Thanks. I couldn't get on Investor Village but I recognized the name as a regular poster on seeking alpha. He is sourcing the latest August presentation which has some new graphics that I have never seen before. Good stuff. It should really drive the bashers nuts.

https://www.tagoil.com/wp-content/uploads/2016/08/TAG-Institutional-Presentation-August-2016.pdf

https://seekingalpha.com/article/4004612-insider-purchases-indicate-stock-bargain

From the Canadian Insider Website, the more prominent insiders are purchasing common shares of Tag Oil (OTCQX:TAOIF) like mad (price in Canadian dollars):

| Date | Date | Insider Name | Type | Securities | Nature of transaction | Volume or Value | Price |

| Aug 30/16 | Aug 30/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 25,000 | $0.820 |

| Aug 24/16 | Aug 24/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 25,000 | $0.820 |

| Aug 19/16 | Aug 19/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 25,000 | $0.830 |

| Aug 18/16 | Aug 18/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 90,000 | $0.800 |

| Aug 18/16 | Aug 18/16 | Perone, Giuseppe (Pino) | Direct Ownership | Common Shares | 10 - Acquisition in the public market | 5,000 | $0.780 |

| Aug 17/16 | Aug 17/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 6,000 | $0.770 |

| Aug 15/16 | Aug 15/16 | Guidi, Alex P. | Indirect Ownership | Common Shares | 10 - Acquisition in the public market | 21,500 | $0.770 |

| Jul 25/16 | Jul 25/16 | Pierce, Toby Robert | Direct Ownership | Common Shares | 10 - Acquisition in the public market | 10,000 | $0.760 |

| Jul 19/16 | Jul 15/16 | Pierce, Toby Robert | Direct Ownership | Common Shares | 10 - Acquisition in the public market | 3,000 | $0.790 |

| Jul 14/16 | Jul 14/16 | Perone, Giuseppe (Pino) | Direct Ownership | Common Shares | 10 - Acquisition in the public market | 5,000 | $0.810 |

| |

Source: Canadianinsider.com Website

For a company with an approximately $40 million market cap (as of the close of the market on September 6, 2016) the insider purchases shown above are extremely significant. There has been some announcements and the company appears to be ready to start operating (exploring and increasing production) again. Up until now management maintained the fields and collected the cash from the production. No growth or new projects were started because commodity prices were so low.

Source: Tag Oil August, 2016, Corporate Presentation

As shown above, Alex Guidi, who is purchasing many of the shares obtained by insiders lately, is a founder of Tag Oil. Alex Guidi probably has the most experienced knowledge of Tag Oil's future so his opinions and actions as an insider are very significant. The other purchaser is the President and CEO.

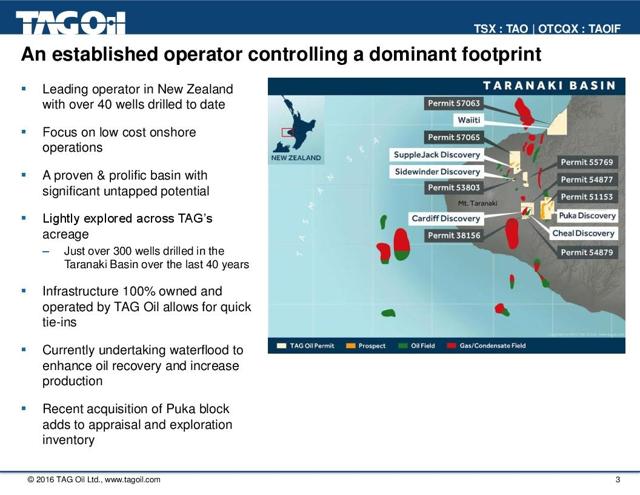

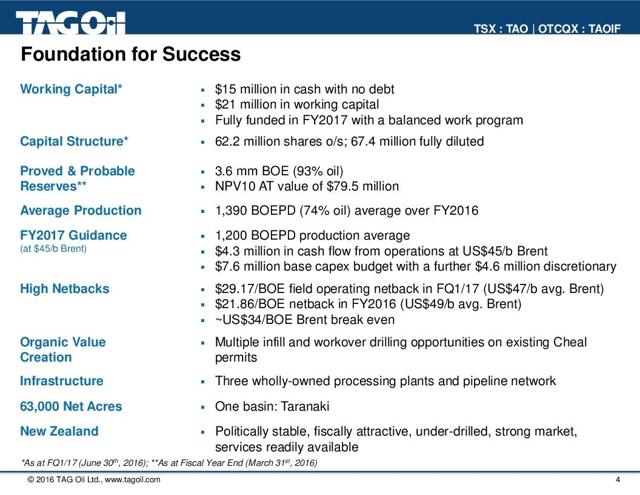

Tag Oil is a Canadian company that operates in New Zealand. The company has been cash flow positive throughout the industry downturn and debt free. For a while, previous articles noted that management basically hunkered down and tried to outlast the downturn while cashing checks from production sales each month. That built up the cash on hand to the point where this company does not need to worry about bank lines for awhile. The capital budget had been stripped to the bare minimum, but what has been spent has "counted".

Source: Tag Oil August, 2016, Corporate Presentation

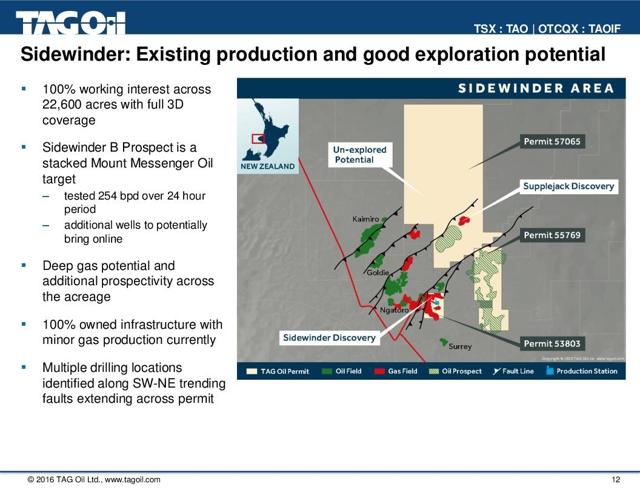

Tag Oil management recently announced a new zone discovery in the Sidewinder prospect. For a company producing a little more than 1,000 BOE per day, that discovery was very significant and will lead to more development possibilities and additional production. Best of all, new zone completions are typically very cheap.

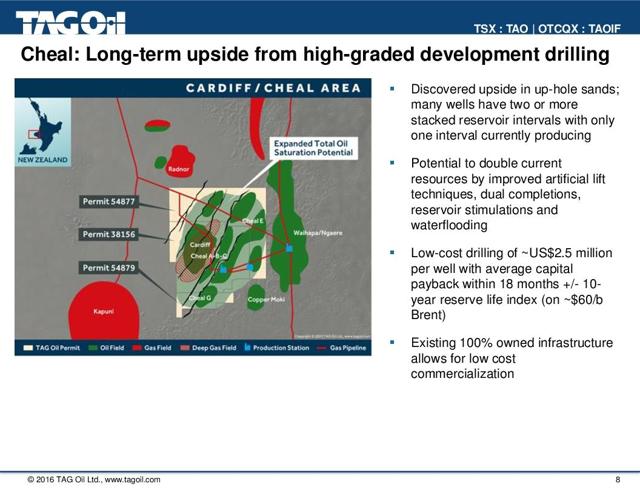

The company originally had a breakeven point of $34 BOE Brent. So at current pricing management has not been too anxious to drill completely new wells. New wells only cost C$2.5 million each and payback in about 18 months at current prices.

However, management has found a way around that problem to expand production using even lower cost techniques. The highest priority will be to recomplete wells in different zones. Several of the prospects have stacked pays, with the wells producing from just one zone. Success in this venture could lead to development wells that are dually completed to lower payback and breakeven costs further.

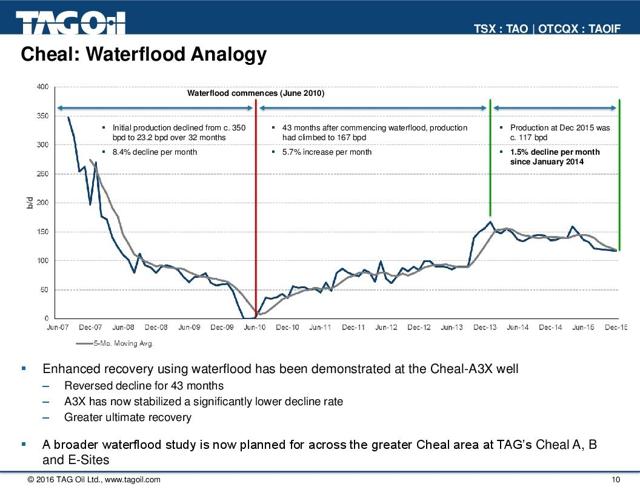

The other low cost way to increase reserves will be waterflooding.

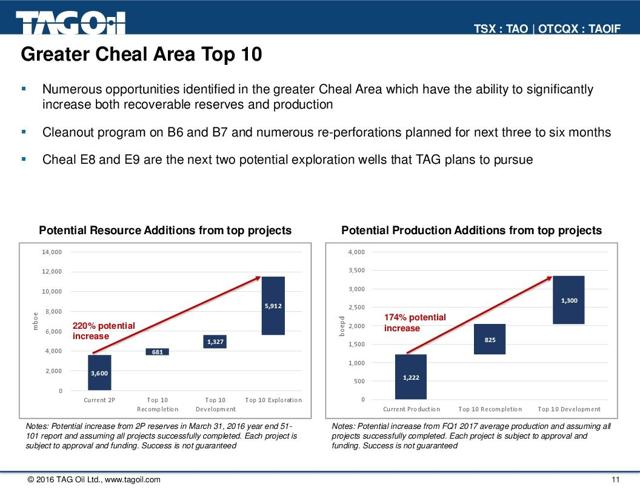

Source: Tag Oil August, 2016, Corporate Presentation

Shown above is a sample of the possibilities for cheap reserve additions. Typically this company adds reserves a few hundred thousand BOE's at a time, but when the market value is in the $40 million range, those additions will prove to be a very effective strategy. Management and the founder must like the possibilities a lot to be purchasing as much stock as shown in the very first slide. It would not take much money to add 1,000,000 BOE to reserves using the techniques above. For a small company the size of Tag Oil, such a reserve addition is extremely significant and would be positively reflected in a higher stock price.

At the end of the fiscal first quarter, the company reported C$15 million cash and production of 1,237 BOED. The recent discovery of a new zone alone should cause production to rise in the third quarter and management has plenty of plans to increase production after that, even with a very low capital budget.

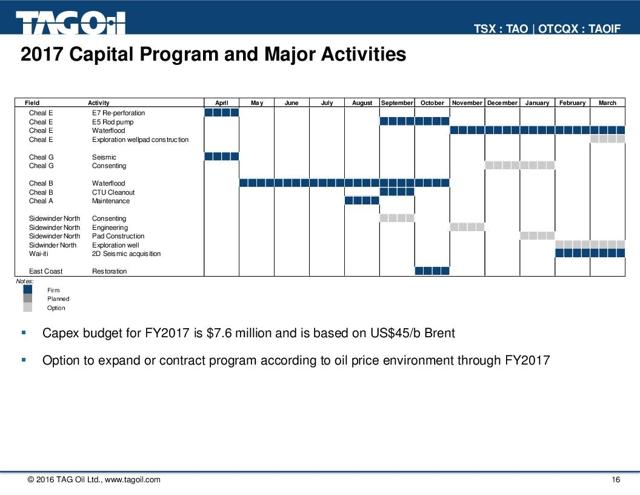

Source: Tag Oil August, 2016, Corporate Presentation

The company can clearly fund all of the capital in the first slide from cash on hand, without worrying about cash flow. In fact, if management became optimistic enough, the capital budget could double and still would be financed from the cash balance with a very small dependence on cash flow. This balance sheet is a rock and management has a very high priority to keep it that way. There are no bank line redeterminations to worry about here ever.

As shown above, the netbacks are extremely good so the company has cash flow even when prices were terrible this past winter. Much of the industry will be in far worse shape than this company when prices are low. Plus management is taking an extremely conservative route to increase production in the current environment. Even so, the company expects to double production over the next couple of years.

This company started the downturn with extremely low costs in addition to the great balance sheet. But the "shale" and alternative oil part of the industry has been steadily lowering costs. This company has been relatively inactive. So the ability to lower costs in this field is not currently evident because it has not been demonstrated. The field could in the future lose its low cost position in the industry. The latest insider purchases would lead one to think that there are good possibilities for lower costs.

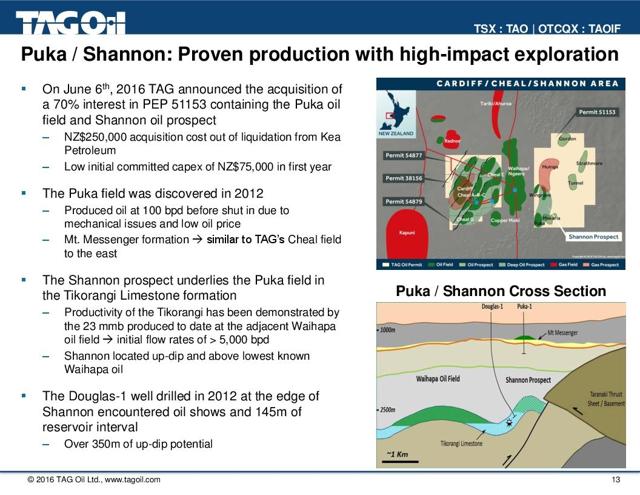

Source: Tag Oil August, 2016, Corporate Presentation

The riskier side of Tag Oil is shown above. Traditionally this company finds a partner for exploratory wells, especially if the wells are deeper. That will probably be the case with the prospects shown above. There are some shallow prospects in the first slide, but whether the company and its partner will risk trying to develop the prospect itself (not usually) or wait until it can attract a financially substantial partner (more likely) is not settled at this point. In the past the company has been fairly conservative with exploratory wells and is not inclined to "risk the company". In the past, East West Petroleum (OTCPK:EWPMF) funded 100% of the initial Cheal wells to earn its partnership interest. Now Tag and East West share the costs proportionately.

The Puka lease itself already has a partner and the first order of business will be to restart the wells that have been suspended from producing. This should be a very cheap source of increasing cash flow. The joint venture is committed to drill one well of depth to be determined. The field cash flow will be expected to fund a significant amount of the well cost.

The founder upgraded the management from the CEO on down during the industry downturn as noted in previous articles. The idea was that a different kind of experience was needed to take the company to the next level. Indeed, the new management is redesigning the water flood project to lower cost more than was originally thought possible.

The market completely ignored the announcement of the new zone production. It has pretty much yawned at management's plans to increase production over the next few years. So there is very little risk in purchasing the stock of this company. Approximately 35% of the market value of the common stock is the cash balance which will also protect downside risk. Any successes that show as higher earnings within the next year could easily send this stock soaring. It should at a minimum triple over the next five years with no help from the current commodity pricing. An exploration success could easily make this a very conservative projection. The insider purchases are saying that this common stock is a bargain and it sure looks that way when examining the company parts.

Disclaimer: I am not a registered investment advisor, and this article is not to be construed as an offer to purchase or sell stock. All investors are recommended to read all the filings of the company and the press releases to assess for themselves whether or not this company fits their investment risk profile.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.