Is lithium the new super-mineral? Analysts seem to think so, including those who wrote Price Waterhouse Coopers latest mining study.

The report highlights lithium’s rising importance on the Toronto Venture Exchange, noting that five companies in the top 100 mining juniors are primarily lithium plays, compared with just one in 2015. This year, there’s even a company within the top 10: Canadian Nemaska Lithium, occupying the 8th spot.

According to the consultancy firm, the race for the white metal has heated up particularly amongst the juniors, given its growing importance as a key material in batteries for electric vehicles, e-bikes, and consumer electronic products.

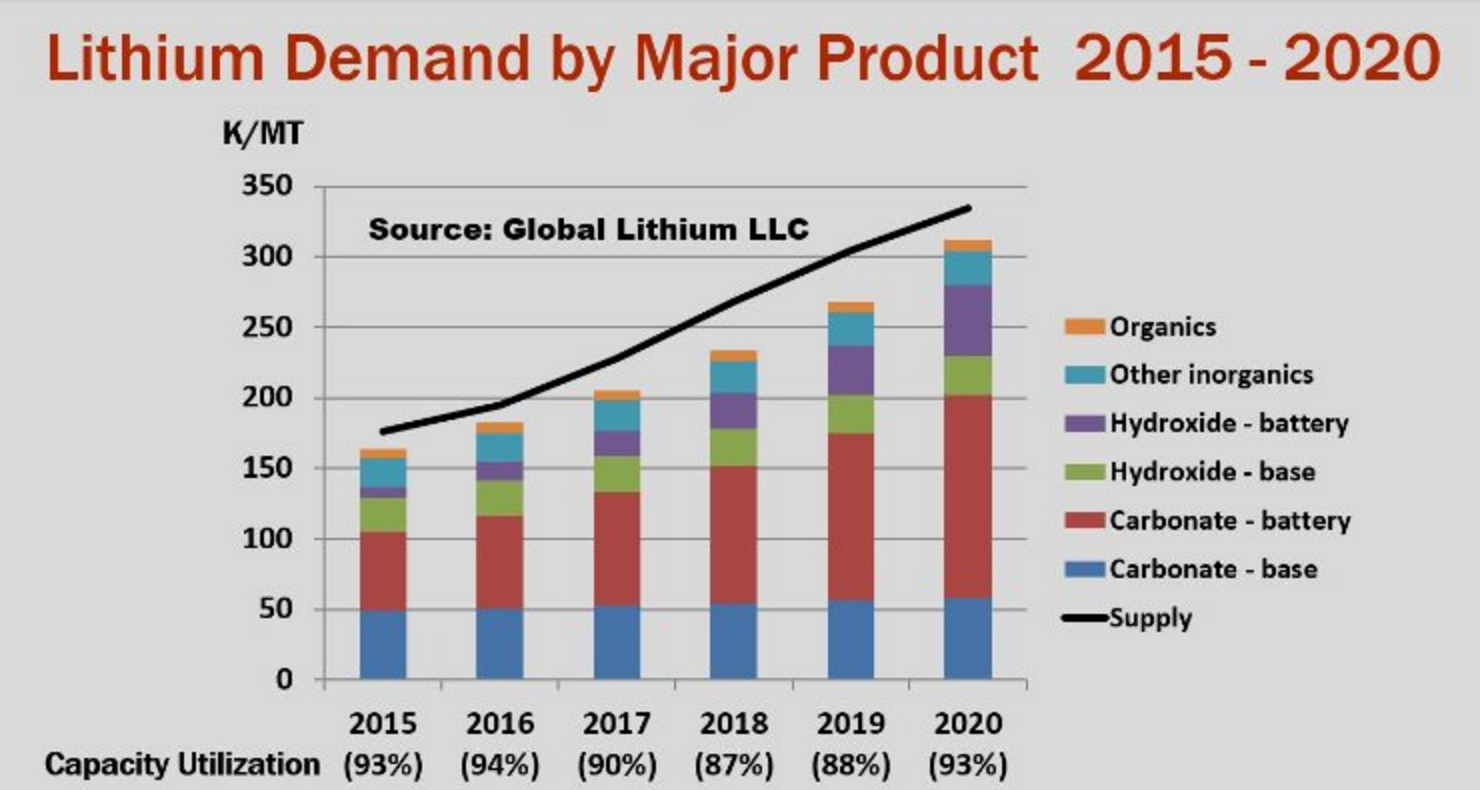

But despite the increase in demand, which is expected to reach almost 350,000 mt by 2020, supply isn’t keeping pace. “Supply will continue to trail until new projects come online in the next five years,” PwC states. “As prices for lithium soar, more than 100 companies are exploring for new supplies, many focused on the lithium triangledefined by Bolivia, Chile, and Argentina.”

Mexico is another area of interest, as it is Nevada's Clayton Valley Basin. The ‘silver state’ is now being dubbed ‘the gigafactory state,’ since Tesla and other giants have started developing the battery industry there.

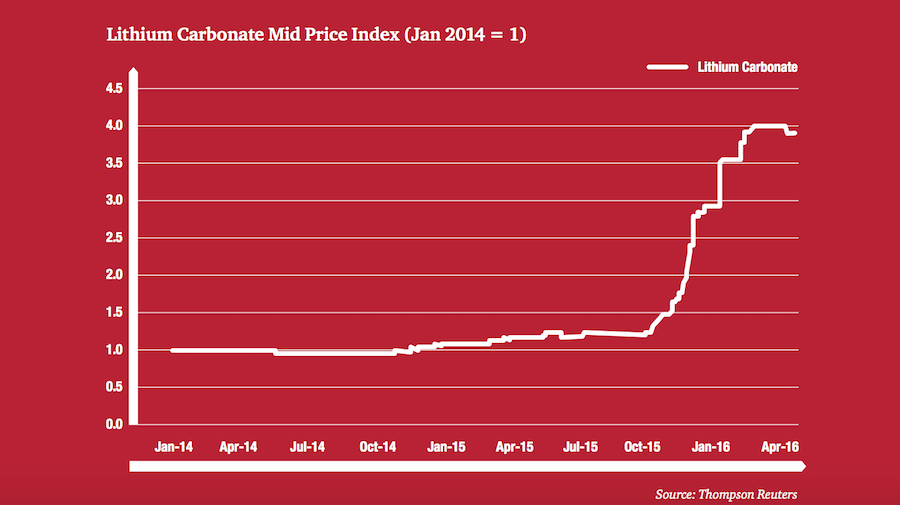

These market conditions have, of course, had an impact on the dollar value. Lithium spot prices in China are up to $16,000 a ton, from only $5,000 a couple years ago. Oilprice.com reports that battery grade lithium spot prices in China surged from $7,000 per ton in the middle of 2015 to $20,000 per ton earlier this year.

In the past 12 months, Global X Lithium ETF, which holds a cluster of stocks related to the mineral, has advanced more than 20%.

Taken from PwC's report.

But not everyone is so optimistic about Li. This week, The Globe & Mail interviewed the head of Toronto-based Stormcrow Capital, Jon Hykawy, who said that the rise in prices is a speculative reaction to “a relatively small increase in final demand,” driven by battery makers desire to stockpile supplies.

The researcher is convinced that this situation is unlikely to last because Lithium exists in abundance and there are many producers so close to financing their ventures, that global production could rise to around 800,000 tons by 2025, well above the expected demand for the same year.

PwC is in the same boat. The firm quotes the Deutsche Bank saying that Lithium supply is likely to triple in the next decade. "Speculation often overshoots demand and lithium may not be an exception, as miners shift rapidly into the South American market."

Nevertheless, PwC's analysts are sure that the mineral supply in the upcoming years is not going to go to waste. "Large corporate actors -particularly in the electric vehicle market- are designing their products around lithium-ion technology and this will not change overnight."