Gold: Major Bull Wedge Breakout? After surging towards $1300, gold is taking a well-deserved short- term rest. Can the rally continue?

Geopolitics news has gotten most of the credit for this rally, but Indian dealers have been buying huge amounts of gold in preparation for the April 28 wedding season Akha Teej celebrations.

Over the past two months, that’s where most of the demand has come from. Western analysts and investors often forget that Indian buyers follow Western news very closely. In fact, I would argue that India’s top gold traders are more in tune with gold-related news in the West than many Western analysts.

For example, gold surged higher on the night Donald Trump was elected because Indians bought gold maniacally when they realized Trump was going to win.

Their frenzied buying took gold to about $1340 that night. It continued until the Modi government stunned the buyers with a cash notes call-in.

The latest surge in Indian dealer buying appears to have peaked last week, but there are more key events that sit dead ahead in the Western news pipeline.

That could mean there will be no more than a short and sweet pause in both Indian and bank FOREX trader demand for gold.

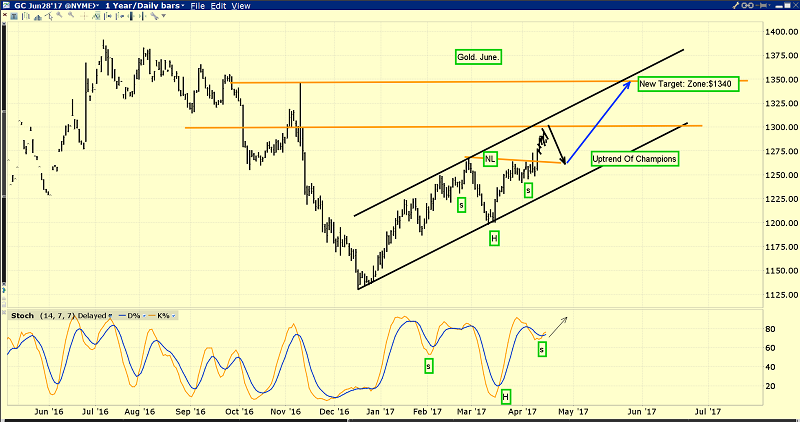

This is the fabulous “Uptrend of Champions” gold chart.

After pausing in mid-February as Chinese New Year buying peaked, gold carved out a nice inverse H&S bull continuation pattern, with a neckline in the $1270 area.

Indian dealer “thunder buying” blasted gold over the neckline and towards the $1300 round number resistance area. It’s unknown whether gold will pull back to the $1260 - $1270 neckline area now. If it does, I’m a happy buyer of more gold, silver, and related stocks!

Gamblers can also buy now rather than waiting for the pullback. It can be done with small size via call options and other gold gambling products.

What I believe is the greatest bull wedge chart pattern in the history of global markets. If there was ever a realistic opportunity for investors to “chase price” in the gold market, I’ll dare to suggest…. it is now!

Incredibly, Akha Teej wedding day is April 28, and the next US debt ceiling deadline is also April 28! One powerful gold price driver is fading in importance, but only as another arrives! For all practical intents and purposes, the US Treasury can probably fund operations using bookkeeping tricks to keep spending at the ceiling limit until the fall.

Congress is on holiday and it’s unlikely they will do anything other than pass an “extraordinary funding measures” bill to allow the debt ceiling can to (yet again) be kicked down the road.

Institutional money managers are becoming more nervous about the lack of any real action plan to reduce the ceiling, and that will continue to be supportive for gold.

Also, first round voting in the French election begins on April 23, just five days from now, and Iranian elections are in mid-May.

The US dollar has finally arrived in my 107.50 target price area against the yen, hitting about 108.30 A rally in the “risk-on” dollar now though, is more likely to be accompanied by a US stock market rally than by a big decline in gold.

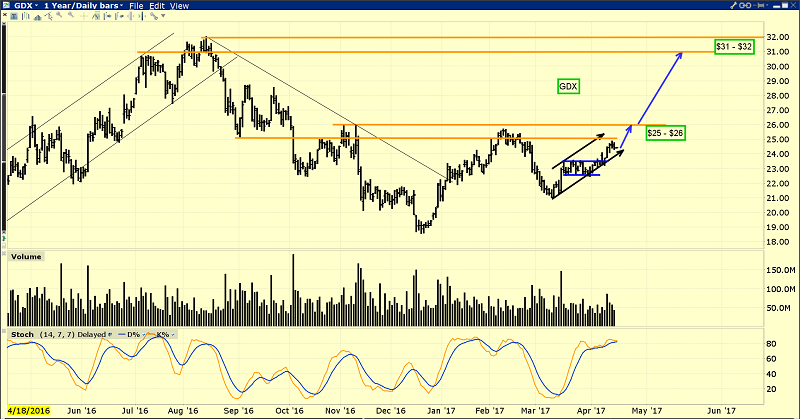

Some gold stock enthusiasts are not aware that the GDXJ ETF is undergoing some portfolio rebalancing. The fund has reached regulatory limits in the amounts of shares it can hold in some companies. That’s causing some temporary selling in some well-known gold stocks, and buying in others.

Investors need to ignore this short-term noise. In the big picture, gold and silver stocks are performing well. Still, it will take more rate hikes to reverse US money velocity and generate the kind of inflation that causes these stocks to stage enormous outperformance against bullion. That scenario is coming, but it’s a few years into the future.

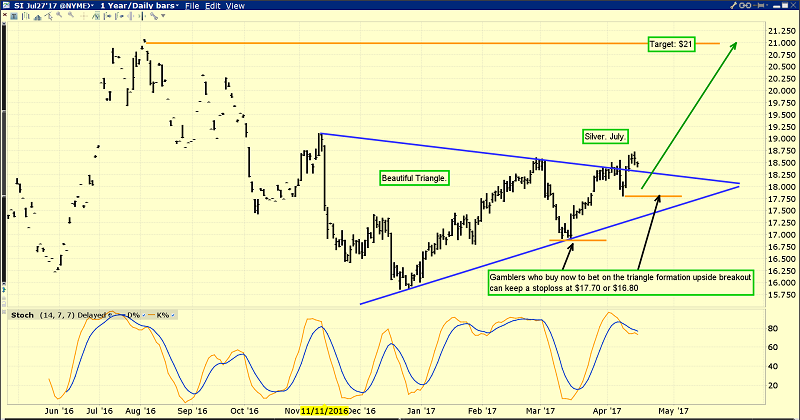

After bursting up from a beautiful symmetrical triangle pattern, silver is consolidating like a champion above the demand line of the pattern.

Gamblers and long-term investors can both profit nicely from the upside implications of this pattern. Investors who own no silver now should use the current breakout and any pullback to make purchases.

I always suggest owning physical bullion first, and then diversifying into other types of silver market investing once that has been accomplished.

GDX has been pretty much unaffected by the GDXJ rebalancing, and is making a beeline towards the $25 - $26 area highs.

I expect a breakout above that key price zone will be followed by a surge to $31 - $32 before there is a significant “price correction”. The bottom line: India demand was strong on US election night. It has been even stronger during the geopolitics-themed rally since mid-March. I expect that as Diwali buying begins in the fall, Western gold community investors will see Indian gold demand reach even greater heights, and that should indirectly produce a significant increase in the value of most of mining shares!

********