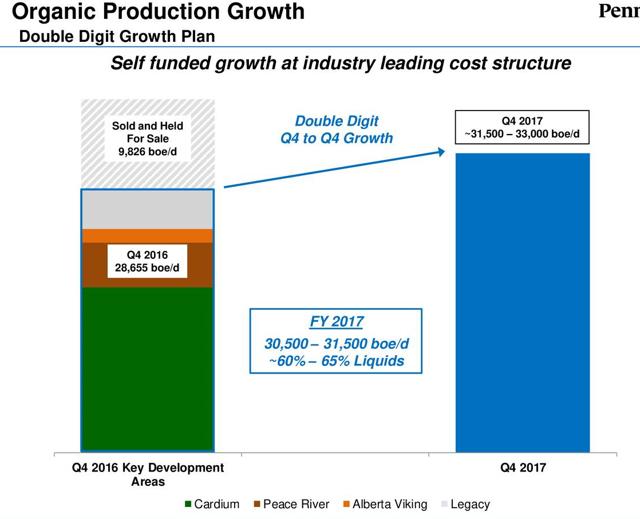

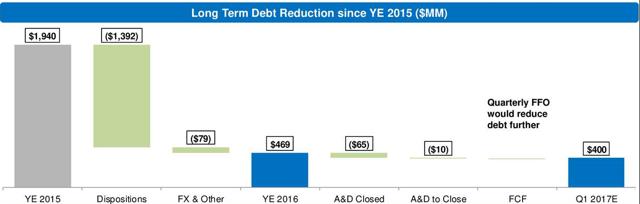

Penn West Exploration (NYSE:PWE) now looks poised for double-digit growth with a clean balance sheet and a laser-like focus on key properties. Debt is now well under control with debt of close to $300 million ($400 million Canadian pro forma Q1 2017) and plans to expand production from key areas to more than 30,000 barrels of oil equivalent per day by year-end.

Source: Penn West slide presentation

Penn West's debt reduction has been dramatic and positions the company for sustained growth from internally generated funds.

Source: Penn West presentation

Penn West has a $180 million Canadian ($135 million) capital budget for 2017 fully-funded from internally generated cash flows and expected to yield a 10% to 15% increase in production. A simple valuation model for Penn West assumes 10% growth and a 12% expected return, with 80% of cash flow required to fund that growth. Using those assumptions, I get a value per Penn West of just over $1 billion ($27 million free cash flow divided by (12% required return less 10% growth rate) = $1.35 billion. That translates into a bit more than $2.00 per share after deducting debt per share.

In the short term, Penn West cash flow will benefit from the final dispositions of non-core assets and I have just ignored this source of funds in my analysis (I assume that excess funds will be used to pay down remaining debt which is currently about $0.60 per share).

Of course, Penn West is hopeful growth will be closer to 15%, offset by the risks inherent in commodity prices. In my view, investors should value Penn West based on $50 per barrel WTI and look past short-term fluctuations in commodity prices. On that basis, a $2.00 per share value from PWE is well supported.

https://seekingalpha.com/article/4055530-penn-west-2016-results-confirm-potential-opportunity?app=1&auth_param=4i15t:1ccj4jh:c2503e79e892085b7266946102ce911a