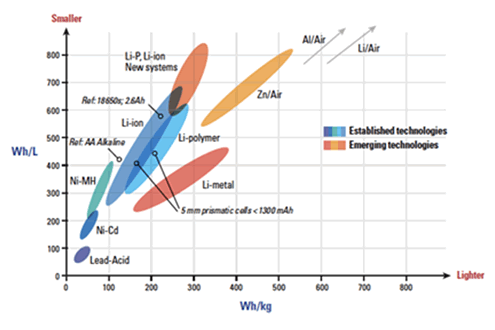

Alternative Batteries

The best Lithium-Ion batteries are cobalt based. Utilizing cobalt provides the greatest energy density and is the primary cell style for laptops, computers, cars, and any product requiring reduced weight and increased performance. Of all the established technologies, cobalt-based lithium ions dominate the high energy density battery world.

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId18.png

Source: Silatronix.com

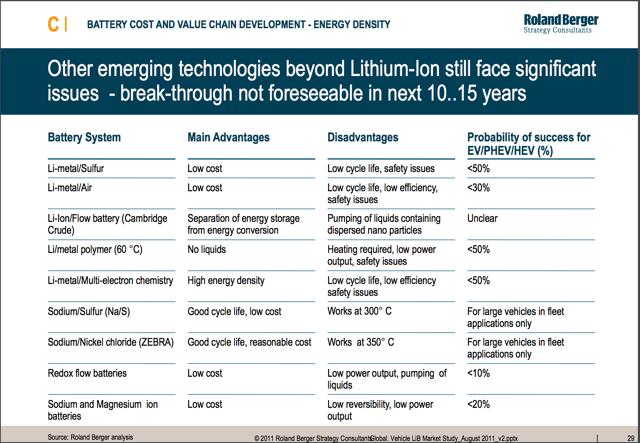

There is no real threat to Lithium Ion dominance coming by the end of the decade to provide relief to the cobalt market. Safety issues, efficiency issues, temperature, or energy density discount nearly every alternative power source. If Tesla were to change the battery type, the density hit, and weight increase would severely cripple the range and capacity of its vehicles.

image: https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/34605935_14651792310867_rId20_thumb.jpg

Source: Roland Berger

Investor Takeaway

The cobalt market is a supply concern that Tesla needs to grapple and solve sooner rather than later. A sudden increase in raw materials will either damage the price point or the margins (likely both) for the model 3 and its more expensive brethren.

Outside of Tesla,it is becoming clear that a copper bottom is in, and a cobalt cliff could provide a windfall to miners with byproduct cobalt production. The subsequent copper recovery and a looming cobalt cliff mean investing in a company exposed to both gives investors two swings at the bat. The likelihood of both occurring in the next 1-2 years is increasingly becoming a reality.

It appears that the market has significantly underestimated the risk of a cobalt shortage. Cobalt is ingrained in the supply chains of many critical industries. A price increase is unlikely to have a demand immediate response due to the time to retool and change technology, and the impacts of cobalt being an industry byproduct means supply can not respond quickly to a price increase.

https://seekingalpha.com/article/3980016-tesla-cobalt-cliff-coming