NEW YORK, NY, November 21, 2016 /Sector Newswire/ -

dynaCERT Inc. (TSX-V: DYA) (US Listing: DYFSF) announced that it has documented via an accredited 3rd-party validation process the dramatic effectiveness of its flagship HydraGen™ carbon emission reduction and fuel-saving H2/O2 technology. The 3rd party validation result are nothing short of stunning, and dynaCERT has solidified the respect of engineers in the transportation sector; dynaCERT now has the ability to alter the flows of H2/O2 and control reductions in fuel consumption as high as 19.2% and control emission reduction as high as 40% of greenhouse gases (Carbon Monoxide, Carbon Dioxide, Nitrogen Oxide) and greater than 65% reduction in particulate matter in class-8 transport trucks. With the ability to now verifiably control outcomes for end users of its product, dynaCERT can look forward to increasingly strong demand for its HydraGen™ product, plus it can look forward to endorsements from government(s), transportation industry advocates, and advocates of the environment. The HydraGen™'s smart-ECU can be programmed for H2/O2 flows that yield desired outcomes and record the savings/reductions while in operation, providing an audit trail for establishing the carbon-credits that governments are expected to approve businesses to qualify for by purchasing and employing the technology.. The Company is the subject of a Market Equities Research Group Market Bulletin, full copy of which is available from source

here.:

dynaCERT Inc.

Technology, Transportation, Power Generation, Mining, Industrial

TSX-V: DYA, OTC: DYFSF, https://www.dynacert.com |

| Prices |

Share: C$0.55 |

MCap: ~C$122.5M |

On: 11/21/2016 |

| History |

52-Week: C$0.06–C$0.94 |

50-Day Average: $0.057 |

200-Day Average: $0.22 |

|

Average 3 mo. Vol: ~3.5M |

|

|

| Shares |

SO: ~222.7M |

|

As of: 11/21/16 |

|

|

National carbon pricing has already been announced in Canada as imminent, and equivalent climate change reduction initiatives are being contemplated in the USA (particularly at the state level), and dynaCERT Inc. is uniquely positioned to excel at the opportunity, expected to be the first able to provide immediate and affordable government sanctioned solutions to business. The desire from the public and governments to see tangible progress on efforts to fight climate change is palatable, and with results as stunning as dynaCERT has confirmed governments would be remiss in not proceeding with efforts to encourage wide-scale adoption of the technology.

Currently trading near 55 cents Canadian per share DYA.V presents tremendous opportunity; analyst Jay Taylor of Hard Money Advisors earlier this year had an initial ~$1.40/share near-term price target for once the Company begins generating meaningful cash flow – it appears that time is now fast approaching. However Mr. Taylor made his $1.40/share price target based primarily on the merits of fuel savings providing the incentive to industry, his forecast was prior to the Canadian government’s intent to implement carbon-credits and fast-track dynaCERT for consideration.

Taking the developments since his forecast into account, an upgrade in share price target nearer $5/share seems more appropriate in this publications opinion.

On October 1, 2016 dynaCERT took possession of a new ~8,000 sq. ft. lease expansion facility that is designed with a monthly capacity of 2,000 units per eight hour shift for the assembly of the HydraGen™ units. A ribbon cutting at the new facility was held on October 5, 2016 and a special Member of Parliament/dynaCERT reception was held on October 19th, 2016 where dynaCERT presented its carbon emission reduction technology to MPPs, media, investment advisors and bankers. We believe demand is going to outgrow the Company’s capacity or its desire to do the manufacturing, and we understand that the Company has already engaged in talks with some of the largest auto part manufacturers in North America that have a very strong appetite for manufacturing for dynaCERT. The Company provided an

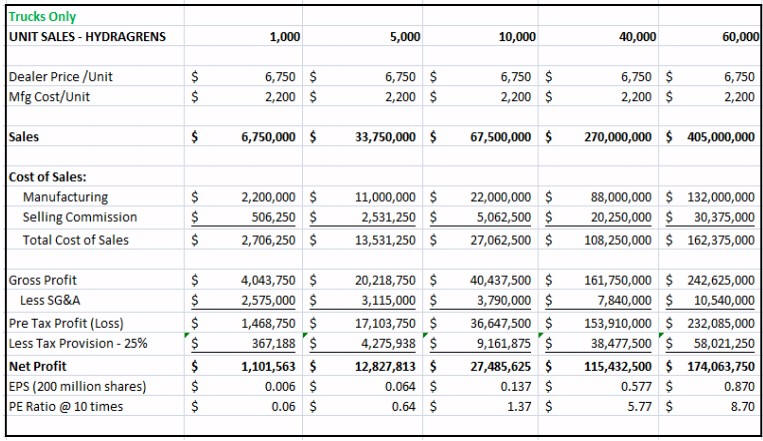

operational update on November 21, 2016confirming all outstanding warrants of the company have been exercised funding the company treasury with $2,928,974. In the update the Company stated it is making moves to expand applications of its flagship product, and has engaged a seasoned manufacturing consultant to develop its new production facility as it continues to assemble units in its current premises. The initial production target for the Company’s new facility is 6,000 units per month to fulfill anticipated sales. Looking at the pro-forma we picked off the Company’s website a few months back of how the company envisions the economics of its HydraGen business for trucks alone, significant positive cash flow is headed its way as the first 10,000 units are expected to generate US$67.5 million and the Company is basically working on 60% gross margin profit:

Details of 3rd-party validation:

Details of 3rd-party validation: Independent scientists from the Automotive Centre of Excellence (AEC) at the University of Ontario Institute of Technology were engaged by dynaCERT in cooperation with the government to verify what the Company has already demonstrated on diesel engines in the field; a proven reduction of toxic gasses within the emissions by 30% to 40% all while improving fuel economy of ~10% to 15%. The lab was also tasked with helping to establishing the carbon-credits that businesses qualify for by purchasing and employing the technology. The following are excerpts from the Company’s November 15, 2016 news release entitled ‘

dynaCERT inc. Reaches Major Milestone in Third Party Validation’; “The objective of this dynamometer testing was to simulate real-life environments with high accuracy and repeatable conditions on an in-service Class 8 truck to determine how much H2/O2 was required for a minimum of 8% fuel reduction while at the same time maintaining the same power and torque. Fuel consumption was measured by rerouting the fuel supply system to an external fuel drum placed on a precision scale. As fuel was consumed the scale measured the weight of the drum over the time of the test. The fuel weight and time were recorded by the CWT data acquisition system. Emissions were measured by using portable emissions equipment supplied by dynaCERT. Several trials were done with two different Class 8 tractors at different combinations of velocity, force load and H2/O2 settings. There was 20+ hours of testing completed producing over 550 pages of valuable data which has been instrumental in the further development and algorithms for our new Smart ECU. While altering flow of gases, and depending on different settings of H2/O2,

test results verified a range of fuel consumption reductions from 2.7% to 19.2% equally on post EGR and pre-EGR engines.

Emission reduction ranged from 10% to 40% of greenhouse gases (Carbon Monoxide, Carbon Dioxide, Nitrogen Oxide) and greater than 65% reduction in particulate matter.”

We note in the above release, 'lows' in the ranges were purposefully induced by altering flows to see the trade-offs in specific scenarios and should not be viewed as the norm. The important thing to take away is that the Company has the ability now to verifiably control outcomes (targeting impressive fuel savings percentages and/or impressive emissions reduction percentages) for end users of its product. Additionally, the mitigation of carbon fouling as a result of a cleaner burn using dynaCERT’s technology will noticeably contribute to less down-time for operators.

dynaCERT named TOP 20 most innovative: The understanding that dynaCERT is truly on the cusp of exceptionalism for shareholders was affirmed this November-2016 when it was named one of the 20 most innovative public technology companies in Canada for 2016 by the Canadian Innovation Exchange ("CIX"). CIX reviewed hundreds of Canadian public company profiles and the Top 20 chosen were based on their innovative technology products backed by strong management, significant market opportunity and sound business models.

The potential for investors is tremendous as the solutions the Company provides are enormous and global in scale, and the technology is not limited simply to Class-8 transport trucks and buses. The technology can also be scaled up to accommodate stationary power generator, marine, and rail markets.

Taking

responsibility for climate change: Besides the financial incentives from impressive fuel savings and carbon-credits for businesses to purchase and employ dynaCERT’s technology, a major emerging incentive is public image associated with corporate social responsibility to mitigate known harmful climate change threats. There is a perception of scary occurrences; glaciers and Arctic sea ice dwindling at alarming rates, oceans acidification, and species migration (including the potential for human climate change refugees in despair). Many believe climate change is the greatest global health threat of the 21

st century, threatening air quality and threatening international food security. dynaCERT is now verified as the single most effective tool available for businesses to make an immediate and meaningful impact on mitigating harmful emissions.

dynaCERT is on track to excel as 2017 approaches and we note that the Company has attracted highly-accomplished talent to reflect this: With the facility expansion having come online operationally this October 1, the release of a new smart-ECU that can track carbon credits, and the release of a third party validation results now in-hand, we expect DYA.V to trade significantly higher before the year is out. Important to note is the August 29, 2016 addition of Mr. David Bridge as Chief Operating Officer to dynaCERT's ranks, this appointment demonstrates the exceptional level of talent willing to associate itself with dynaCERT at the cusp of inflection, such caliber usually only associates itself with high-growth success stories -- here is an excerpt of his CV

"Mr. Bridge has an extensive background in managing technology operations and multi-million dollar corporate ventures. He is an accomplished leader with extensive knowledge of restructuring and streamlining IT to increase efficiency and reduce cost. Mr. Bridge has held several senior IT positions with major firms for the past 25 years as well as successfully led teams at AMD, RBC Financials, Virgin Mobile and Blackberry. As the senior IT leader, he helped Virgin Mobile in Canada expand from a start-up to a key competitor in the Telecommunications sector. In his most recent position at Blackberry as a Director of Infrastructure, Architecture and Engineering, he led a high performance team that designed and supported large scale enterprise wide systems."