In my last article on gold I presented a thesis that during the ongoing correction in precious metals the American investors were selling gold while the Chinese investors were buying it. In conclusion, I wrote:

"In other words, to see substantially higher prices of gold the physical accumulation of gold by American investors must begin. Now, according to GLD reports, we see the selling pressure (indeed, the lower one but it is still the selling pressure). The gold bugs have to wait…"

In this article I would like to look at the silver market. The common knowledge is that silver goes in tandem with gold. Putting it differently, the patterns delivered by the silver market should coincide with those delivered by gold. However, most recently silver is sending somewhat different signals from those of gold.

The Chinese are accumulating silver

In my previous article on gold I discussed the differences between the Chinese and American approach to gold. Shortly speaking, the Chinese demand for gold increases when the prices of gold go down while the American investors tend to buy gold when its prices go up (fortunately, during the final stage of a correction in gold prices the Americans start buying again). The same pattern is visible in silver:

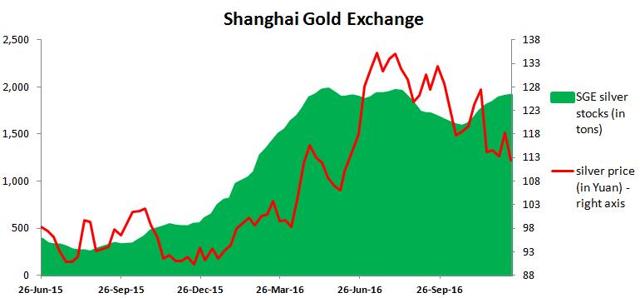

Source: Simple Digressions and SGE data

The chart shows silver stocks reported by the Shanghai Gold Exchange. The prices of silver have been recalculated into Yuan, the standard unit of money in China.

Now, interestingly, the Chinese started building up their silver stocks in the second half of 2015. Between August 2015 and May 2016 the SGE silver stocks went up from 239 tons to 1,964 tons (an increase of 722%). Then, due to higher prices, the Chinese stopped accumulating silver. Between May and late October 2016 the stocks went down to 1,570 tons (as of October 21, 2016). However, taking the advantage of lower prices, now the Chinese are accumulating silver again. According to the last SGE report (as of December 16), there are 1,898 tons of silver in SGE vaults.

Summarizing, similarly to gold, due to lower prices the Chinese are buying silver again. What about the American investors?

The Americans

To present the American approach to silver I have selected two sources of data: iShares Silver Trust (NYSEARCA:SLV) and the Commitments of Traders report (COT report).

SLV

The iShares Silver Trust seeks to reflect the performance of the price of silver. The trust holds physical silver so it works, more or less, as its big gold counterpart, SPDR Gold Trust (NYSEARCA:GLD). It means that during a bull market in silver SLV should report higher stocks of this metal. During a bear market the opposite should happen. However, although it is generally true, the changes reported by SLV are not that high as those reported by GLD:

- Between the end of 2012 and the end of 2015, when silver was in its bear market phase, the SLV silver stocks went down from 10,085 tons to 9,889 tons (a decrease of just 1.9%). In the same period the GLD stocks went down by 52.8%. Simply put, the American investors investing in silver were, generally, invulnerable to the bear market in silver

- Then, between the end of 2015 and September 30, 2016 (a bull market in silver), the SLV silver stocks went up from 9,889 tons to 11,270 tons. Since that time, due to lower prices of silver, they went down to 10,576 tons (as of December 16). Interestingly, once again the decrease in silver stocks was much lower than a similar decrease in gold stocks, reported by GLD (a decrease of 6.2%, reported by SLV versus a decrease of 11.2%, reported by GLD).

Summarizing, although SLV is showing similar patterns to those delivered by GLD, the silver trust is less vulnerable to fluctuations in silver prices.

The COT Report

In my opinion, the patterns delivered by the COT reports are of higher importance, especially in the short - term. Simply, these reports are more about the speculative nature of financial markets than about the long - term investing.

Let me look at current developments in gold and silver, reported by the COT reports:

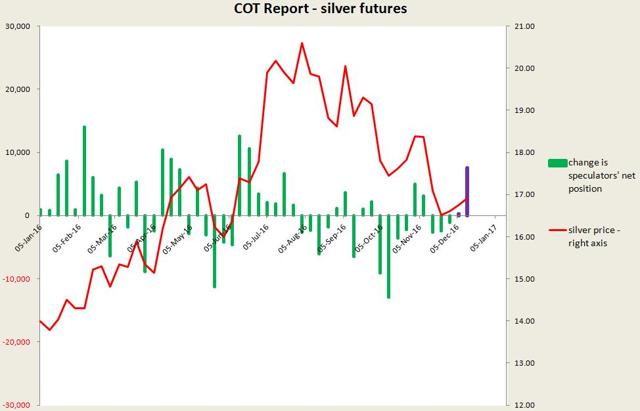

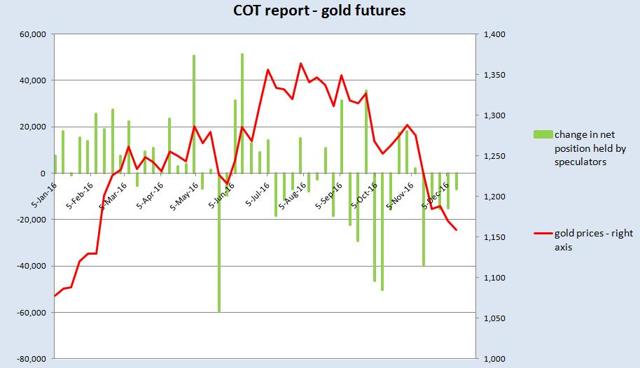

Source: Simple Digressions and the COT Report

The charts above show the changes in net long positions held by speculators in silver and gold futures. Unfortunately, the last report is dated December 13, a day before the December rate hike, so it does not take into account this "historical" event (forgive me for my sarcasm - despite this rate hike, I think that US interest rates are still at their historically lowest levels).

Anyway, the difference is very obvious. While the gold speculators are still decreasing their net long positions, for the last two weeks the speculators in silver have been increasing their net long positions. I would say that the sentiment among speculators in silver is much different (positive) than that among the speculators in gold (negative). I think that the message delivered by the COT report is quite contradictory - speculators are optimistic about silver and pessimistic about gold.

What is more, the last increase in net long positions in silver was very high - speculators added 7,568 contracts to their total holdings. Last time I had seen such a high increase was June 2016 (June 13: 12,598 contracts added and June 21: 10,604 contracts added). However, remember that in June both metals were in their furious bull market stages. Now, the situation is totally different because we are in a strong correction in silver and gold prices. Nonetheless, the speculators in silver are adding new long positions, which is a typical pattern.

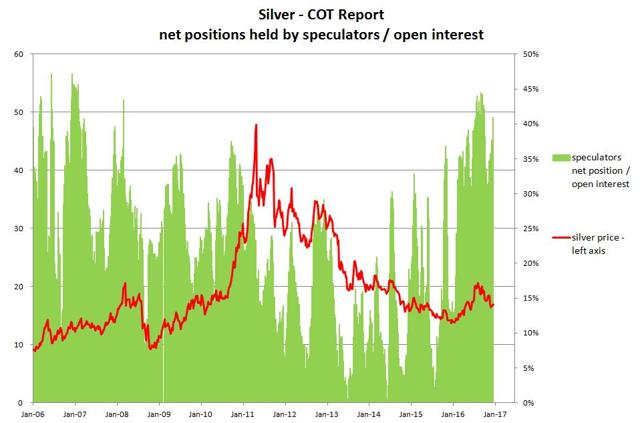

Another chart shows the total net long position held by speculators in silver futures:

Source: Simple Digressions and the COT Report

Note: contrary to other analysts, I measure the net position, held by speculators, against the open interest; in my opinion, such an approach is more appropriate because it takes into account the current size (represented by open interest) of the game called "silver speculation"

The chart shows that, despite lower prices of silver, the current net long position held by speculators is close to the last peak, reported in late August 2016 (40.9% as of December 13 vs. 44.5% as of August 30).

I should have said that such development is indicative of an incoming change in the downward trend in silver prices but…let me wait until the next report, which should show what had happened after the last rate hike…

The silver market is cornered

The silver market is different from that of gold. It is driven not only by the investment demand (as is, generally, the case with gold) but also by the industrial demand. However, let me skip this issue now (it is a nice subject for another article). In this article I want to show that the silver market is much more consolidated that the gold one.

Firstly, a question. Have you ever heard of the Hunt brothers? It is an old and relatively well-known story. To remind my readers, between 1973 and 1980 these two Texan speculators were trying to corner the silver market. Over the years they and their business partners accumulated around 130 million ounces of silver, most of which were in the form of physical holdings. These times 130 million ounces accounted for around 40% of total world's annual production(323 million ounces per year, on average). As a result, silver prices went up from $3 per ounce in 1973 to $50 per ounce of silver in 1980. Then the prices of silver crashed…

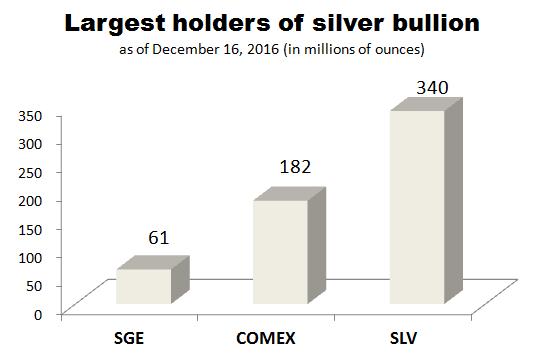

Well, that is history but today the situation in the silver market resembles the Hunt brothers' times. The graph below shows the largest holders of silver bullion:

Source: Simple Digressions

As the graph shows, the largest holder is the iShares Silver Trust (340 million ounces of silver). The all three entities (SLV, COMEX and Shanghai Gold Exchange) hold 583 million ounces of silver. This amount of silver accounts for 65.7% of the forecasted 2016 production of silver (887.4 million ounces). Let me put together the numbers again:

- The Hunt brothers and their allies held 40% of annual silver production

- Now, the three big entities hold 66% of annual production, of which the largest holder, SLV, holds 38.3%

Simply put, now the silver market is cornered again. What is more, it is cornered to a greater extent than during the Hunt brothers' era. Some people say that history repeats itself. If that is a case, silver is poised for a much stronger bull market that we have ever seen. However, the main question is when. I am leaving this question for the oracles because I have no idea when the silver mania is going to start.

On the other hand, all I want to say is this:

The silver market seems to be cornered. Among the largest holders of silver bullion is a new player - the Shanghai Gold Exchange. A few months ago this exchange started heavy accumulation of silver. Now there are "only" 61 million ounces of silver in the SGE vaults. However, keeping in mind the rate at which the SGE is accumulating silver, quite quickly this exchange may get much closer to the second largest holder of silver, the COMEX. In this way the silver market may get cornered to a much larger extent. If I am correct, in the coming years the silver market should be stronger than the gold market. As a result, applying the old rule that during a bull market in precious metals it is silver that is stronger than gold, I think that the bull in precious metals is still alive.