Welcome to the September edition of the lithium miner news. It certainly has been a big month of announcements, but a disappointing month for the Australian lithium miners stock prices, as sentiment (in Australia) is currently very weak.

Lithium news

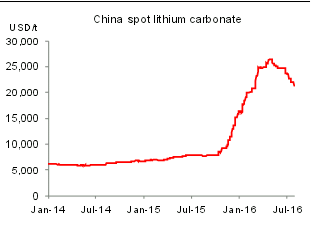

During September, 99.5% lithium carbonate China spot prices were basically flat, and are still around USD 20,000/tonne.

Lithium carbonate China spot price to July 2016 - currently around USD 20,000 per tonne

Source

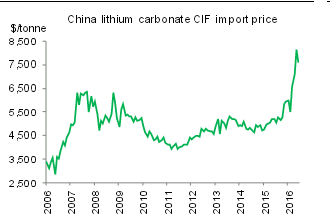

Lithium carbonate contract prices range from USD 9-14,000/tonne, depending on the company, the location being sold to, and the size of the contract.

Lithium carbonate contract prices

Source

Lithium demand versus supply

Mr Lithium, Joe Lowry, tweeted on August 30 that he was "convinced lithium supply won't exceed demand in this decade." Seems he disagrees with the Macquarie report also. He also stated in July, "the lithium market itself is a LONG way from oversupply or bubble territory." Joe also recently tweeted (same link as above): "Back in the US, still pondering the huge lithium demand numbers I heard last week." Joe has recently been in Asia. I agree with Joe, and I respect his over 20 years of industry experience as a lithium expert. Another lithium expert, Chris Berry met with industry producers, buyers and sellers. He tweeted: "There is no way supply will meet or exceed demand before 2020 under current circumstances for either lithium or cobalt", "knowing the threats to growth in either space is key to investment in either space".