From the Lamb on Seeking AlphaAny longs want to counter with something as deep or are you all chasing after the wrong crooks???

Oct. 4.16

Summary

Concordia’s $3.5 billion acquisition of AMCo in October 2015 exposed them to severe price gouging regulatory risk.

AMCo was previously flipped multiple times with increasing valuations by private equity firms and Concordia ended up holding the bag.

AMCo acquired off patent branded drugs with limited competition and resold them as expensive generics to avoid NHS price controls.

Our research finds the average price increase of AMCo’s drug portfolio that only face one competitor or less is on average 1,220%, ranging from 82%-26,429%.

A reversion to historical drug prices for AMCo’s portfolio could result in an equity value of zero for Concordia.

Note: All images in this article are created by the author, except where otherwise noted.

Introduction

Concordia International (NASDAQ:CXRX) is a specialty pharmaceutical roll-up that has been growing through acquisitions. Using the capital markets as their fuel, Concordia valiantly bought 18 of Covis' drugs for $1.2 billion in early 2015 and AMCo's entire drug portfolio for $3.5 billion in late 2015. Both of these transactions were heavily financed by debt, pushing Concordia's leverage to 6.6x Debt/EBITDA and 2x EBITDA/Interest based on management's latest guidance. On September 16, 2016, the UK drafted a bill to close a loophole that allowed geometric price increases on generic drugs. In this article, we will present evidence that AMCo is one of the few drug companies targeted in this new bill due to their opportunistic price gouging practices.

History of AMCo - Slumdog millionaire

Amdipharm Mercury was formed as a merger between Amdipharm and Mercury Pharma, both of which were founded by UK immigrants.

Amdipharm was founded by Vijay and Bhikhu Patel in 2002. The brothers had humble beginnings living in poverty in Kenya. Thanks to their father choosing British rather than Kenyan citizenship after the Kenyan independence in 1964, they had the opportunity to leave for the UK when they were 16. After graduating from university, Vijay started his own chain of pharmacies and learned how the industry works. It is likely that while operating the pharmacies, and after seeking help from his brother Bhikhu, he learned that more profits could be made in the distribution business. The brothers founded Amdipharm and started acquiring international pharmaceutical assets in order to exploit the NHS loophole that they discovered (See loophole section for more details). As a result, they were able to amass a fortune of £366 million after selling Amdipharm to Cinven in 2013, instantly becoming UK's 14th richest Asian.

The story of the Patels does not end here. Just like how an alcoholic never truly quits, the Patel brothers went back to business by starting another firm called Atnahs in 2013. As you would have guessed, Atnahs specializes in buying rights to legacy drugs that doctors prescribe out of habit but are no longer of interest to large pharma. Using the same loophole, they were able to rake in millions. The Patel brothers now live in a mansion on the hills of Essex.

The history of Mercury Pharma (formerly Goldshield) is quite similar to Amdipharm. In 1989, Ajit Patel, along with his pharmacist friend Kirti Patel, founded Goldshield Group to acquire manufacturing rights of generic drugs. Unlike Amdipharm, they actually colluded with five other companies to fix and inflate prices of warfarin, a blood-thinning medicine, and penicillin-based biotics. This resulted in a raid of Goldshield's offices by the Serious Fraud Office (SFO) and the arrests of Ajit and Kirti. Ultimately, the company settled for £5 million. Fortunately, Ajit and Kirti were able to sell their stakes to Cinven in 2012, valuing the company at £465 million.

Having brought Amdipharm and Mercury together, Cinven continued to execute their strategy of exploiting the NHS loophole. Using AMCo as their platform, they bought Abcur in 2013, rights to Fucithalmic in 2013, and Focus Pharmaceuticals in 2014. We believe these drug portfolios were acquired due to their ability to convert to generics with limited competition and to reduce existing competition in AMCo's drug portfolio. This is likely true because a portion of AMCo's drug portfolio has Focus Pharma as its sole competitor.

Before selling AMCo to Concordia, Cinven undertook a $1.6 billion recapitalization in October 2014. This allowed them to take home a special dividend of over $643.76 billion while leveraging the company significantly. It was only after the recapitalization did Cinven decide to shop around to see who would be willing to buy AMCo.

The timing couldn't have been worse. Right after Concordia paid $3.5 billion (a price tag that far exceeds what Cinven paid for the drugs themselves) for AMCo in October 2015, negative media headlines began to surface relating to the price gouging of Martin Shkreli's Daraprim. In addition to concerns relating to price gouging, the market became increasingly concerned about Concordia's elevated debt levels. Ever since the acquisition of AMCo, the share price of Concordia has been on a downward slope. (See SA for pic)

The NHS loophole

The loophole is simple. We conveniently found a chart from AMCo's own filings to explain how they exploit the NHS, but with some of our own annotations. (see SA for pic)

The general scheme works like this:

- AMCo would acquire a branded but off-patent drug for a few million dollars. Most large pharmaceuticals generally sell them for cheap because the profits have declined substantially after patent expiration. AMCo typically acquires drugs that face limited competition and have few substitutes to allow for maximum price gouging effectiveness.

- AMCo drops the brand name and sell them under their generic names. This allows them to move from Category C in the NHS drug tariff to Category A - meaning that profits were no longer capped. Drug prices in Category C are set by a single supplier or manufacturer with a profit cap set by the NHS. Category A drugs are outside this cap because the prices are set by prices from two major manufacturers and two major wholesalers. The NHS assumes multiple manufacturers will naturally drive down the price, but realistically it is not always the case.

- Once sold as Category C, AMCo is free to increase the price to make a healthy return on their investment.

- (Optional) - Sell the drug to a desperate buyer at 13x EV/(Exploit-adjusted EBITDA) and make all your money upfront.

In the next section, we provide concrete examples how the major drugs that AMCo acquired were switched from branded to generic.

Detailed analysis of AMCo's drug portfolio

We start with a high level overview of the top contributors of AMCo's revenue. See below for a breakdown of the major molecules by revenue. We will also look into the other 44% of AMCo's drug portfolio to look for significant price gouging. All pricing data is from NHS prescription cost analysis data, which includes prescriptions written by General Medical Practitioners and Non-medical prescribers in England. The data does not cover items dispensed in hospitals or private prescriptions, so volumes may be understated. Quantity sold includes all marketers unless otherwise stated.

For those that don't want to see the detailed story of each drug, we provide an overview of AMCo's price gouging magnitude in the chart below (see SA)

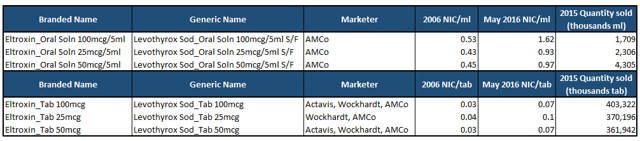

Levothyroxine Sodium

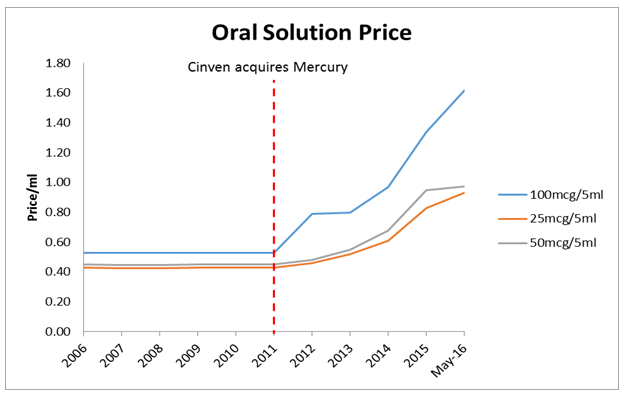

This molecule came from the Mercury acquisition in 2012. AMCo currently markets both an oral solution and tablets. They command a monopoly over the oral solution after Teva Pharmaceutical (NASDAQ:TEVA) exited the market in 2012 and they compete with Actavis and Wockhardt on the tablet forms. See the figures below for a summary of the drug. Quantity sold includes competitor's quantity as well as the data does not segment the data by company.

We believe it is not a coincidence that immediately after Cinven acquires Mercury, the price of all three formulations of the oral solution increased in price by over 100% when historically the price has been exactly the same. AMCo is the only company marketing the oral solution in the UK so this drug is ripe for price increases.

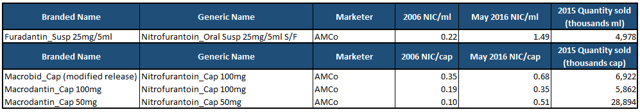

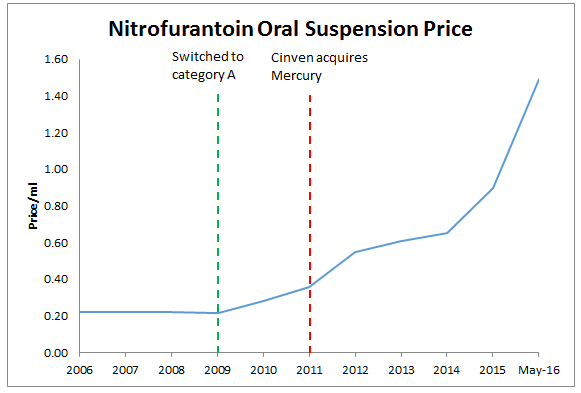

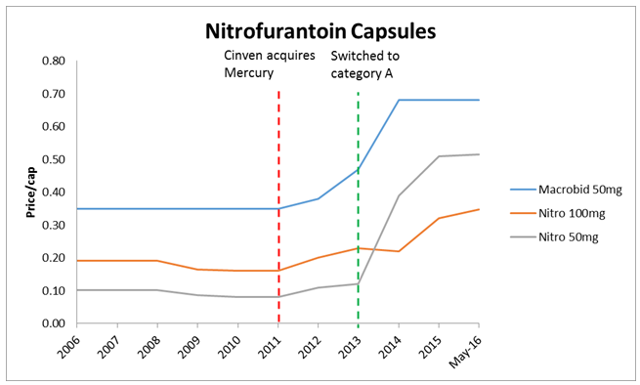

Nitrofurantoin

This molecule became part of AMCo's portfolio through the 2012 Mercury acquisition. Similar to Cinven's strategy with levothyroxine sodium, they used their monopoly power to raise the price of 50mg nitrofurantoin capsules by over 500%. The oral suspension version also had a 600% price increase. The bulk of the increase came after the capsules switched to category A in 2014.

It is also odd that the price of 50mg capsules went from being half of the price of 100mg capsules in 2006, but now cost more than the 100mg capsules. This behavior provides some evidence that price increases have not been due to increases in manufacturing costs.

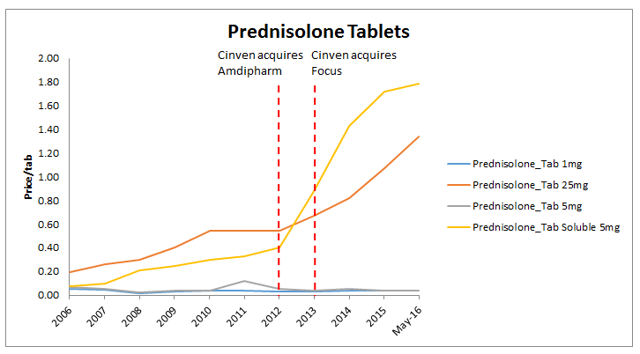

Prednisolone

The market for generic prednisolone tabs is generally competitive. The bulk of the volume flows through the 1mg and 5mg formulations. As shown in the table below, the 1mg and 5mg formulations have at least three competitors. As for the 25mg, we found that AMCo only markets the branded version Pevanti and not the generic version. Based on the PCA data, Pevanti scripts are non-existent. This means Zentiva has a monopoly over the 25mg and it's likely a reason that the price increased significantly for this formulation as well.

Cinven first gained access to the prednisolone market through their acquisition of Amdipharm in 2013 and secondly through their acquisition of Focus Pharmaceuticals in 2014. For these acquisitions, Cinven was not interested in the boring prednisolone tablet market. Instead, they were interested in the soluble prednisolone tablet market that has no competitors. After their acquisition of Focus, they became the sole marketer of soluble prednisolone in the UK. Doctors will also generally prescribe the soluble version for patients that have difficulty swallowing, which will always lead to a sale to either Focus or Amdipharm. This has likely led to the 2,443% price hike in this specific formulation of prednisolone.

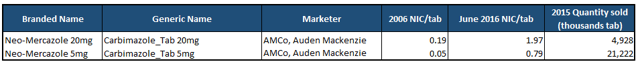

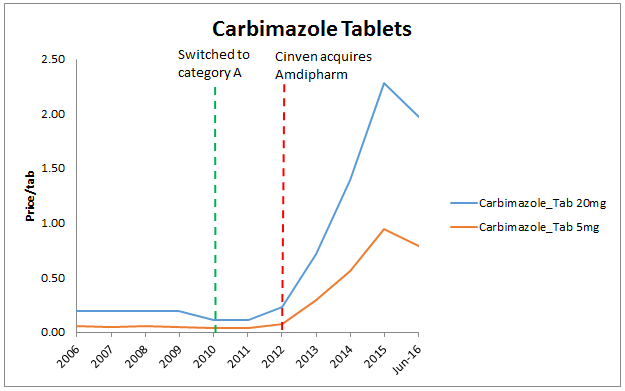

Carbimazole

The market structure for carbimazole tablets is an oligopoly as Amdipharm and Auden Mackenzie are the only marketers for this drug. Auden Mackenzie deserves some special attention because their history is similar to Amdipharm. Brother and sister Amit and Meeta Patel started the operation in 2001 when they identified a nice market for generic medicines. Auden Mackenzie was criticised in 2011 for large increases in the prices they charged on some generic drugs to the NHS. Mr. Patel's response was dismissive: "I do not need to justify my profits to anybody. There are companies that make bigger profits than I do." He also mentioned that the NHS "didn't care" what the drugs cost. Indeed, Carbimazole was one of those drugs that deserve some scrutiny as highlighted below.

From trough to peak, the 5mg formulation saw a price increase of 2,250% and the 20mg saw an increase of 1,972%. What is interesting here is that the drug saw price decreases in 2016. This could be due to Actavis' acquisition of Auden Mackenzie in 2015 that shook up the cartel between Amdipharm and Auden. We can only speculate that further price decreases may occur in this market.

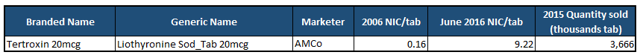

Liothyronine Sodium

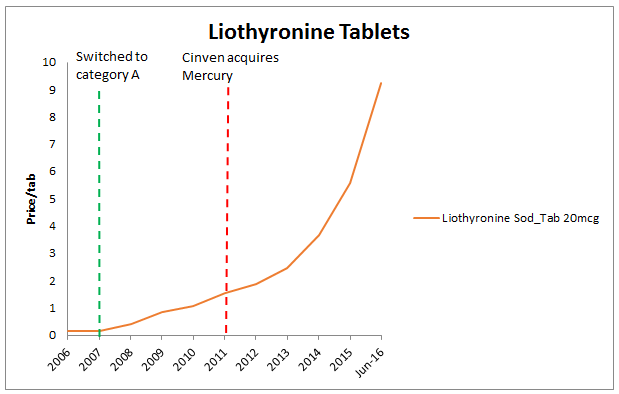

This molecule came from the Mercury acquisition and over 90% of the market volume flows through liothyronine sodium 20mcg tablets, which Mercury has a monopoly on. The magnitude of price gouging on this specific formulation exceeds Martin Shkreli's Daraprim price hike of 5,456%. The 20mcg tablets saw an increase of over 5,692%, from 16 pence per tab in 2006 to 9.22 pounds per tab in June 2016.

The story follows that of the previous drugs we mentioned. In 2008, Mercury decided to switch from selling the tablets as branded Tertroxin 20mcg to generic liothyronine sodium 20mcg tablets. Soon after, prices began to skyrocket as price controls no longer applied. Cinven buys Mercury in 2012 and double-downs on the price hikes.

We note that Mark Thompson in a BNN interview said, "We have a very different business model than both Valeant and Turing. We have a model that doesn't rely on taking geometric price increases. We also have a model that buys products."

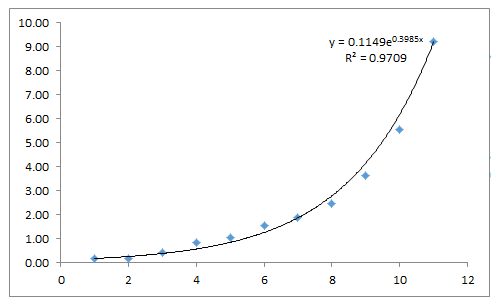

We beg to differ because by fitting the prices with an exponential function, the R^2 is over 0.97. In other words, the price on average increases roughly 40% a year with this model.

Either Mr. Thompson didn't know what he was buying into, or he did not want to admit on BNN that they price gouge.

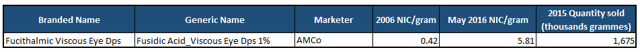

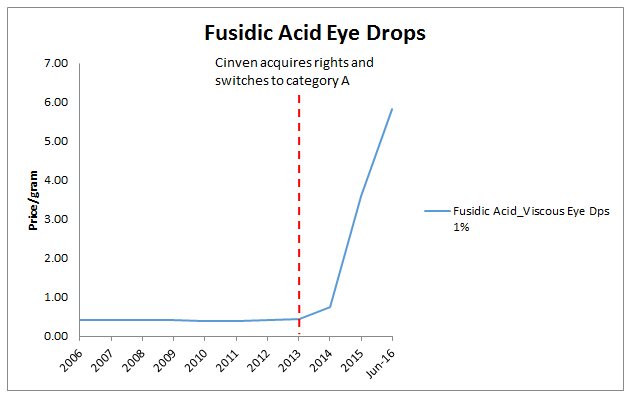

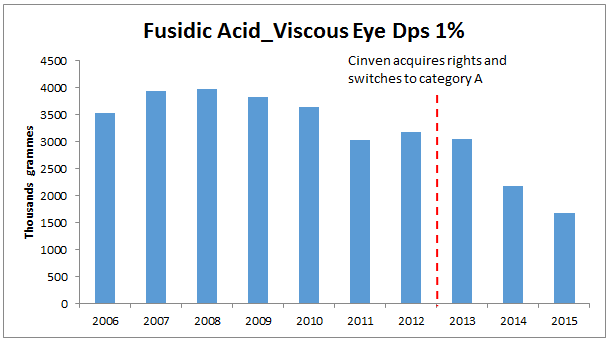

Fusidic Acid

This molecule came from a bolt-on Cinven acquisition of the rights to Fucithalmic Acid in 2013. Before 2013, Cinven only marketed the Fusidin acid 20mg/g cream, which has competition with Leo Laboratories. The volume of the cream was also too small to justify price hikes (2015 NIC was less than 400,000 pounds). The more lucrative market is in the fusidic acid 1% viscous eye drops, a formulation that no one else markets in the UK. Ironically, the rights were bought from none other than Leo Laboratories.

The price increase on this drug is beyond geometric. The same year that Cinven acquired the drug, they stripped it of its branded status and sold it as generic. This allowed them to hike the price by over 1,390%.

The abrupt increase in the drug price seemed to have drawn some attention as the volumes sold under this drug declined about 50%. We believe the price increase on this drug is unsustainable and further volume drops could materialize.

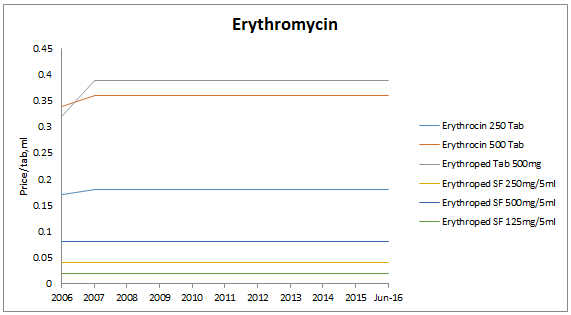

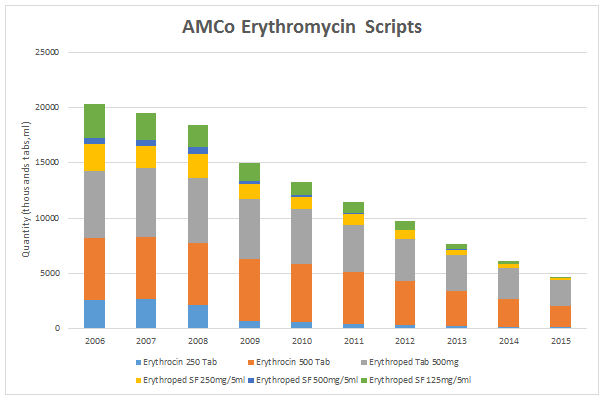

Erythromycin

This was one of the few molecules we found that did not experience price hikes. Amdipharm currently only markets the branded versions, which are subject to price controls under the Drug Tariff Category C. We believe they have not transitioned to the generic version because there is ample competition in this market.

This market exemplifies the structure of a normal drug pricing environment. Amdipharm's branded drugs will slowly lose market share and prices remain low due to generic competition. The volumes for Amdipharm's erythromycin drugs have been declining ever since 2008 when generics started to hit the market.

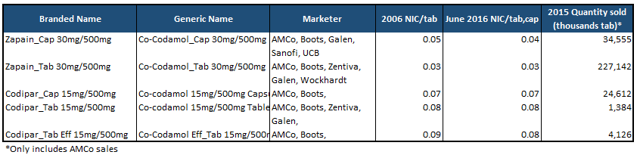

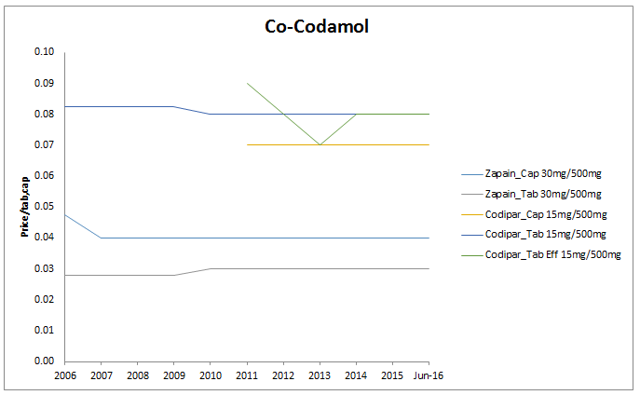

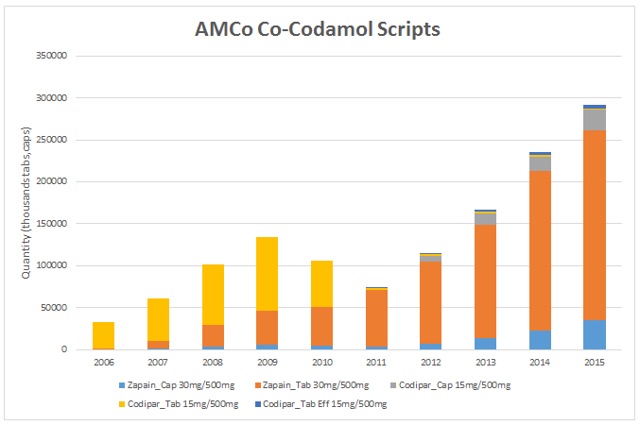

Codeine Phosphate with Paracetamol

Similar to erythromycin, the market for this molecule is highly competitive. As we would expect, prices of AMCo's products in this market has been fairly stable due to competition. This was also the only market that we saw volume growth in AMCo's branded generic drugs. Most notably, this volume growth came from successful push through of Zapain 30mg/500mg tablets. This is one of the few drugs that we expect to have continued success in the future.

Biperiden Hydrochloride

This drug is currently not marketed in the UK so we do not have PCA data on it. We will assume that this drug will not experience any price reduction.

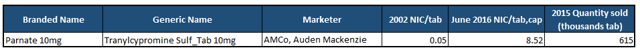

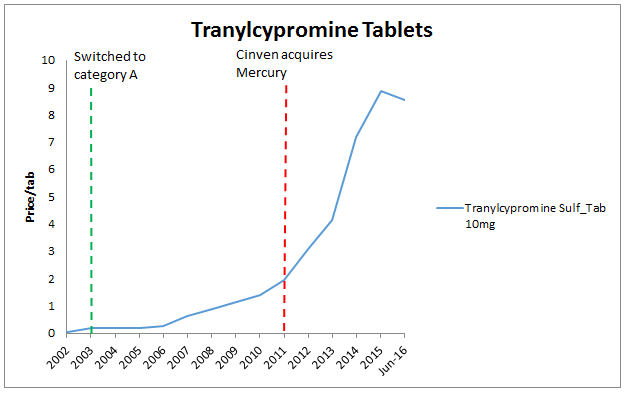

Tranylcypromine Sulphate

Similar to carbimazole, Mercury shares the market with Auden Mackenzie. Based on the repeated pattern of price increases in markets where these two firms operate, we suspect that some collusive effort is being made to raise prices together. Tranylcypromine sulfate 10mg tablets saw a price increase of 1,7620%, from 5 pence a tab in 2002 to 8.86 pounds a tab in 2015. We congratulate Cinven and Auden for beating Martin Shkreli's record by more than triple the amount. It is interesting to note that similar to carbimazole, prices are coming down this year likely due to the Actavis acquisition.

Other molecules

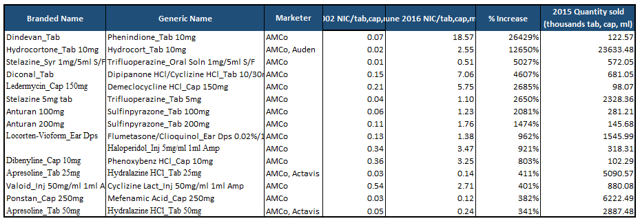

Out of AMCo's top 10 molecules, 8 experienced significant price gouging, 1 experienced generic competition, and 1 drug had some promise. For drugs not listed as top 10, we sifted through every drug marketed by AMCo to see which other drugs were price gouged. The table below lists drugs that AMCo price gouged more than 300% and had NICs greater than £100k.

The table clearly demonstrates that AMCo was a serial price gouger. We note that some of these drugs experienced significant price hikes between October 2015 and June 2016. This implies that under Concordia's management, they continued to increase drug prices. Combining this list with AMCo's top 10 drugs, we found that the volume weighted price increase since 2002 on drugs where AMCo has one or less competitors is 1220%. In the next section, we estimate the potential impact of the new UK bill 72 on Concordia's EBITDA.

Financial Impact of Bill 72

On September 15, 2016, the Department of Health, along with NHS health secretary Jeremy Hunt, drafted a bill called the Health Service Medical Supplies (Costs) Bill to address geometric price increases on certain drugs. Specifically, the passing of the bill will grant the government absolute power to "reduce the price of a generic medicine, or to impose other controls on that company's unbranded medicine, even if the company is in the voluntary scheme, the PPRS 2014, for their branded medicines." This passing of this bill could revert AMCo's drugs currently priced in Category A back to Category C (essentially back to their branded prices).

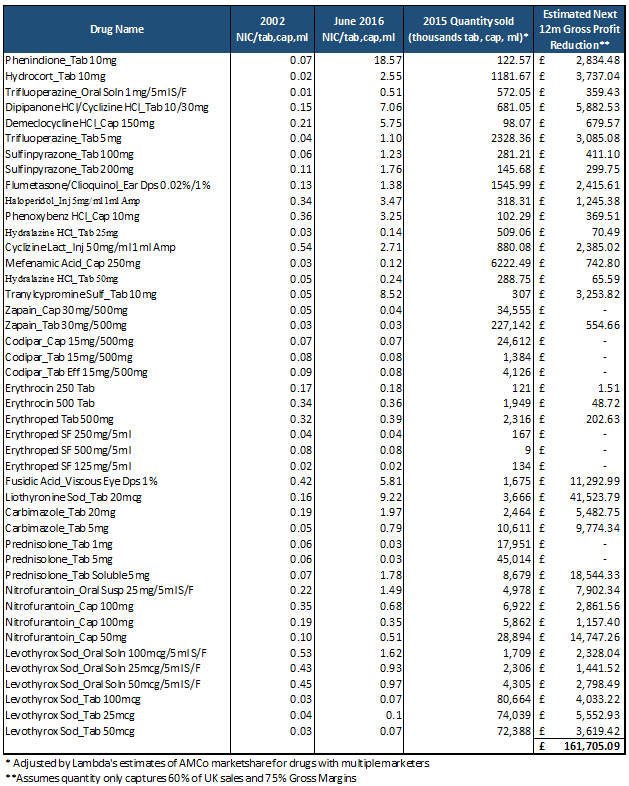

We estimate this reversion on Concordia's gross profit by assuming that volumes will remain stable but prices revert back to old prices. See the table below for our estimate.

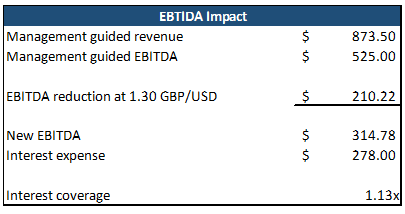

We assume that the PCA data only captures 60% of the volume dispensed as the data does not capture drugs dispensed in hospitals. We also assume that price reductions flow through gross profit and not revenue because the wholesalers' cut generally make up the bulk of cost of goods sold. Next we estimate the impact on Concordia's guided EBITDA.

We assume that management guidance was based on most recent drug prices and no further deterioration in the North America segment. If our estimate of gross profit reductions flow directly into EBITDA, then the new EBITDA barely covers the interest.

Further Weakness in NA Segment

There is also the possibility that Donnatal sales disappear altogether due to its current DESI designation. Depending on how much of an EBITDA reduction management already considered for Donnatal in their revised guidance, the potential downside to EBITDA could be up to $30 million if it was no longer available in the market. In addition, any further generic pressure for Plaquenil and Nilandron beyond management's revision could push Concordia's EBITDA below their interest expense. This scenario will leave equity holders nothing except for the some optionality value of equity. Thus, Concordia's current distressed valuation is warranted given the uncertainty regarding their liquidity situation.

On October 1st, 2016, the company will also have to make their earn-out payment to Cinven relating to the AMCo acquisition. Assuming a 1.30 GBP/USD exchange rate, the earn-out will be approximately $188 million. In a previous filings by Concordia, there is also the possibility of a $72 million additional fee relating to additional drug acquisition.

"In addition the Company will pay to the Vendors a maximum cash earn-out of £144 million (with an estimated value at closing of $207.9 million) based on AMCo's future gross profit over a period of 12 months from October 1, 2015. If the Company acquires certain specified pharmaceutical products from a specified third party introduced to the Company by certain of the Vendors within 12 months of the date of the AMCo Acquisition, the Company will pay to the Vendors an additional $72 million."

On October 3rd, the company decided to exercise their option to defer half of the Cinven payment to February. In the same announcement, however, the company added, "The Company continues to evaluate its strategic alternatives including, but not limited to, various capital markets financing option." This statement is new language regarding the strategic review and likely hints at a potential liquidity shortfall the company could face in the near future.

Conclusion

We believe Concordia could have further room to drop. How the additional financing will be conducted will ultimately determine what equity holders are left with. Medium-term uncertainty regarding Bill 72 will prevent any sensible institutional investor from owning the stock. We speculate that bankruptcy is one possible scenario, leaving the equity worthless. If Concordia manages to stay afloat until the end of next year and Bill 72 does not pass, then the upside potential could be large. Until then, Concordia will remain a risky and speculative bet that only the most daring investors should purchase.

Disclosure:I am/we are short CXRX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.