RPA report shows inferred not always 100%

Exploration Insights

by Brent Cook and Joe Mazumdar

www.explorationinsights.com

September 9, 2016

On August 22, Orezone Gold (ORE.V) announced that, as a result of a resource review and update, approximately 30% of the previously estimated oxide gold resource was eliminated from its Bombor mine plan in Burkina Faso. As a consequence, Orezone’s share price and market capitalization declined by about half.

Did this represent an opportunity for Exploration Insights subscribers?

We are familiar with the project, know the management team to be solid, and evaluated the potential risks and reward of an investment in the company, considering this new information, in our August 28 newsletter.

What follows is the commentary we published for our subscribers. We are now making it public to offer an illustration of how we evaluate potential investments in the junior mining sector in the hope that our reality-based methodology may overlap with yours and that you will give Exploration Insights a try.

Orezone Gold’s Resource Revision

by Joe Mazumdar

In late August, Orezone Gold Corp (ORE.V. ORZCF.AMEX) shares were halted from trading. Some speculated that the suspension was due to a pending takeover announcement; however, the news turned out to be decidedly negative.

On August 22, the company’s independent consultants, Roscoe Postle Associates (RPA), indicated that the September 2013 Measured and Indicated (M&I) resource from the Bombor open pit gold project in Burkina Faso may have been overestimated by up to 30%. The resource downgrade is likely to have a commensurate impact on the reserve, mine plan, and project economics.

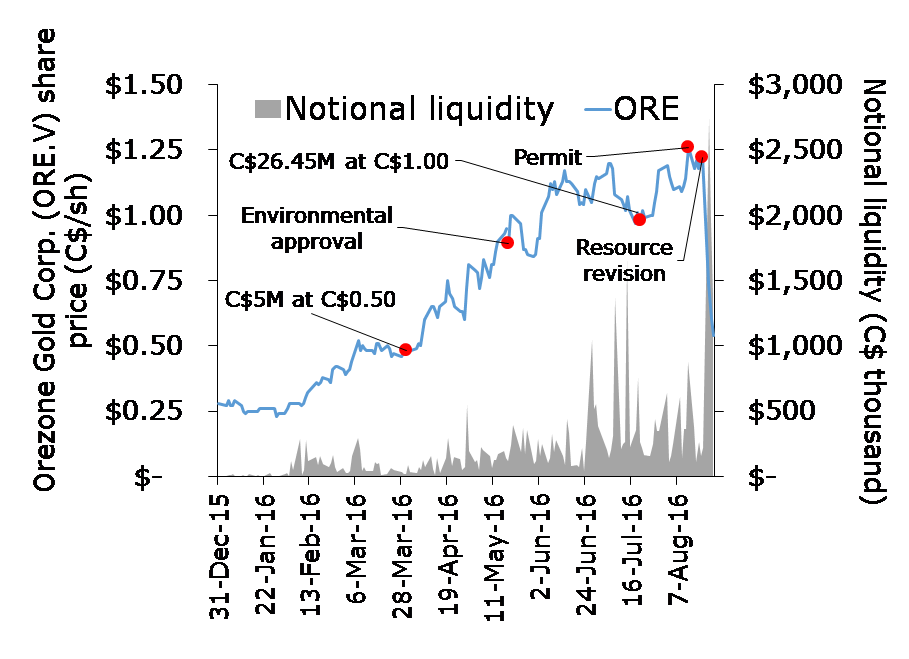

The news generated high trading volumes—11.1 million shares or C$7.1 million—equivalent to ~40% of the stock it issued in its most recent equity financing in mid-July 2016. The share price closed the week down ~50% to C$0.60 with a market capitalization of C$106 million and ~US$24 million in cash, Fig. 1.

(Fig. 1: ORE share price performance and notional liquidity in 2016 year-to-date with significant catalysts highlighted, Source: Google Finance and Exploration Insights)

The April 2015 Feasibility Study (FS) focused on the oxide and transitional material at the Bombor Gold Project (BGP) as this material is less expensive to process than sulfide material. The project required fewer capital expenditures and lower processing costs than a project focused on the sulfide material, which is marginal at current gold prices.

Reputable firms such as Kappes, Cassiday & Associates (KCA, lead), RPA (mine plan), SRK (resource), and Golder (geotechnical work) were involved in preparing the FS.Many believed that this was a sound study, but the recently discovered uncertainty regarding the estimated resource has put the reliability of the NI 43-101 compliant technical report into question.

Unfortunately, this series of developments is not unprecedented. We have observed a number of setbacks related to the estimate of gold projects’ resources over the past couple of years, including Pan (link here), Phoenix (link here), Tasiast (link here), and Cochenour (link here); plus others that bordered on disaster, like El Limon-Guajes (link here) and Soledad Mountain (link here). Furthermore, this issue is not limited to single-asset junior mining companies, as larger companies have been involved as well, but the valuation impact on the former is obviously higher.

[We have previously discussed the controversial resource estimates at the Phoenix, Brucejack, and Barkerville gold projects, which first time subscribers may find useful to review to better understand the art of resource estimation.]

I have been to site and both Brent and I have a lot of respect for the management team at Orezone Gold. We were looking at potentially picking up ORE over the summer if it pulled back. Regrettably, it did so for the wrong reason. We chose to review the Bombor gold project due to subscribers’ requests; they wanted to know what had happened to the ounces and whether this event presents a buying opportunity.

Humpty Dumpty sat on a wall ...

At the end of last week, ORE was up over 330% in 2016 and had outperformed the GDXJ junior gold mining index by 175%, Fig. 1. It had closed an equity financing to raise C$26.45 million (more than 5x the amount of its previous raise) at a healthy price of C$1.00, which is double its previous financing price. It also avoided issuing any new warrants, a rare occurrence for a junior gold developer.

The shares were free trading and issued prior to the receipt of the permit to develop the Bombor open pit gold project. This catalyst provided the participants in the equity raise a return of 25% in only a few weeks.

(Humpty Dumpty in the shell, Source: William Wallace Denslow)

The Bombor Gold Project M&I oxidized/transitional resources, extracted from an April 2013 resource estimate prepared by SRK out of Toronto (link here—Table 32), amounted to 67.1 million tonnes grading 0.91 grams per tonne gold containing 1.96 million ounces at a cut-off grade of 0.45 grams per tonne gold.

[Oxidized rocks have no sulfide minerals, whereas transitional rocks have a mix of oxidized and sulfide material. The oxide-transitional boundary is defined by the appearance of sulfide minerals like pyrite (FeS2), and the transitional-sulfide boundary is defined by the disappearance of oxide minerals.]

The total M&I (oxidized/transitional+sulfide) amounted to 139.8 million tonnes grading 1.01 grams per tonne gold containing 4.56 million ounces at a cut-off grade of 0.45-0.50 grams per tonne gold. The resource estimate was based on 404,648 meters of drilling in 5,096 drillholes at an average depth of ~80 meters and represented the fifth estimate for the project.

Everything was looking good:

“SRK is of the opinion that the drilling information used in the resource estimation summarized here is sufficiently reliable to interpret with confidence the boundaries for gold mineralization.”

April 2015 Feasibility Study

The FS presented a Proven and Probable reserve of ~60 million tonnes grading 0.76 grams per tonne gold containing 1.46 million ounces for the near surface, Phase 1 oxidized (saprolite) and transitional ores. In RPA’s opinion, the most significant risks to the reserve were:

-

potential for greater than modeled surface or groundwater

-

capacity of the heap leach and tailings storage facility

-

gold recovery in the transitional material

But RPA missed one significant risk: the methodology employed by SRK to calculate the resource estimate. The drill data for the resource estimate was capped to November 2012, but there were an additional 57,258 meters completed on the project since that date.

Prior to building the mine plan for the FS, RPA had recommended that the additional meterage be included in the resource estimate. However, Orezone wanted to get the FS completed to present it to the Burkina Faso government before any revisions were made to the local Mining Code (link here), since such revisions would have negatively impacted the project economics (higher corporate tax rate). The FS was completed in April 2015 before the implementation of the new Mining Code and did not include the post-November 2012 drilling results.

...Humpty Dumpty had a great fall

Ahead of the release of the resource revision, the company’s next significant catalyst was the arrangement of the financing for the US$250 million project. We believe that potential lenders requested that the +50,000 meters be incorporated into the calculations. RPA was selected by the company to redo the 2013 estimate by SRK from the bottom up. The results from this study led to the conclusion that the revised resource of the oxide and transitional material could be significantly lower (~30%) than the original.

The company’s press release this past Monday unequivocally stated that investors could no longer rely on the April 2015 FS, and key NI 43-101 technical reports were withdrawn, Fig. 2. RPA will deliver a revised 2016 resource statement for Bombor along with a comparative analysis of the previous 2013 resource estimate (SRK) by September 7, 2016.

(Fig. 2: Technical reports withdrawn, Source: Orezone Gold website)

Initially, ORE management believed that the difference between the two resource estimates would not be significant. Typically, infill drilling upgrades ounces to higher resource categories (Inferred -> Indicated -> Measured), it does not eliminate them (Measured & Indicated -> ?). The material impending downgrade of up to 30% of the resource is, in the company’s opinion, predominantly related to a change in the modeling methodology (RPA vs. SRK) and less so to other adjustments.

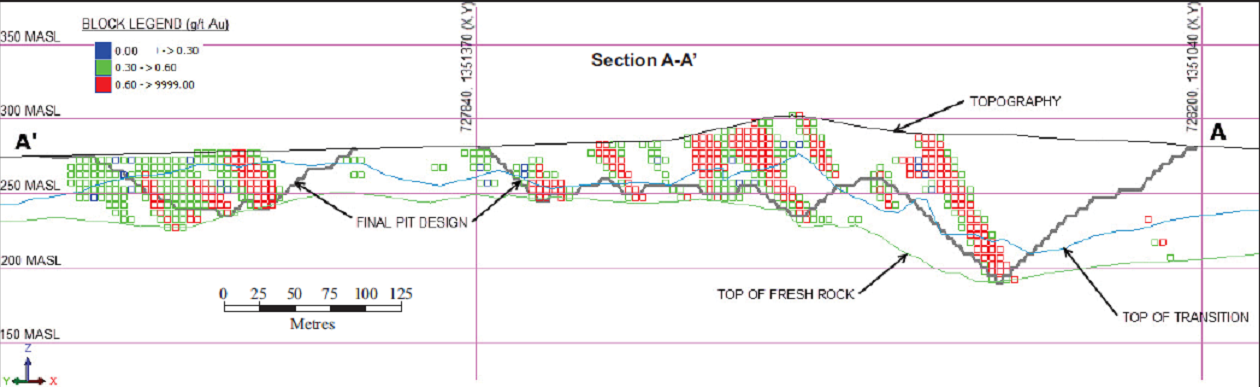

Ore reserves were calculated using a US$1,100 pit shell at a cut-off grade range of 0.30 to 0.42 grams per tonne. Each block represented a 5-meter by 5-meter by 10-meter cube of rock, which may contain 450 tonnes of material applying a specific gravity of ~1.8. RPA had placed a hard boundary between the Waste Domain and the Low Grade Domain, whereas it appears that SRK’s boundary was less rigid.

As an illustration, Fig. 3 depicts a cross section through one of the numerous proposed shallow open pits designed to extract the saprolite and transitional ore atBombor. In our opinion, the ore blocks that may have been removed by RPA resulting in the resource downgrade may be the red and green blocks that fall outside the final pit design.

(Fig. 3: Cross section looking northeast through one of the open pits at Bombor illustrating the limits of the final open pit design and the ore blocks that fall out of it,Source: April 2015 Bombor Oxide Feasibility Study [KCA])

Orezone’s press release stated that “...RPA nor SRK will officially comment on the contents of this release or a comparison of the two resource estimates” until the publication of the revised resource in September. But we know from Inca Kola News(IKN, link here) that SRK put forward a press release after market close on Friday in an attempt to defend its 2013 resource estimate.

All the king's horses and all the king's men...

According to the company’s website, nine firms provide sell-side research coverage of its projects, which is impressive considering the company had a market capitalization of only C$30-35 million at the beginning of the year. The reaction to Monday’s announcement of the resource downgrade was predominantly negative on the part of analysts, generating a spectrum of revisions of target prices and recommendations.

We managed to track down the comments from seven of the firms and noticed that their target price revisions ranged from no change (GMP) to down 72% (Clarus), Table 1. Given that the stock had fallen ~50% by the time they filed their research notes, only three firms downgraded their recommendation (BMO, Clarus, and National Bank), and only one presented a Sell rating (Clarus).

[For those unfamiliar with sell-side research firms in Canada, which include banks and brokerage firms, the lack of Sell ratings is not unusual, as the proportion of negative ratings for their entire coverage universe, according to their disclosures, is usually less than 5%.]

(Table 1: Analysts’ revisions of Orezone’s share price after the Monday’s press release regarding the resource revision. An asterisk [*] denotes those with an investment banking relationship, to disclose any potential bias. Source: Bloomberg and Exploration Insights)

We note that the majority of the firms have indicated that they have an investment banking relationship with the company, denoted with asterisks in Table 1. GMP’s disclosures were especially noteworthy as they indicate that a member of ORE’s Board is also a member of its Board. In addition, the GMP research analyst is apparently related to an officer, director or advisor at ORE. Interestingly, GMP was the only firm not to change its target price or recommendation.

Higher gold price needed to put Humpty back together again

Given that ORE’s share price fell ~50% this week, we decided to evaluate the potential buying opportunity it offered to investors. As previously mentioned, Bombor’s NI 43-101 technical reports are no longer valid due to the uncertainty of the underlying resource; therefore, we made some assumptions to accommodate the lack of a reliable FS.

We assumed that the 30% drop in the resource translates fully to the reserves, thus lowering the mineable resource estimate by 30%, to 40 million tonnes, grading slightly higher than the previous estimate (+5%, 0.80 g/t Au), Table 2. We raised the grade of the 1 million contained ounces to offset the removal of low-grade ounces. Assuming the low-grade stockpile material from the FS is now waste, we added 16 million tonnes to the waste volume (+25%, 80 million tonnes). The combination of lower ore tonnage and higher waste tonnage raised the strip ratio of waste to ore to 2:1 from 1:1.

(Table 2: Our assumptions for the Bombor oxide open pit gold project versus the 2015 Feasibility study, Source: April 2015 Feasibility Study [KCA] and Exploration Insights)

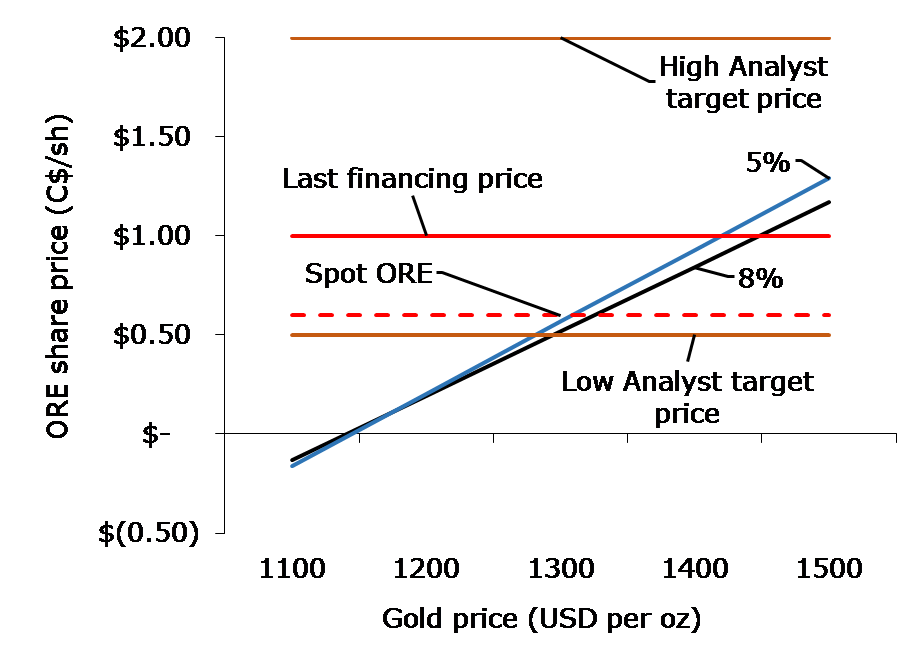

Our high level valuation of ORE, applying an 8% discount rate, and based on the development of only the oxide and transitional portions of the Bombor gold deposit, plus its current cash position of US$24 million, suggests that the company is fully valued at ~C$0.60. If we applied the industry standard discount rate of 5%, it would be currently trading at a 10% discount.

[As an aside, we point out that the 5% discount rate employed by the North American gold industry is inexplicably linked to an anachronism. It ignores today’s differences in geopolitical risk from various jurisdictions and takes no account of the cost of capital. This is, however, a topic for another Rant.]

We estimate that a gold price of US$1,450 per ounce would value ORE at its last financing price of C$1.00. This target price, if it pans out, would provide investors bullish on the gold price with a 65-70% return. We note that some analysts have also valued the sulfide resource (~3.0 million ounces grading 1.0-1.3 g/t Au in all resource categories), Fig. 4.

Valuing ounces on an enterprise value per ounce (EV/oz) basis is a crude but effective way to get an idea of how much a project is worth. We note the current average EV/oz for gold resources is US$40-45 and ranges from less than US$5 to ~US$280 (Source: Dundee Capital Markets). Out-of-the-money ounces within marginal projects trade at below US$10 on an EV/oz basis. At an enterprise value of US$10 per ounce (EV/oz), the Bombor sulfide resource could generate an additional ~C$0.20 of value, but we are not in the habit of valuing out-of-the-money options and have no intention of beginning now.

(Fig. 4: Sensitivity of Orezone Gold Corp. share price to discount rate and gold price,Source: April 2015 Feasibility Study [KCA] and Exploration Insights)

Summary

As mentioned earlier, we trust ORE’s management team. In our opinion, the issues at Bombor result not from nefarious acts but from the fact that there is an explicit risk underlying all resource estimates. The key word here is estimate. A typical caveat accompanying a resource statement is that there is “...no certainty that all or any part of the mineral resource estimate will be converted into a mineral reserve.”

This inherent risk is prevalent in the junior gold mining sector as a whole. We have to remember that we are trying to estimate the amount of gold within an ore block (5-m by 5-m by 10-m, ~450 tonnes of rock) with only a couple of drillhole samples no bigger in diameter than a fine bottle of Malbec. A flawed resource estimate can either generate a fatal flaw (Phoenix and Pan) or lead to a revision of the mine plan with a downgrade in the reserves, which seems to be the case for Orezone.

If you strongly believe that the gold price will go up (>US$1,400 per ounce) and that the market will eventually value the sulfide resource, then ORE may present a buying opportunity. Thankfully, the company is well funded (US$24 million) with no debt. For the time being, we will stay on the sidelines as the risk (resource, financing, execution) may exceed the potential reward in the near term at the prevailing gold price.

That's the way we see it,

Joe Mazumdar and Brent Coo