It was an important week in the history of the Canadian cannabis industry as the 112-page final report of the Task Force on Cannabis Legalization and Regulation (TFCLR) was released to the public on December 13, 2016. In my opinion, the report lays out a workable path to legalization while avoiding the controversial issues. If there was any concern the task force report would scuttle the legalization effort, it was put to rest. (Read the full Canadian Marijuana Task Force Report)

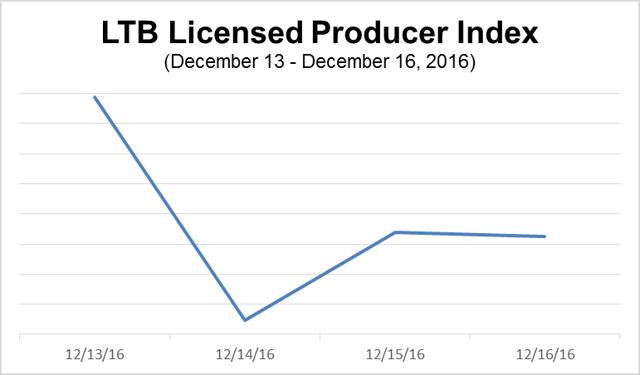

Let's begin by looking at the performance of the Canadian cannabis stocks since the report was made public.

The chart shows the LTB Marijuana Composite Index has moved lower since the publication of the report. However, the magnitude of the decline is exaggerated by the scale. The index is down only .9% as shown.

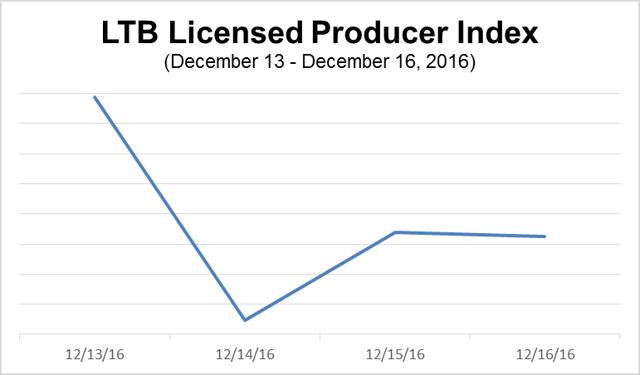

This is the chart of the LTB Licensed Producer Index over the same period of time. In this case, the decline in the index is a slightly better .8%. The Let's Toke Business Canadian Licensed Producer (LP) Index includes all LPs traded on the public markets: Aphria Inc. (OTCQB:APHQF), Aurora Cannabis (OTCQB:ACBFF), Canopy Growth (OTCPK:TWMJF), Emblem Corp. (TSXV: EMC), Emerald Health (OTC:TBQBF), Mettrum Health (OTC:MQTRF), Organigram Holdings (OTCQB:OGRMF), PharmaCan Capital (OTC:PRMCF), Supreme Pharmaceuticals (OTCPK:SPRWF) and THC Biomed Int'l (OTCQB:THCBF). These are the stocks most likely positively impacted by the task force report.

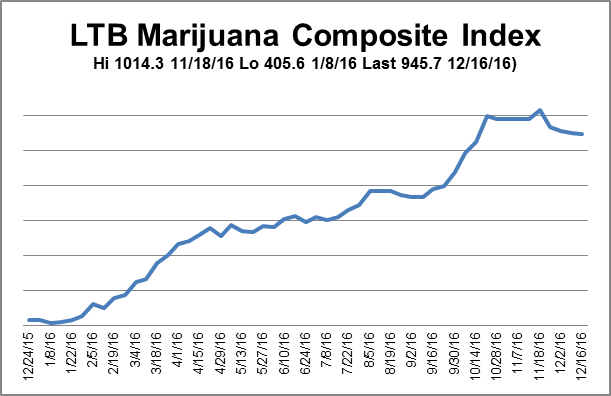

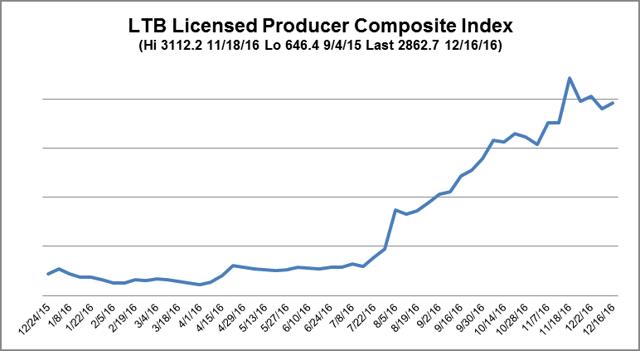

To provide some perspective, these two charts show the graphs above over a year rather than four days. What the charts seem to indicate is the task force report did not produce much response in the marijuana stocks although both charts look decidedly top-heavy.

Let's look at the highlights from the report. Readers should remember the recommendations from the task force are suggestions. The government can make changes as it frames the legislation for legalization. However, it should also be understood that government legislation will probably follow the recommendations closely.

Here is a summary of the report:

Law: The overall approach is the Federal government will control production while provinces and territories regulate the sale of cannabis, in collaboration with the municipalities. This means there will undoubtedly be and the TFCLR contemplates variations across Canada as there was and is with alcohol and tobacco distribution. For example, a Federal age limit of 18 can be adjusted by provinces to match local alcohol sales age restrictions and recommends public smoking restrictions be extended to marijuana. In this case, the TFCLR demonstrated a practical sense recognizing too low a legal age encourages youth while too high a legal age will promote underground sales.

The TFCLR says criminal offences should continue for illicit production, trafficking, trafficking to youth and possession for purposes of trafficking/export. Canadians over 18 years of age can carry up to 30 grams of recreational marijuana and grow four plants under 100 cm in height at home.

There are many recommendations throughout the report to educate the public. Some of these are in strong language such as "send a clear message to Canadians that cannabis causes impairment and that the best way to avoid driving impaired is to not consume." This is a step backward to the time when the best birth control was abstinence from sex and the current advice on alcohol which is "don't drink and drive." Driving under the influence of marijuana is a major concern.

Production: There seems to be a concern that currently, Licensed Producers will drop their medical marijuana customers in favor of the larger recreational market. As a result, the recommendations specify that the medical marijuana regime continue. The TFCLR recommends a diverse, competitive market that includes small producers. It seems to contemplate co-op or community garden type of operators as well as craft producers and outdoor growing. This might be a path to legality for some underground growers but the devil will be in the details. Regulation to include both growing and production of extracts.

An ominous recommendation for MMAR growers is to review the role of designated persons under the ACMPR with the objective of eliminating this category of producers. This probably spells the end of third-party growers who will have to apply to become Licensed Producers or shut down. It appears Health Canada will have its way in this regard.

Grow Your Own: This is a proactive move by the TFCLR as the court requirement to allow home growing applied to medical marijuana based on the right of Canadians to access medicine. Personal cultivation should also be allowed with a limit of four plants per home and a height restriction of 100 cm (about 39 inches). The report says professional production techniques developed under the current system should be applied to the cultivation of cannabis for personal consumption and small LPs.

Dispensing: The TFCLR allows a diversity of sales methods including: storefront outlets with knowledgeable staff as well as mail order. But independent dispensaries will face regulation by the provinces, territories and municipalities so we must wait to see what those regulations will be.

The TFCLR specifically recommends alcohol and tobacco sales be separate from recreational marijuana sales "whenever possible" which leaves the door open a bit and wide open for pharmacies. It also recommends dispensaries be kept away from schools, community centers and parks.

Dispensing will continue to be a hot potato from a regulatory point of view and the Feds will happily download the problems onto provinces, territories and municipalities.

Advertising: Generally follows the restrictions applied to alcohol and liquor products. Plain, childproof packaging with "comprehensive restrictions to the advertising and promotion of cannabis and related merchandise" and the inclusion of warnings.

Edible marijuana products: The task force recommends the ban of products that mix alcohol and caffeine. Products "appealing to children" that are packaged to look like candy should not be allowed. Edibles should be packaged in opaque child-resistant packages and have individual servings clearly labeled. The report also suggests regulation of CBD and other compounds derived from hemp or from other sources. This will require additional record keeping on the part of many edible producers.

Taxation: Establish pricing and taxation following an economic analysis and apply the same tax system for medical and recreational marijuana. We note other jurisdictions in the U.S. have applied lower taxes on medical compared to recreational marijuana allowing them to protect patients while reaping higher taxes from recreational users.

The taxation philosophy is a balancing of health protection (higher taxes) with reducing the black market (lower taxes). There is also the trade-off with making legal marijuana accessible enough to eliminate the black market without overly promoting its use, especially among younger Canadians. The other principle is higher tax on higher THC content.

Tax revenues generated from the sale of cannabis should be immediately directed toward public education campaigns and further research on the health risks associated with cannabis consumption.

General:

Government should create exemptions for "social sharing" of marijuana by allowing dispensaries and vaping lounges similar to bars and pubs.

Supply shortfall is a concern of the TFCLR that urges "Canada's governments will need to move swiftly to increase or create capacity in many areas relating to the production and sale of cannabis."

Implement as soon as possible an evidence-informed public education campaign, targeted at the general population but with an emphasis on youth, parents and vulnerable populations.

No THC/CBD restrictions but research urged so restrictions might be introduced.

Implement a seed-to-sale tracking system to prevent diversion and enable product recalls.

The Liberal government has promised to table a legalization bill in the spring.

Opportunities:

Current Licensed Producers appear to be the big winners as the advantages gained in two years of medical marijuana production can be leveraged forward into the recreational market. In addition, we could see the end of the former MMAR growers and that will be a major benefit for LPs. Home growing and small LPs may cut into their non-medical sales but small LPs may be an opportunity as well.

Current dispensary operators also appear to be winners as they are accommodated in the report but they will be regulated and profit margins will be reduced substantially as they will be required to purchase merchandise from LPs. Pharmacies may elbow into the dispensary action.

Companies that manufacture and market home-grow kits are looking at a gift-wrapped prospect. To open home-grow ability to recreational marijuana users might prove to be the most significant opportunity emerging from the task force report.

The report identifies many areas that will require laboratory and scientific testing. These operators are out there and their business will undoubtedly expand significantly. There will likely be many new entrants into this field.

There may be a category of smaller LPs perhaps subjected to less regulatory overhead. Also, outdoor growers and craft growers will have a role to play. People will be able to participate in these areas.

There will be an increase in smoking and vaping lounges similar to bars and pubs for alcohol. Some may feature edibles, which the report makes frequent reference to as a growth area. It seems cannabis bars must be connected to dispensing or selling marijuana to be profitable enough to attract owner/operators.

Consulting/accounting/record keeping will also benefit from the report. There are many references to the need for research to guide future policy. Also, growers will benefit from developing branding strategies within a restrictive regulatory environment.

Conclusion: The task force report reinforces my belief that companies I have focused on such as the Licensed Producers will continue to prosper: Organigram Holdings, Canopy Growth, Mettrum Health about to be acquired by TWMJF, Aphria Inc. and my junior pick to click with their technology Lexaria (OTCQB:LXRP). I am trying to work out a timing opportunity to start buying these stocks again which I hope to have refined in the next week or so. But if you don't own them, I wouldn't hesitate to initiate positions in a portfolio.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.