Update: Document from the ASC regarding the cease trade order on SJL. I am pretty disappointed by the bumbling of management when reading this. All investors should read it in full before making an investment decision on SJL.

--------------------------------------------------------------------

On Monday evening, Saint Jean Carbon Inc. (OTC:TORVF)(SJL.V) provided an update on its order with Panasonic. This update largely disappointed investors and SJL dropped nearly 50%, trading at levels just over where the stock was prior to the first announcement of this deal. There is a lot of anger coming from people who took a heavy loss and a lesson to be learned here about positioning yourself according to how well you know the story and trust management.

Stories like this Panasonic deal debacle are why I tend to avoid mining companies and invest heavily in companies like First Global Data (OTC:FGBDF) (FGD.V), Peak Positioning Technologies (OTCPK:PKKFF) (PKK.C) and Peeks Social (OTCQB:KEEKF) (PEEK.V). SJL fits better under the technology category but it is still out of the culture of the mining world of the TSX Venture. With FGD, I don't need to rely on the word of CEO Andre Itwaru when he says the goal is to get to a million users. I can see that the CEO of Vijaya Bank, Kishore Sansi (FGD's partner with VPayQwik) has said the same thing. I can also check Google Play and see that VPayQwik has over 100,000 installs. With PKK, I have known management for three years, met the company's billionaire backer Mr. Wang in person and have Q3 financials and soon the audited 2016 annual results to know that business is going well at this early stage. With PEEK, myself and anyone else can download the app and see that the tipping monetization method is generating revenue for the company. The business model works, now it's only a matter of gaining scale.

With pre-revenue resource companies like SJL, investors are completely reliant on the word of management. And this time, whether intentionally or by mistake, SJL's CEO Paul Ogilvie broke that trust of shareholders. This is unacceptable, especially considering that he was very well paid in 2016 at a base salary $270,000 and total compensation of $392,500. I can understand why investors who lost money would be upset.

However, with this debacle comes opportunity. I believe that the risk to reward trade-off makes a lot of sense at 9 cents and I took this opportunity to triple down on my SJL long position on Tuesday. I believe that once some of the smoke blows over from this screw up and as April 17th nears - the date SJL expects to ship the sample to Panasonic - people will start to buy up the stock in anticipation. I think the stock price can rise back up to the 15 to 25 cent range in the next few weeks, which will then be the time to reassess whether it's worth holding through the binary outcome of the Panasonic deal.

Breaking down the press release

Let's break down the key parts of Monday's news release:

The Company was informed by regulatory authorities on March 8, 2017 that Panasonic had advised them that it was considering cancelling the Order and that Panasonic did not intend to enter into the Company's proposed offtake agreement.

Some stupid blabbing nearly cost SJL the order. It likely was the company's own news release that played up the Panasonic relationship in the most positive light possible in addition to competitors sticking their nose where they don't belong. At least we know we cannot trust any claims that SJL never had anything to do with Panasonic. You cannot cancel what does not first exist.

On or about March 15, 2017, Panasonic confirmed the Order, requesting that the Company provide a 5 kg (approximately 11 lbs) sample of Anode Material for testing of its suitability for use in batteries. The Company has already sourced the raw carbon material from a third party supplier, has completed the necessary milling and refining of the raw carbon material to make the Anode Material, and is in the process of completing the certification and analysis of the Anode Material required to meet Panasonic's specifications under the Order. The Company anticipates that the Anode Material will be shipped to Panasonic on or about April 17, 2017.

After about a week's worth of convincing, Ogilvie got Panasonic back on board. The people at Panasonic are probably rolling their eyes at the amateur hour being played here in Canada and the 10,000 emails they must have gotten from competitors begging to give them a chance or SJL shareholders prompted to contact them for follow up on claims that there was no contact between the two companies. But the bottom line is that if the tech works, the tech works and Panasonic will probably overlook all this nonsense if the anode meets its needs.

We have less than a month before SJL sends the sample to Panasonic and we should know the outcome soon after that. This is a huge positive catalyst which I think will drive the stock price up as people will place their bets. TSX Venture traders love to gamble and there are few bigger gambles than the outcome of this deal.

On or about March 13, 2017, Panasonic advised the Company that it will not sign the Company's proposed form of offtake agreement. When Panasonic reconfirmed its Order by email dated March 15, 2017, it also confirmed that in case of mass purchase of Anode Material from Saint Jean, Panasonic will do so under its own form of standard purchasing agreement.

Panasonic puts the company in its place, basically neutering Ogilvie but in the end decides to give him one testicle back. Why would Panasonic even bother if it wasn't at least casually interested in what SJL can offer?

Do not trust anyone in this industry - trust the financials and your own research

What I have concluded having looked at the graphite industry with casual interest over the years is that it is hate-filled and cut-throat. There is so much high school drama in addition to the normal competitive atmosphere you would expect with any young industry still trying to find its way to revenue and profits. SJL has been in the middle of that drama before and Paul Ogilvie appears to be a lightning rod for hate, particularly with this recent debacle.

I think there are a few industry experts and wannabe experts who know that the investment community at large is very ignorant of the graphite business model and will prey on that in hopes of promoting their own agendas. The point is, investors shouldn't trust anyone and should try to do as much due diligence as they can, even if it is limited based on what one can find in SEDAR filings.

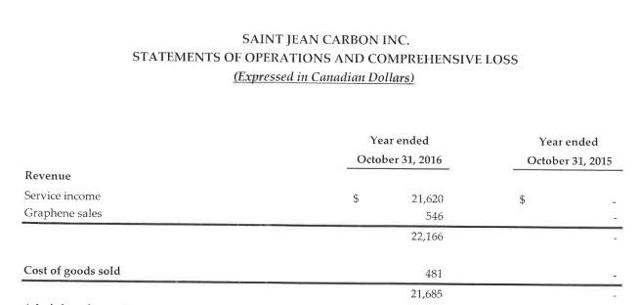

Look at the audited financials of SJL:

Revenue was a modest $22,166 for fiscal 2016, split between Q1 and Q2 and is based off of a commercial contract announced in December 2015:

...Saint Jean has signed a commercial contract for the design and development of advanced graphene material. An advance material will be made with the graphene the Company has been developing and added to a resin type material. The project that starts today is the Companies first revenue generation. The contract runs until the end of February and entails design and engineering work as well as full-scale prototypes for in product testing. The Company believes this is the first of possibly 10 to 15 additional contracts in the future.

There has been no follow up, at least to the company's year end of October 2016 where no further revenue was recorded. The latest MD&A doesn't disclose any potential future revenue from this source either. Even so, compared to the industry peers which don't have a penny of revenue to speak of, SJL is $22,166 ahead of them. Claims that SJL is some kind of bucket shop which doesn't have anything that would be of value to Panasonic or anyone else or that the business model doesn't work because SJL's outsources the raw materials are false. The audited financials prove otherwise. SJL produced a product, delivered a product and recorded revenue all to the satisfaction of its auditor. $546 worth of graphene sales which cost $481 from SJL's supplier was accompanied by $21,620 in service revenue. It remains to be seen if this one order will be followed up or if its reflective of the size and margin SJL can expect to see in the future. But it looks like a pretty good start.

Claims that companies like Panasonic take samples from any number of graphite companies are dubious without evidence. If companies are bound by confidentiality clauses, this is fine, but we should still see some evidence of activity that suggests they are sending samples to someone within the financial statements. If the companies are charging for their samples then we should see some marginal revenue. If they are giving away samples for free then we should see a line item like cost of goods sold or something to indicate samples are being shipped, not just line items to keep the lights on like salaries, professional fees, consulting fees and rent.

I have briefly checked the financial statements of several actively traded companies in the graphite/graphene space and the only one I have seen with any revenue is Graphene 3D Lab (GGG.V) while Mason Graphite (LLG.V) appears to be shipping samples or will do so soon.

SJL messed up and nearly cost its shot at becoming Panasonic's supplier. Still, there is evidence to suggest that its business model is ahead of its competitors. I had held shares going into the halt and now I own three times as many shares picking more up at prices which I find very opportunistic. Again, I must stress this is far from my largest holding and I don't speak with as much authority as I do with my larger investments. But when investors start to look at this situation agnostically and without such emotion - hostility, jealousy and doubt - I think they will start bidding up the stock as April 17 gets closer.

Disclosure: I am long SJL but I do intend to sell some shares at the right price if my thesis is right and the stock price moves up going into mid-April. I plan to hold onto some shares as a lottery ticket bet on a positive outcome between SJL and Panasonic.

Disclosure: I am/we are long TORVF.