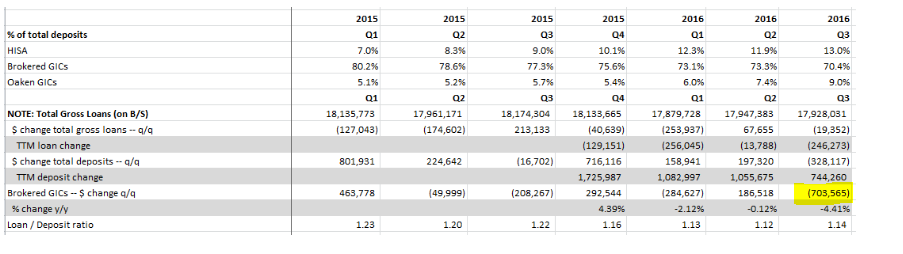

What is going on with HCG deposits?Before I show you evidence of deposit flight, let's first take a look at the company's own disclosures from the last quarter.

As you can see, HCG had significant trouble attracting and maintaining brokered GICs (Guaranteed Investment Contracts) last quarter, despite offering higher yields than the big banks do. For a financial company already running a fairly aggressive loan to deposit ratio, this is a troubling sign.

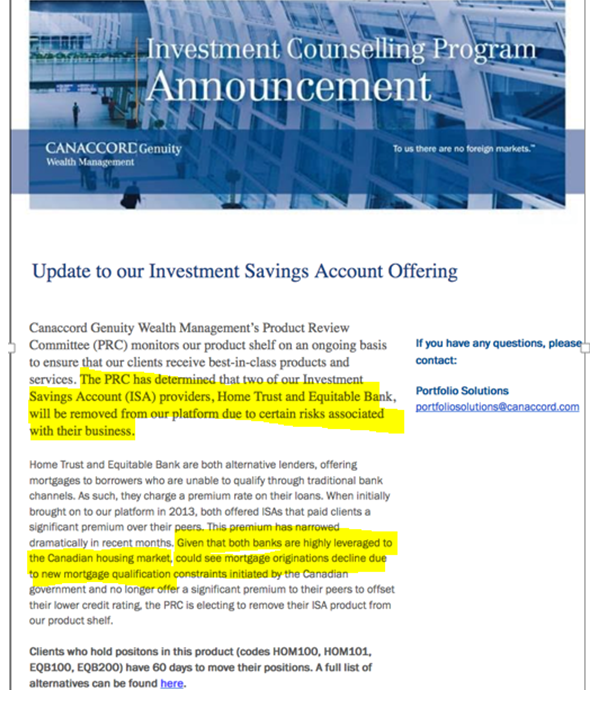

We, therefore, started making calls in the market to figure out what is going on with HCG deposits. That is when we stumbled upon the following flyer:

Source: Canaccord Genuity Wealth Management Announcement Retrieved by The Friendly Bear investigators

We felt the need to put this text in bold caps:

"THE PRODUCT REVIEW COMMITTEE HAS DETERMINED THAT TWO OF OUR INVESTMENT SAVINGS ACCOUNT PROVIDERS, HOME TRUST AND EQUITABLE BANK, WILL BE REMOVED FROM OUR PLATFORM DUE TO CERTAIN RISKS ASSOCIATED WITH THEIR BUSINESS"

Canaccord Genuity, a large institution that should have a strong pulse for what is happening in the Canadian financial markets, has decided that it has a fiduciary duty to prevent its clients from parking money at Home Capital.

And while we do not have a supporting document like the one above, we have verbally confirmed that similar actions have been taken by both BMO and Scotiabank through calls to both institutions.