More thoughts on AR - increased production and valuation Argonaut Gold Looks Better Than Ever

Summary

Argonaut hasn't been in this good of a position before (and I mean ever).

A 45% increase in production is expected over the next 2 years.

Argonaut announced that it had acquired a key Fresnillo mineral concession adjacent to the El Castillo mine.

The market cap of Argonaut is just US$263 million, the valuation should be much higher given the growth expected in production and cash flow.

I see no reason why the shares can't double back to $3.40, assuming gold keeps trending higher too.

Let's just run some numbers here. Argonaut Gold (OTCPK:ARNGF) has a market cap of US$263 million, yet they have: US$42 million of cash on the balance sheet (after backing out a US$12.5 million deferred cash consideration due later this year), basically zero debt (under US$1 million), generated US$33.5 million in operating cash flow last year, have AISC under US$950 per ounce, and they are expecting a substantial increase in gold production over the next few years.

This is the first time in a while where this company really has the wind at their back. I have been following this story since the company was formed, as I like the management team (former Meridian Gold team). Argonaut hasn't been in this good of a position before (and I mean ever).

Rather, for the last several years they seemed to have some teething issues as they attempted to reach their long-term goal of becoming a 300,000-500,000 ounce gold producer. They weren't even coming close as they were stuck in the mud at around 125,000 ounces. They have had their share of setbacks, including the San Antonio mine not being permitted, but now they might finally be breaking through. They are still far away from their targeted objective, but progress is being made.

A few things have changed recently, and it's mostly centered around their El Castillo mine.

A 45% Increase In Production Is Expected Over the Next 2 Years

10 kilometers from the El Castillo mine is Argonaut's San Agustin project, which is currently under construction and will enter production in Q3 of this year. The economics are robust, as the low initial capex of US$43 million, combined with the low cash costs of US$648 per GEO, results in an after-tax IRR of 50% and an after-tax NPV of US$90 million - using a gold price of $1,200.

San Agustin is a simple, open-pit, heap leach operation that will average 80,000 ounces of gold production annually. The only downside is the mine life is relatively short at only 6.5 years.

However, San Agustin combined with the El Castillo mine will be the new growth platform for Argonaut. Production in 2017 is expected to be stable, but in 2018, there will be a surge, and then the company will see further gains in 2019 as San Agustin is fully ramped up.

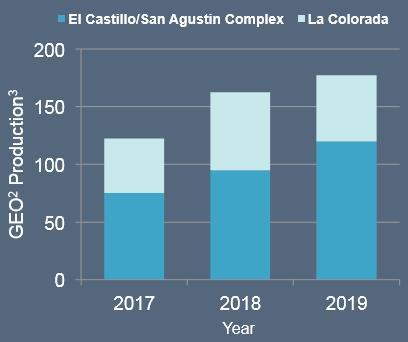

(Source: Argonaut Gold)

This is the breakdown of the production profile for those years. La Colorada will see an increase in output in 2018, but then it drops off a bit. The real growth is coming from the El Castillo/San Agustin complex. In total, production is expected to increase by 45% between 2017 and 2019.

(Source: Argonaut Gold)

That would be a strong enough catalyst as is, but there is an additional one that just came out of left field.

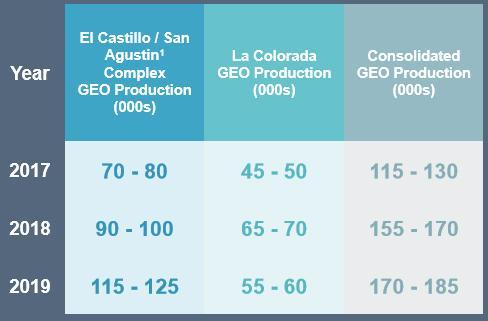

El Castillo Open Pit No Longer Constrained

Two months ago, Argonaut announced that it had acquired a key Fresnillo (OTCPK:FNLPF) mineral concession adjacent to the El Castillo mine. The blue areas in the map below are Argonaut's concessions, and the red outline is the El Castillo pit limit. The pale yellow area was Fresnillo's concession. As you can see, Argonaut was constrained by the borders of its concession, and the mineralization at El Castillo extended past these lines. Argonaut has been trying to acquire this concession for the last three years, and it took a cash payment of US$26 million to get the deal done.

(Source: Argonaut Gold)

This deal is significant for two reasons. One, Fresnillo has already drilled nearly 35,000 meters on this concession, and Argonaut now has a huge jump start on exploration given the "impressive database of drill holes" that have been logged. Two, this now allows Argonaut to expand the pit limits at El Castillo, which means the mine life of this asset will be greatly extended.

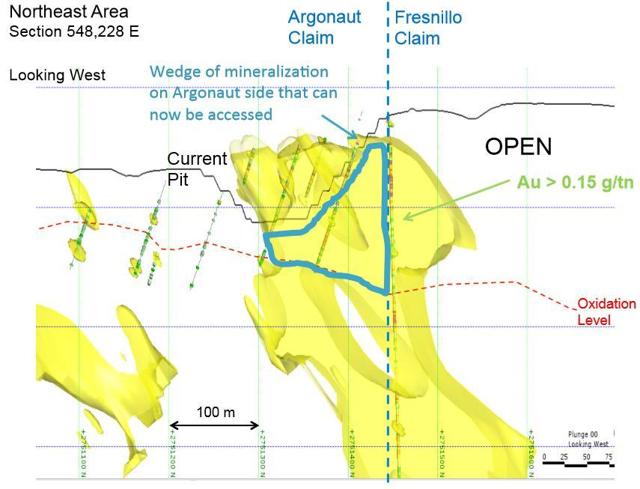

The diagram below is a cross-section of the current pit boundary on the Northeast side of the deposit. The area in blue is now mineable by Argonaut and will be incorporated into a new mine plan. This mineralization extends into Fresnillo's claim as well, and it's similar in grade to what Argonaut has on their side of the property boundary. The strip ratio and oxidation level are also similar.

(Source: Argonaut Gold)

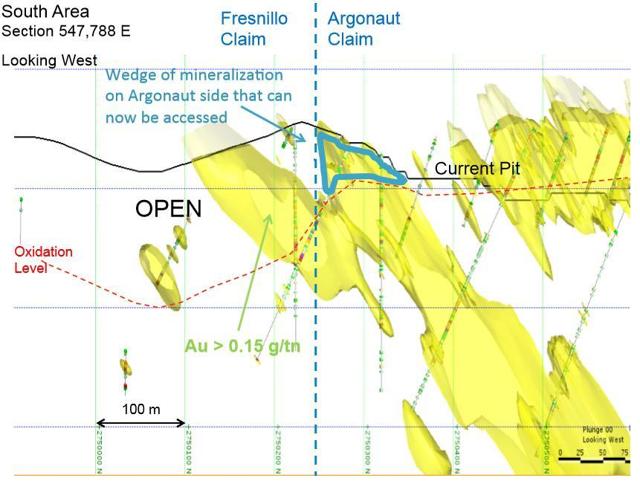

It's the same story on the south side of the pit; however, there are two key advantages on this portion of the deposit. The first is, the mineralization is basically just below the surface, which means the strip ratio will be very low. The second is, you can see how the oxide level dips steeply on the Fresnillo claim side, which means that this could be a larger mineable part of the deposit.

(Source: Argonaut Gold)

The production growth outlined above for the company doesn't include any of these new mineable ounces at El Castillo. This new concession could have a significant impact on the overall production at the El Castillo complex. Argonaut is stating that they hope to be closer to 150,000 ounces by 2019 at El Castillo/San Agustin. Capex to expand this operation would be minimal as well, just some small investments in leach pads and the crushing circuit.

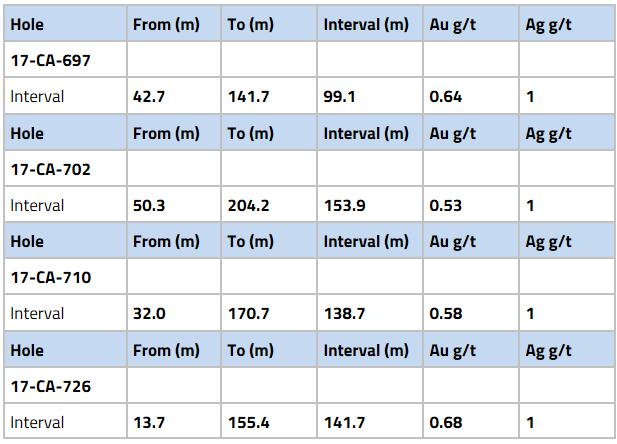

Recent Drill Results From New Concession

Argonaut has wasted no time since acquiring this concession, as just a few days ago they announced the completion of over 11,500 meters of 75 reverse-circulation drill holes on the north area. Fresnillo had done some wide-spaced drilling in this section, and Argonaut used this valuable data to design the current drill program. The objective was to increase drill-hole density to 35 meter spacing within this mineralized zone, which would be consistent with the spacing they use at El Castillo. Argonaut continues to drill on the south area, the results of which are expected to be released during the second half of 2017.

(Source: Argonaut Gold)

The current reserve grade at El Castillo is 0.42 g/t. Argonaut is not only hitting higher grade in parts of this North Target area, but the widths are very good as well. Below are a few drill holes from the press release.

(Source: Argonaut Gold)

The company made the following statement on these results:

Based on our geologic understanding of the El Castillo gold system, it was clear that there is a north to northeast trend of mineralization that continued into the North Target area. Overall, the continuity of gold mineralization and thicknesses were better than expected and the depth of oxidation is deeper than our current pit in the north exceeding 200 metres. We are very pleased with the results of this drill program to date.

I'm more curious to see what the assay results look like from the south area, as this zone could have very good potential (for the reasons I described above).

Latest Q1 Earnings Results

On Tuesday, Argonaut released first quarter earnings results, and all financial metrics showed a meaningful improvement as production increased to 37,707 gold equivalent ounces (compared to 32,154 ounces in Q1 2016).

More if you look up the article. DF