6 Reasons You Must Own Canadian Cannabis Licensed Producers

6 Reasons You Must Own Canadian Cannabis Licensed Producers Now

Summary

Although the Canadian Cannabis Licensed Producers have been rising strongly, I have six reasons why you should still be buying them.

Assuming California approves recreational marijuana in November, in the next few months the equivalent of the 6th largest (California) and the 10th largest (Canada) countries will be going legal.

As these are still relative new, comparatively small companies, the mutual funds and pension funds have not been actively buyers yet. But they will be eventually.

An emerging paradigm is countries such as Germany, Brazil and Croatia working with Canadian LPs to provide product and services to their people. There is a two-way benefit here.

My picks of the Licensed Producer group are: Organigram, Canopy Growth and Mettrum.

Investors have choices when it comes to investing in the marijuana space. Below I explain why investors should be looking to the Canadian Licensed Producers as a source of continued above average returns. I have six reasons that explain my thinking.

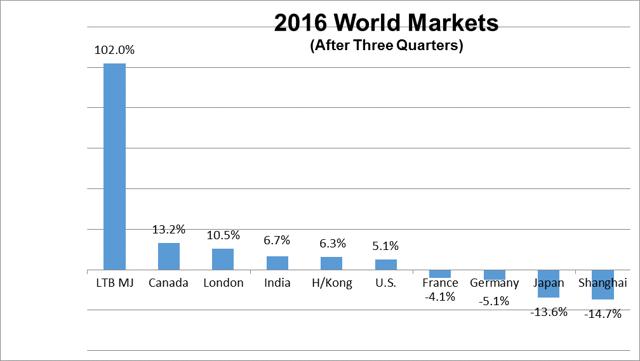

Reason #1: your portfolio will benefit from owning the broadly based Canadian marijuana stocks that have been producing spectacular rates of return compared to all world markets. Here is a summary of the performance of the Let's Toke Business Marijuana Composite Index in the first nine months of 2016 compared with the returns in the major world markets.

Click to enlarge

As the chart shows, although international markets have been recovering of late to the 'shock and awe' of some of the super bears, the Canadian marijuana stocks have been on a tear posting a nine month return of 102% as measured by the LTBMC Index.

Although one would normally be hesitant to buy into a sector after such a spectacular rise, remember the Canadian government has announced it will table legislation to legalize recreational marijuana in the spring of 2017. Medical marijuana is already legal in Canada. Even more important, it seems highly likely California voters will pass Proposition 64 in November 2016 making recreational marijuana legal in the largest U.S. state economy. This means two jurisdictions equivalent to the 6 th (California) and 10 th (Canada) largest economies in the world will legalize marijuana in the next six to nine months. So I think the optimism in marijuana stocks is justified and there is still upside to be had. But remember, there will probably not be another equivalent opportunity for investors in our lifetimes. So if you don't act, it will be like missing Haley's Comet. It's not likely you'll get a second chance to see it.

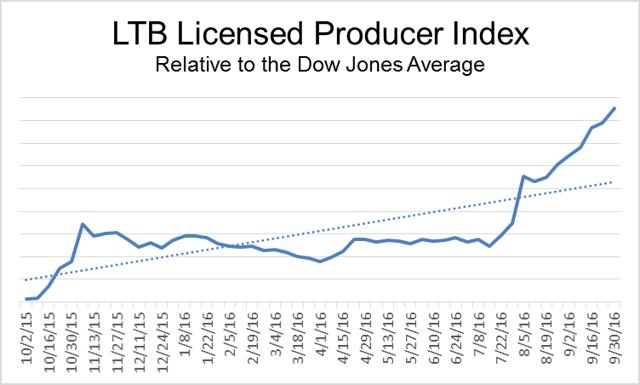

Reason #2: Clearly having some exposure to the Canadian marijuana stocks in portfolios and particularly the Licensed Producers will continue to increase your portfolio return, in my opinion. The following chart shows how the LTB Marijuana Composite Index has performed relative to the Dow Jones Average.

Click to enlarge

This chart shows the Licensed Producer group has outperformed the Dow Jones Industrials by a wide margin. In other words, the chart shows the amount by which the return on the LTB LP Index exceeded the return on the Dow. The improvement would have been nearly 100%. Clearly an American investor would have benefited greatly by having some part of their portfolio invested in Canadian LP stocks earning such returns.

In a world where professional portfolio managers strive to gain a performance advantage of 2% or 3% per annum on the averages, I think an investment in the Canadian LP sector would have been one way for individual investors to accomplish a similar goal. Here is the kind of analysis a mutual fund or pension fund manager will give you:

If you invest $10,000 today at 5.0% per annum for 25 years, you will accumulate $33,864. But if you invest in our fund and we can earn you an extra 3.0% per annum for 25 years, you will accumulate $68,485 - more than twice as much.

If you believe, as I do, that investing in the marijuana sector at this point in time will enable you to earn a lot more than an extra 2% or 3% per annum, the potential benefits are obvious.

But time is of the essence. The cannabis group appears to be entering a strong accumulation phase with the indexes gaining several points a day. You haven't missed the boat yet but you better hurry.

Reason #3: At the present time, there is much confusion with respect to the international financial markets and cannabis stocks may prove to be a comparatively safe haven from such turmoil. Many pundits believe the world is coming to an end or words to that effect. You only have to scan the headlines from the Seeking Alpha reports each morning to find many threads along these lines.(Donald Trump, for example) In my experience, bear markets never begin in a climate in which so many people are expecting one. In fact, bear markets usually begin as a bombshell in hindsight because no one was expecting it. I would be surprised if the bear reared his head in the near future.

Having said that, pessimists are generally intelligent people and their arguments are well considered. So you cannot not completely ignore their warnings. In this respect, owning marijuana stocks might be a bit of a hedge against the possibility of bad times. Thirty years ago we considered tobacco and alcohol stocks, among others, to have some countercyclical characteristics. Similarly, if the economy goes into a recession now and the financial markets decline, the demand for marijuana might well increase. We can't prove this yet because there has been such a short period of time in which marijuana industry has been operating legitimately and cannabis stocks have been trading. But it is a reasonable assumption to make if not in an absolute sense, certainly relatively speaking. What is likely to hold up better during an economic contraction - car sales or marijuana sales? Cannabis might grow through the next economic slowdown.

Maybe not in the absolute but comparatively speaking, I certainly think it's reasonable to assume cannabis will do better than average. From an investment perspective that is important and is another reason to consider having exposure to the group.

Reason #4: Widespread institutional buying of Canadian marijuana stocks still lies ahead. The Licensed Producers (LPs) are Canada's largest cannabis companies but are still relatively small in market cap terms. The five largest of the nine public LPs have market caps between U.S. $100 and U.S. $400 million based on data from Google Finance, October 4, 2016.

Company Symbol Market Cap

Canopy Growth (OTC:TWMJF) $354.8 mm

Aphria Inc (OTCQB:APHQF) $241.6 mm

Aurora Cann (ACBFF) $134.6 mm

Mettrum Health (OTC:MQTRF) $131.0 mm

Organigram (OTCQB:OGRMF) $103.9 mm

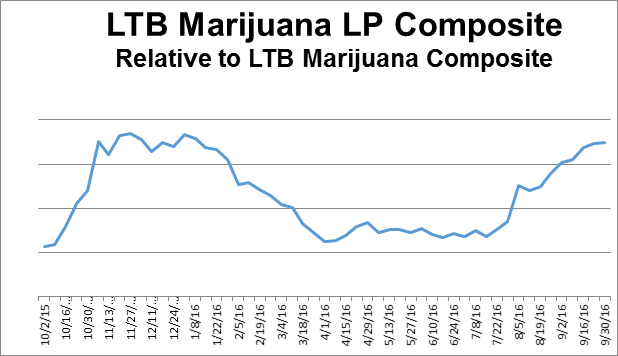

This sector has also been performing extremely well; outperforming the Composite Index since July as seen in the accompanying chart. These results explain our strategy of the past couple of months to rebalance portfolios away from the average marijuana stock to the Licensed Producers.

Generally speaking, however, the Canadian marijuana stocks are still too small to be widely owned by institutional investors. But among the first to be bought by the mutual funds and pension funds down the road are likely to be the LPs because they are already larger and better established with respect to revenue generation.

It is important to note each LP has passed one important security check. A Licensed Producer is a company given approval by Health Canada to grow marijuana and depending on the level of licensing, produce derivative products (oils) and sell them. In order to be licensed, each senior employee of the LP must pass an RCMP security check. In addition, each company has been approved to trade on a recognized, strictly regulated stock exchange and Canopy Growth is listed on the senior Canadian Toronto Stock Exchange Canopy Growth. So if you look at the investment merits of the Canadian Licensed Producers, institutions and individuals have an added layer of security and comfort with this group.

Reason #5: there is a new paradigm coming to light for Canadian Licensed Producers. Because they are so closely regulated with respect to best practices, Canadian bud is developing a well earned reputation for quality around the world. As a country prepared to offer the benefits of medical and/or recreational marijuana to your people, why go through the controversy and regulatory of hassle of developing your own industry. Why not simply buy a tried and true product from Canada?

There is evidence this is happening. TWMJF has been issued an export license to sell dried marijuana for sale in pharmacies across Germany. CEO Bruce Linton observed this is probably the best entry to the European Union.(Canopy Growth to sell Medical Marijuana for distribution by German pharmacies) Bedrocan, TWMJF's subsidiary has also received a license to ship proprietary strains of cannabis to Brazil.(Bedrocan establishes Brazilian subsidiary) The first LP to be granted an export license was Tilray that has a contract to supply medical marijuana to Croatia.(Tilray to export Medical Marijuan to Croatia)

There will also be a technology transfer associated with these transactions. Some proprietary knowledge will move from the Canadian LP to the foreign operator. But there will be a quid pro quo. For example, in Bedrocan's case, they may be able to develop new products through their Brazilian subsidiary much faster than if they tried the same in Canada. So it is potentially beneficial to both parties. But the paradigm shift could well mean considerably more business for the Canadian LPs moving forward.

Reason #6: In order to get into the Canadian cannabis group, you have to do-it-yourself. Why? Although the marijuana industry has been operating in the underground economy for decades, it is a relatively new industry in the legitimate economy. Most public cannabis companies you can invest in today did not exist three or four years ago. This means your typical mutual fund and pension fund are still shut out of this market because the target companies are too small. There is not enough liquidity. These stocks are what Wall Street managers call 'lobster traps' - easy to get in and hard to get out.

But it is more than just size. In the U.S., marijuana is a Schedule One drug which means under Federal law, it is an illegal substance. (DEA Leaves Marijuana as Schedule One) Never mind that the states of Colorado, Washington, Oregon and Alaska and the District of Columbia have legalized cannabis. This conflicting Federal/State legislation has caused a number of problems. For example, many U.S. banks refuse to deal with marijuana companies because they could end up providing banking services to companies the Federal Government deems illegal. In addition, U.S. Customs and Border Protection is a Federal responsibility. So if you're traveling from British Columbia, Canada, to contiguous Washington State, United States, you had better not tell American border security you're going to Seattle to smoke marijuana. The Federal officer might refuse you entry or worse. As a result, most institutional mutual and pension fund managers are like the banks - still hesitant to invest in the U.S. cannabis industry.

Simply owning mutual funds or having a pension is not enough. Think of it this way. If you believe the high tech sector is the place to invest, you don't really have to do anything. If you hold some diversified mutual funds, chances are they have a meaningful exposure to the sector. Similarly with your pension plan. If you have a professionally managed pension plan through your employer, you will probably have investments in technology companies.

But not so with cannabis. At the present time, it is more likely that your mutual funds and pension funds have little to no exposure to the cannabis stocks. So if you believe in the outlook for marijuana companies, you must do-it-yourself.

Conclusion: I think all prudent investors should take advantage of the marijuana opportunity that exists today for the following reasons:

I expect owning the Licensed Producers will make a significant improvement to your longer term portfolio rate of return. In the first nine months, the Let's Toke Business Marijuana Composite Index outperformed the Dow by almost 100%. At a time when there is much controversy and confusion about the outlook for international equity markets, the marijuana stocks may offer a countercyclical, safe haven. The Canadian marijuana stocks will enjoy another broadly based lift in values when institutions decide the companies are large enough to invest in. An emerging paradigm is foreign countries working with Canadian Licensed Producers as a more efficient way to develop their own marijuana industries instead of building from scratch. If you want exposure to marijuana in your portfolio it is a do-it-yourself exercise because the industry participants are too small for the conventional mutual funds and pension funds to own.

My favorite in the group remains Organigram for reasons I explained in Seeking Alpha recently. (Organigram: A-win-win-in the Canadian Cannabis Group) Regular readers will also know I am a big fan of Canopy Growth, the leader in the Canadian LP group. TWMJF commands a premium price but it will be worth it in the long run. My remaining pick is Mettrum Health that might be the Rodney Dangerfield of the LP group. It deserves more respect than it sometimes gets.