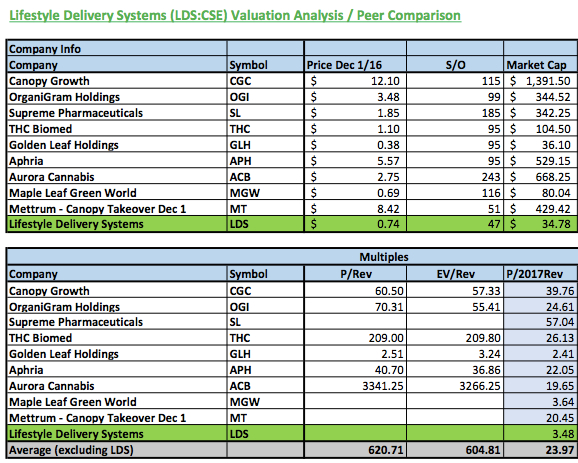

Relative Value AnalysisBack on Dec 1, 2016, Danny Deadlock published a valuation analysis of the cannabis sector where he looked at valuation of a number of players in the space, including Canopy Growth, and found that the average valuation for the sector at that time and for the names he examined was a Price to 2017 Revenue ratio of ~24-to-one (see excerpt below).

Canopy Growth at the time was trading at C$12.10/sh and today it is at C$9.88/sh. LDS at the time was trading at C$0.74/sh and today it is at C$0.57/sh. Although the whole sector has come off some since that time, the valuations remain elevated in part due to this being a newly legalized sector (relative to other slower growing mature sectors).

What is baked into these valuation metrics is the double digit growth rate of the cannabis sector that is expected to last for years. And if you are a company in this sector that can harness this growth rate, those valuations are well deserved as you will quite literally grow into your valuation. Over time (years) the average valuations will come down (as the sector matures and slows) but this will be accompanied with much higher revenues and share prices for those players that can capture a good slice of the pie.

While Canopy Growth's P/2017 Rev was a lofty 40-to-one, LDS' was a mere 3.5-to-one. Even if the valuations come down in the short run, LDS is, on a relative value, undervalued and it could be said that Canopy Growth is, on a relative value, overvalued. If you want exposure to the sector, you could make a strong case to sell the expensive names and buy the cheap names as a pairs trade and could do very well with the strategy. They key is to pick the horse that is truely going to make a name for itself and that is up to everyone to decide for themselves.

As far as criticizing the entire cannabis industry by saying that it's going nowhere or that it will crash is a bit reminiscent of the early critic of the electric car market and Tesla. Sure, it is possible that Tesla may ultimately fail as a company and perhpas it is not a good long-term hold, but you have to admit how much the share price has appreciated since 2013 when all the naysayers would dismiss it as something you would ever want to invest in.

~S