RE:RE:RE:Key Resignations/Firings We have already demonstrated in our past coverage on Home Capital Group that the company is not exactly a stickler when it comes to making timely disclosures regarding either their mortgage fraud fiasco or related party dealings.

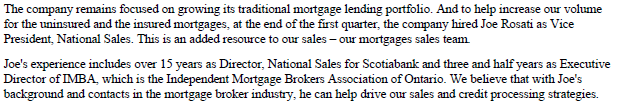

The same can be said of the company's candidness at times of key executive departures. For example, readers may recall the new head of sales, Joe Rosati, who management touted on the Q1 2015 conference call. In case you don't recall, here is the transcript:

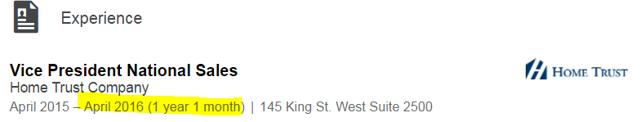

Now, remember when the company put out a press release to report that Mr. Rosati had left the company only ~1 year after initially being hired? If you're still searching for the press release, please suspend your search. Because they did not bother to press release this fact.

It has also now come to our attention that at least THREE and potentially FOUR other key executives appear to have either voluntarily or involuntarily left the company or had their roles restructured. And these three to four individuals represent an even more material event than the unreported resignation noted above.

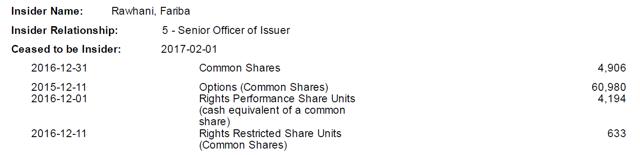

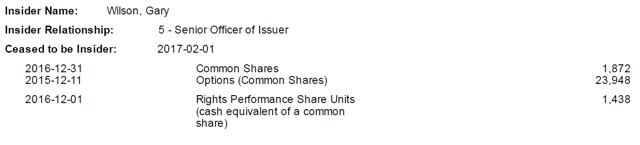

The apparent departures that we have identified that we believe have not yet been communicated to the market are of Marie Holland, Fariba Rawhani and Gary Wilson. We also note that Anthony Stilo's bio is now missing from the latest version of Home Trust bio page without any explanation.

Marie Holland and Anthony Stilo were in charge of Enterprise Risk Management. The role of Enterprise Risk Management appears to have been created in response to the disruption caused by the mortgage fraud incident. One would then logically assume that these two individuals were responsible for ensuring that the lax underwriting controls that allowed the company to somehow "overlook" $2bn CAD of fraudulent mortgage originations would never happen again. It is probably also safe to assume that OFSI would have been comforted with the appointment of these roles in the course of their oversight of HCG following this episode.

We continue to hear musings from the mortgage broker community that "business as usual" (c. 2015 mortgage fraud era) is alive and well at Home Capital Group. Therefore, we were surprised to see that both senior individuals from Enterprise Risk Management - a group that is charged with clamping down on loose underwriting - have been removed from the company's Directors and Officers page.

We also note that through SEDI filings (that track insiders at Canadian companies), we figured out that both Rawhani (EVP and CIO of Home Trust Company) as well as Wilson (EVP of Underwriting), are no longer listed as insiders as of February 2017 per SEDI records.

For all of our evidence, see before and after below:

Before (Cache Jan 17, 2017)

After (February 6, 2017)

Holland and Stilo are obviously missing from the new version of HCG's page. While Rawhani and Wilson are still shown on the current Home Trust bios page, SEDI records below suggest both are no longer insiders:

We note that from SEDI records, Holland's end as an insider was dated 1/20/17 giving us higher confidence that she is no longer with the company. Stilo remains a mystery, because his SEDI records have not been updated to show he is no longer an insider, suggesting it is possible his role has been reshuffled but that he remains at the company, albeit no longer on the company's bio page.

There has been no press release from Home Capital Group relating to any of the four individuals identified above. Yet again, Home Capital's management team apparently has decided to not inform the investment community about material events that every investor should be aware of in order to properly assess their investment in HCG.

So what is the TRUTH? Why are people responsible for managing risk and underwriting in the organization either jumping ship or being forced to walk the plank? What else is Home Capital not telling us?