Trevali Mining (OTCQX:TREVF) shocked the market when it announced an acquisition of two zinc mines from Glencore (OTCPK:GLCNF). The transaction is worth more than $400 million, which is more than Trevali's market capitalization. The acquisition that should more than double Trevali's annual zinc production will be financed using a combination of debt and a huge share dilution. It is the enormous share dilution and an increased exposure to more unstable countries, that scared some of the investors. As a result, the share price declined by more than 8% the day after the announcement.

TREVF data by YCharts

What Trevali gets

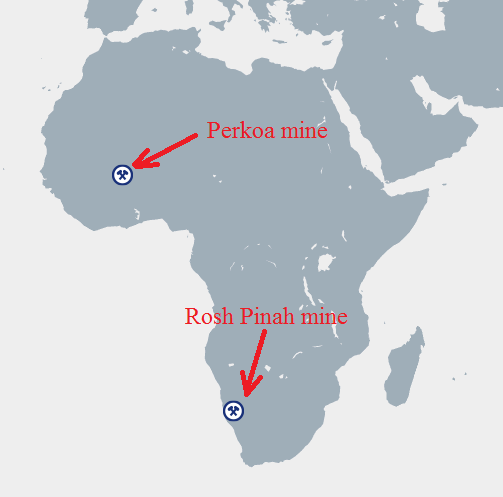

Trevali will acquire Glencore's stake in two operating mines in Africa. The Perkoa mine located in Burkina Faso is 90% owned by Glencore, the remaining 10% stake is owned by government of Burkina Faso. The Rosh Pinah mine located in Southern Namibia is 80.08% owned by Glencore and 19.92% owned by Namibian Empowerment Companies. While the Perkoa mine is focused on zinc only, the Rosh Pinah mine produces also meaningful lead and silver by-products.

Source: Glencore

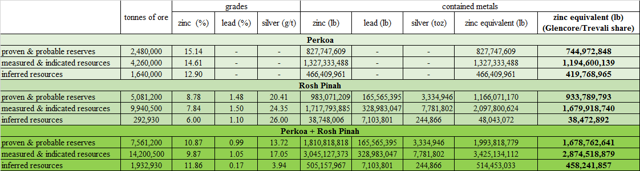

At the current metals prices of $1.22/lb zinc, $1/lb lead and $17.3/toz silver, the acquisition of Perkoa and Rosh Pinah should add 1.679 billion lb of zinc equivalent to Trevali's proven & probable reserves. The measured & indicated resources should increase by 2.87 billion lb of zinc equivalent and the inferred resources should grow by 458.24 million lb of zinc equivalent. The current market value of the metals contained in the acquired reserves and resources is $2.048 billion and $4.066 billion respectively.

Source: own calculations, using data of Trevali

Both of the mines contain high-grade mineralization. At Perkoa, the reserves are grading 15.4% zinc and the resources are grading 14.13% zinc. At Rosh Pinah, reserves are grading 10.41% of zinc equivalent and resources are grading 9.5% of zinc equivalent. The grades at Perkoa and Rosh Pinah are far superior to the grades at the Santander mine and comparable to the grades at the Caribou mine.

Thanks to the high-grade nature of the ore and relatively low labor costs in Africa, both of the mines are expected to be highly profitable at the current metals prices. The Perkoa mine should produce 165-170 million lb of zinc at an AISC of $0.83-0.87/lb and the Rosh Pinah mine should produce 100-105 million lb of zinc, at an AISC of $0.68-0.72/lb in 2017. After the transaction is completed, Trevali's annual zinc production should increase by 232.83 million lb zinc, at an AISC of approximately $0.8/lb.

At the current levels of production, the Perkoa reserves should be sufficient for 5 years of mining, while the measured & indicated resources (including the reserves) should be sufficient for more than 8 years. At Rosh Pinah, the reserves should be enough for another 9.6 years and the measured & indicated resources (including the reserves) should be enough for 16.8 years of production. However, there should be a lot of exploration potential at both of the properties. According to the news release:

(Rosh Pinah)

Mineralization remains open for expansion with exploration potential classified as excellent.

(Perkoa)

Mineralization remains open for expansion at depth with exploration potential classified as good-to-excellent.

At Santander and Caribou, Trevali has proven that it has a great exploration team. If there are more resources on the Rosh Pinah and Perkoa properties, I'm sure that Trevali will find them.

The Perkoa and Rosh Pinah mines are the main parts of the transaction. But the news release mentions also the Gergarub project in Namibia, Heath Steele property in Canada and some other exploration properties. The Gergarub project is 39% owned by Glencore. According to an ESIA from February 2014, the deposit contains 3.3 billion lb zinc, at an average grade of 8.6%. The proposed mine was expected to produce 150,000 tonnes of zinc concentrate and 30,000 tonnes of lead concentrate per annum.

The Heath Steel mine is a former producing mine, located close to Trevali's Stratmat mine. As a part of the deal, Trevali should get an option to acquire 100% of the Heath Steele property.

What Trevali Pays

To acquire Perkoa, Rosh Pinahand the other assets, Trevali must pay $400 million. $244 million should be paid in cash and the rest of the sum should be paid by issuing 175,125,304 shares. As a result, Glencore will own 25% of Trevali's shares. The effective date of the transaction is April 1. The transaction is expected to be closed by July 31.

The cash payment should be financed via a debt and an equity offering. Trevali intends to secure a senior secured credit facility of $190 million. The debt should mature in 5 years and it should bear an interest rate of LIBOR + 3.5%. The current USD LIBOR rate stands approximately at 1%, which means that Trevali shouldn't pay more than 5% p.a. in the near future. Trevali also intends to issue 191.7 million new shares at a price of C$1.2. The proceeds should be approximately C$230 million, or $171 million, at the current exchange rate.

Together, the loan and equity offering should be worth $361 million, of which, $244 million should be used for the cash payment to Glencore and approximately $60 million should be used to repay the old debt. It means that $57 million should be left for other purposes.

The production at Perkoa and Rosh Pinah attributable to Trevali should be around 232.83 million lb zinc per year. The expected AISC is $0.8/lb. At the current metals prices, the Perkoa and Rosh Pinah mines should be able to generate cash-flow of almost $98 million. It is enough to repay the $190 million loan in only 2 years. Not to mention the other assets included in the transaction. Given these numbers, the deal seems to be good for Trevali.

The problem is that the fully diluted share count should increase from slightly more than 385 million to approximately 750 million, or by 95%. Although the proceeds of the dilution will be used for a good purpose, some of the shareholders just don't like it. Also the political risks will increase notably, as approximately one half of Trevali's production will come from Africa.

What should Trevali be worth, after the transaction is closed?

According to the 2017 guidance, Trevali should produce 155.5 million lb zinc, 44 million lb lead and 1.65 million toz silver and it should generate cash flow of approximately $80 million. After the Perkoa and Rosh Pinah mines are added, Trevali should be able to generate cash flow of almost $180 million per year. Assuming that the interest payments equal $9.5 million per year and using a 30% tax rate, the earnings should climb approximately to $120 million. At the new share count of approximately 750 million, the EPS should climb to $0.16. Using a conservative P/E ratio of 10, the share price should be around $1.6. It represents a 74% upside to the current share price of $0.92.

But there is also the potential Santander mine expansion, the potential development of a mining operation at the Halfmile-Stratmat property, the Gergarub project and a lot of exploration potential at Santander, Caribou, Perkoa and Rosh Pinah. All of the mentioned properties have the potential to add even more value to the whole company.

What is important, as of the end of 2016, Trevali held cash of $15 million. After the transaction with Glencore is completed, it should hold $72 million, not including the cash generated over Q1 and Q2 2017. In other words, it is almost sure, that Trevali will grow further. The cash will be probably used to acquire another properties, maybe the Heath Steele property, and/or to finance the internal growth, i.e. the Santander expansion or Halfmile-Stratmat development.

Conclusion

The acquisition of Perkoa, Rosh Pinah, Gergarub and the other properties is a good step. Trevali will not only double its annual production, it should also more than double its expected cash-flow. The properties bring also additional exploration potential. Trevali should become a billion dollar company which should help to attract new investors. Moreover the acquisition should increase the exposure to the zinc market, which further strengthens Trevali's position of the only publicly traded primary zinc producer. Although the shareholders will be diluted by slightly less than 100%, the expected EPS should grow slightly. It means that Trevali shareholders should be the winners in the end. After the dust settles down, the share price should start to climb to the $1.6 level. And even higher, if the zinc price keeps on growing.

Disclosure: I am/we are long TREVF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.