Oh my Aurora Sky ...Aurora has taken on a great deal of debt to jump start the Aurora sky project.

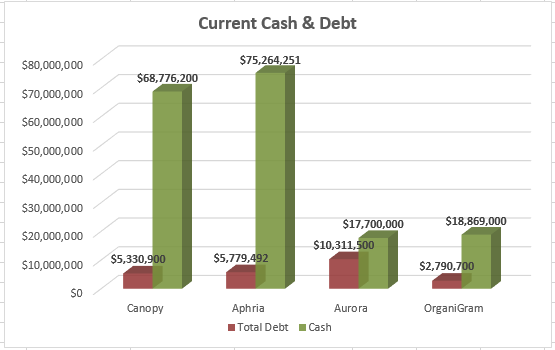

The company, with $10.3 million in debt and only $17.7 million in cash, is treading on thin ice compared to its competitors. If the project goes south, other prominent players like Aphria and Canopy can swoop in with more cash and brand recognition to develop higher production capabilities and leave Aurora in the dust. Canopy and Aphria have $68.7 million and $75.2 million cash on hand respectively. Additionally, both companies carry half our Aurora's current debt. We believe it would be uncanny for these two industry leaders to lay around doing nothing while Aurora is building to maximize revenue opportunities upon legalization.

Aurora investors also face risk in the form of a somewhat questionable management team. This management risk was investigated explicitly and elaborately in an article by SA contributor Grumpey Bear Research. The article detailed that

CEO Terry Booth has no experience with the marijuana industry and faced a lawsuit in the past for selling his company after giving overly optimistic projections. The article adds that

President Steve Dobler also has no relevant experience in the marijuana business and was noted by Grumpey Bear as a past business partner of Booth. Grumpey Bear remarked that ex-director Marc Levy worked to "aggressively promote Aurora in order to drive the share price higher"

before selling his shares and leaving the company in August 2015.

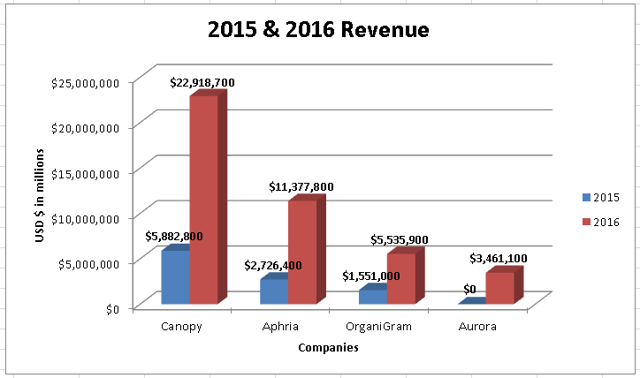

From my following of cannabis tickers for the past year, we've learned that stock prices entirely follow news on legalization and the two highest valued marijuana companies (Canopy and Aphria) are also leaders in sales revenue for the industry.

Since we have no way of forecasting Canadian politics in the short term, we have to look for correlation between sales revenue and stock price. Aurora's first year sales of $3.46 million in 2015 surpassed Aphria's 2015 revenue of $2.72 million by a good margin. If Aurora is able to surpass Apria's current TTM sales revenue in 2017, we believe there is high potential for Aurora to double from its current price in the next 9-12 months. Of course, this capital appreciation would come along more smoothly if upcoming news on legalization are positive. Personally, we do not have the risk tolerance to initiate a position in Aurora. We may buy into Aurora in the future but

we'll stick with Canopy and Aphria for now.