From Seeking Alpha ArticleBrad Thomas is the resident REIT expert

https://seekingalpha.com/article/4013368-3-new-monthly-mailbox-money-reits

Another monthly paying REIT that we are adding to our research lab isMilestone Apartments (TSX:MST.UN). Two weeks ago the company concluded the internalization of its asset management function by acquiring its asset manager, TMG Partners LP, via its operating partnership in conjunction with the renewal of its base shelf prospectus.

Yesterday Milestone agreed to buy a portfolio of six garden-style multifamily properties in U.S. Sunbelt markets for about US$242.2 million and launched a roughly C$175 million bought-deal offering to help fund the transaction.

The company's board of trustees also boosted the monthly cash distributions by 10% to 5.041 U.S. cents per unit, up from a current monthly distribution of 4.583 cents apiece. The increase is effective for the January 2017 distribution.

Milestone Apartments agreed to issue 9,490,000 trust units in the bought-deal offering at C$18.45 apiece and has granted the underwriters a 30-day option to buy up to 949,000 additional units. The offering is slated to close on or about Oct. 28. The company is acquiring the multifamily portfolio at an average cap rate of about 5.8% for the first year, and it expects to close on the transaction no later than Dec. 1.

The properties in the portfolio contain 1,460 units and are spread across Charlotte, N.C.; Colorado Springs, Colorado; Denver; Orlando, Florida; San Antonio; and Oklahoma City, Okla. They had average occupancy of 95.5% and roughly US$1,175 in average monthly per-unit rents as of Sept. 30.

Milestone Apartments projects its pro-forma mortgage notes obligations to be about US$1.34 billion after the transaction, including all related financing, and its pro-forma debt to gross book value ratio to be about 50.8%. Following the monthly distribution increase and the completion of the portfolio acquisition and Park 9 purchase, the REIT expects its adjusted funds from operations payout ratio to remain below 60.0%.

Here's a snapshot or Milestone's portfolio as of September 15th:

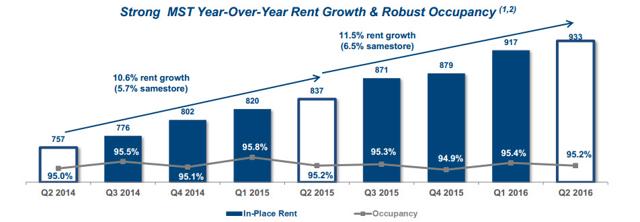

Milestone has maintained steady rent growth and stable occupancy:

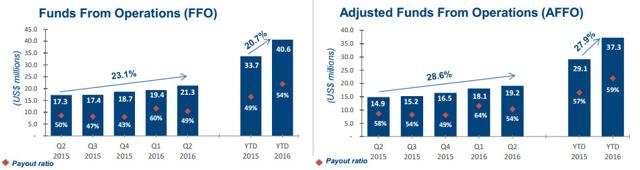

Milestone has increased FFO by over 20% in 2016 and AFFO by almost 28% in 2016:

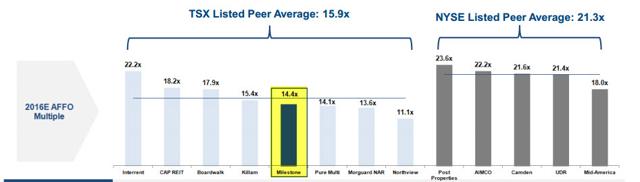

Milestone pays well below the US REIT peers and within Fair Value for the Canadian peers:

Milestone's current dividend yield is 3.8%.