Spectra7 Will Be A $50 Stock By 2020 Unless...Spectra7 Will Be A $50 Stock By 2020 Unless It Gets Bought Out Before Then Mar 16, 2015 8:18 AM *Update: Sad news on May 27, 2016 as the company announced the sudden passing of CEO Tony Stelliga. After this unfortunate turn of events I am considerably less bullish on the stock today than I was at the time of writing this piece as a significant part of my thesis was due to Mr. Stelliga's success, knowledge and connections in the competitive semiconductor space. Spectra7 to this point has raised funds at decent valuations and stayed ahead of the competition in VR and other consumer tech fields and I believe that a lot of that has to do with him. Because of that, I am going to have to become far less bullish on the company as I see how it deals with this tragic situation.

I believe that Spectra7 (OTC:SPVNF) (SEV.V) will be a $10 stock by 2018 and a $50 stock by 2020 unless it gets bought out before then. By 2020 that would be 77 times more than the $0.65 closing price on March 13 on the TSX Venture and 100 times the close on the seldom-traded US OTC listing. That would imply a market cap of $5 to $6 billion by that time (upon warrant exercise I'm assuming 100 to 120 million shares outstanding). Clearly this is a bold claim, one of the boldest I have ever made and not without heavy consideration. I strongly believe anyone who owns Spectra7 right now who is willing to hold this stock for any significant length of time will make at least 10 times their money. If it doesn't happen, then my bold call fails and I accept the fallout in credibility from it. If it succeeds, then I want to be remembered as the person who made that call in 2020, and not the overly conservative 12-month target from Global Maxfin of $1 which has already been hit briefly late last year. No doubt that firm will raise its target as Spectra7's business plays out in due time, but I want to make this claim in one bold leap.

My bullishness on Spectra7 has grounds based on the success of another semiconductor company, Ambarella, Inc. (NASDAQ:AMBA). Best known as the company that makes the Ultra HD chips that power GoPro (NASDAQ:GPRO) cameras, since listing in October 2012, the company's stock price has increased from $6 to nearly $70. Revenue averaged around $20-$25 million per quarter in 2011 while the past two quarters it has been about $65 million in revenue each. The semiconductor industry hasn't been particularly "hot" tech in the stock market over the past several years as the many companies in the space battle for market share and former tech darlings and industry leaders like Intel Corporation (NASDAQ:INTC) and Advanced Micro Devices, Inc. (NASDAQ:AMD) are well off their 2000 tech bubble highs.

AMBA has shown that a chipmaker can become a darling of the market once again when it is technologically superior and good fit for a desirable consumer product. Its stock price has greatly outpaced its revenue growth since 2012 as annual revenue has grown 125% from $97 million in 2012 to $218 million in 2014 but the stock price is up over 1000% since listing. AMBA has paved the way for companies like Spectra7 to quickly become the hot stock in the market when they can prove that they are on the leading edge of the consumer electronics industry.

AMBA has a $2 billion market cap with a P/E ratio of 25 and a P/S ratio of nearly 10. For Spectra7 to get to a $5 billion market cap it's reasonable to assume that it'll need to achieve close to three times that revenue or around $600 million annually to get to that type of valuation. That is clearly a huge leap from 2014 revenue of $5.5 million.

However, $100 million in annual revenue may not be in the too distant future. In aninterview on BNN held in 2013, CEO Tony Stelliga stated the following when asked what kind of growth he expects from Spectra7:

"We would expect in the next three to five years to be a hundred-million dollar company. That's the kind of traction we expect to get in the market. When you get designed into a consumer application (HDTV or a Smartphone), the volumes are outstanding. The volumes are incredibly high so the ramp is quite steep".

Keeping his three to five year revenue projections on target, $100 million in annual revenue would be achievable between 2016 and 2018. Applying the 10 P/S ratio seen by AMBA and the stock price would be around $10 by that time. Global Maxfin expects $50 million in revenue by 2018.

Mr. Stelliga's comment about the revenue ramp up being steep once Spectra7 gets designed into a product is the key to my extreme bullishness in the company. Spectra7 has already surpassed 20 design-ins with leading OEMs for the company's recently announced chip sets. This is an incredible rate of market acceptance given that these products have only been announced starting October 2014.

These design-in wins span multiple market segments:

- Virtual reality and wearable computing (likely the VR7050 chip announced in October and the VR7200 chip announced in November)

- Home entertainment and mobile (likely the HT8181 chip for Ultra HD 4K displays announced in November)

- Ultra-thin notebook and tablet devices (likely the TC7108, TC7216 and TC7050 chips for USB 3.1 Type-C interconnects announced earlier this month)

Up until recently, the market's main focus for Spectra7's future was the virtual reality and gaming industry. The company's near-term revenue growth was highly dependent on the consumer release and market acceptance of VR headsets produced by Oculus and other OEMs. I believe that the release of the HT8181 chip and the chips that enable USB 3.1 significantly improve revenue expectations for the company. Spectra7 will now have a hand in powering three major movements in consumer electronics in the next two years. The biggest opportunity of them all may be the impact Spectra7's chips can have on Smartphone capabilities.

"The infrastructure that delivers bandwidth to your handset is largely based on mechanical technologies. We changed those to semiconductor technologies which increase the bandwidth by a factor of ten and decrease the cost by as much as a factor of ten" - Tony Stelliga, CEO of Spectra7 during his BNN interview in 2013.

I believe one of the biggest short-term pushes for the stock price is going to be the naming of the OEMs and brand names that will be powered by Spectra7 chips. The company has avoided naming its clients so far but some companies known to use Spectra7 chips include LG, Panasonic, Motorola and Oculus, a subsidiary of Facebook (NASDAQ:FB). I am not aware of the inclusion of Spectra7 chips into Microsoft (NASDAQ:MSFT) or Apple (NASDAQ:AAPL) products but with the rise of USB 3.1 for tablets and laptops and the way Spectra7's semiconductors will fundamentally change mobile bandwidth per the CEO's comments above, I believe it is only a matter of time before those two tech giants start implementing Spectra7 chips into their devices, if they haven't already.

The company may be quiet about who uses its chips, possibly at the request of its clients for competitive reasons, but eventually Spectra7 will be named in marketing documents or product specifications or be discovered in product reviews like it was in the Oculus Rift Developer Kit teardown. If that were to happen with several more popular upcoming consumer devices, I believe the stock price would explode. I don't think we are too far off from that point, maybe in a matter of months or a year or two.

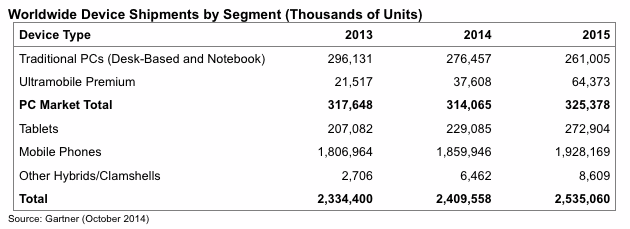

Mobile phone and tablet shipments are expected to surpass 2.2 billion units combined in 2015 and will likely grow from there. If Spectra7 was to eventually help power just 10% of these devices with a $1 chip, that would lead to $220 million in revenue, or over a third of my target to reach $50. And that's without considering the impact on the VR industry, TVs, its legacy businesses or any new initiative Spectra7 will develop between now and then. When looking at it from this perspective, you can see how revenue numbers approaching a billion dollars isn't that unbelievable for the company in the coming decade.

Source: techcrunch.com

I mentioned in my previous article about the competence of Spectra7's CEO Tony Stelliga and his tendency to have his companies bought out. One got bought out by Intel and the second by Intersil (NASDAQ:ISIL) and I believe Spectra7 is on the same path. Reviewing his LinkedIn page shows a claim that he has "Raised over $150M in Capital to achieve product vision and market disruption, resulting in over $2B in market capitalization". Achieving the same feat with last year's private placement at 30 cents would leave Spectra7 valued at $4. It might never reach $50 because it may be bought out before it has the chance. If a buyout happens at a good price and relatively quickly, I wouldn't have any problems with it because I can always redeploy the capital in another opportunity.

When investing in a company like Spectra7, I believe risk-tolerant investors will have incredible returns to look forward to and have an excellent chance to see at least 10 times their money back if they are patient enough to hold onto it for a while. I believe this because Spectra7:

- has flooded the market with its chip sets that will impact at least three huge new trends in consumer electronics (VR, 4K Displays, USB 3.1)

- has surpassed 20 design-ins and has a total of more than 30 retail brands using its chips

- it's only a matter of time before these large brand names in consumer electronics start mentioning Spectra7 in their product specs

- has seen strong recent revenue growth and is closing in on positive EBITDA

- has cancelled a loan facility, suggesting that the company believes the warrant exercise will bring in a sufficient amount of cash until it reaches profitability, limiting or eliminating future dilution once the warrants have been exercised

- the CEO has a tendency to have his companies get bought out

- will be a prime candidate for uplisting to the NASDAQ in the next couple of years

Disclosure: I own Spectra7 shares and warrants which I intend to convert to shares before the end of this month. I have not discussed the content of this article with Spectra7's management and all forecasts and estimates are my own except when noted.

Disclosure: I am/we are long SPVNF.

---------------------------------------------------------------------------------

I just stumbled upon this article just now while doing my research on Spectra7. I believe one should always be cautious with how they execute their dd towards any one stock. Although this author is being speculative at certain points in this article, and whether or not he is right or wrong on these matters, he does bring up a lot of interesting facts about Spectra 7. This is why I posted this article. So others can see those facts he brings up which rehashs some valid postive points or facts about this company.

Anyways, I myself will be chewing on certain facts brought up in this article and will further look into them to validate their truth.

In the end, trust your own DD. Be very leery or skeptical of message boards, and always keep one eye open at least looking out for how posters may try to manipulate you into buying or selling based on nothing but, fluff, hype, fearmongering, exaggerating, wishful thinking, speculation etc..

You all have a good day now...