After being fortunate enough to see one of our speculative positions acquired (whose merits we discussed last year), we are now looking to reallocate this speculative money and we wanted to share one of our picks: Beaufield Resources (OTCPK:BFDRF).

We want to make clear, that this is a VERY SPECULATIVE play which is only suited to the most speculative allocations of an investor's portfolio. But we do believe the risk-reward ratio here is sufficient to be worth our interest (and money).

Why Are We Interested in Beaufield Resources?

There are two primary inter-related reasons why we are interested the company:

- The success Osisko Mining (OTC:OBNNF) has had drilling at its Windfall project.

- The adjacent land package that Beaufield holds.

It is no secret that one of the most exciting projects in Canada is Osisko Mining's Windfall deposit, with current high-grade resources of 748,000 ounces of gold at 8.42 g/t gold in the indicated category, and 860,000 ounces of gold at 7.62 g/t gold in the inferred category. Due to its recent success, the company is undergoing one of the largest drill programs by an explorer that we are aware of as they plan to drill 400,000 meters during 2017 on their Windfall property as combined definition and expansion drilling.

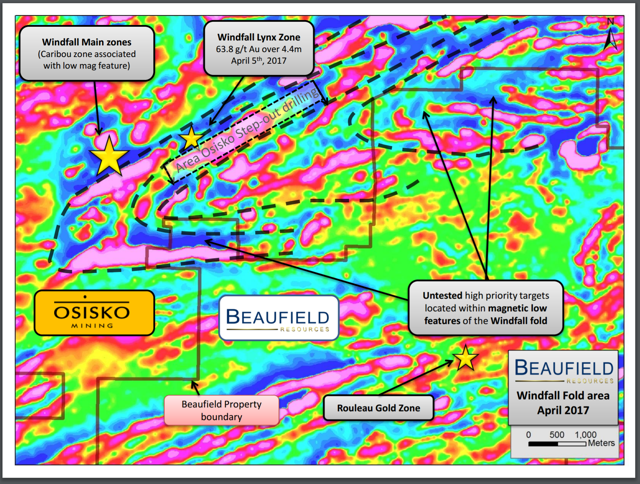

Some of the standout hits that the company has seen with recent drilling has been its newly discovered Lynx zone, which is a corridor of gold mineralization located to the East of the main Windfall deposit mineralized zones. One of the more exciting ones at this new Lynx zone was 63.8 g/t Au over 4.4 metres and 50.9 g/t Au over 4.6 metres from its April drill results. In fact, the company is continuing step-out drilling of the Lynx zone to the southeast to see how extensive this zone is.

Here is where Beaufield Resources gets interesting…

Beaufield's land package consists of claims around 1 kilometer from the main Windfall deposit, and within 1-2 kilometers of the new Lynx zone.

Source: Beaufield Resources Corporate Presentation

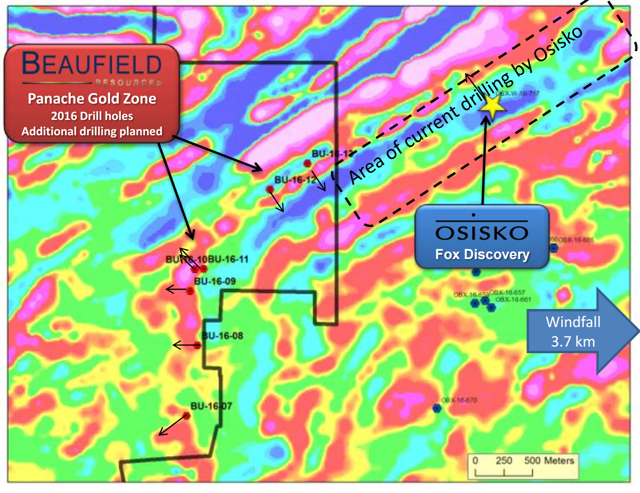

Not only is their property border extremely close to Windfall, based on some of the airborne magnetics, there are similarities to the Windfall deposit. Beaufield is now choosing priority targets to test and we are very interested in some of the targets that may represent an extension or similar mineralization to what Osisko has found at Windfall.

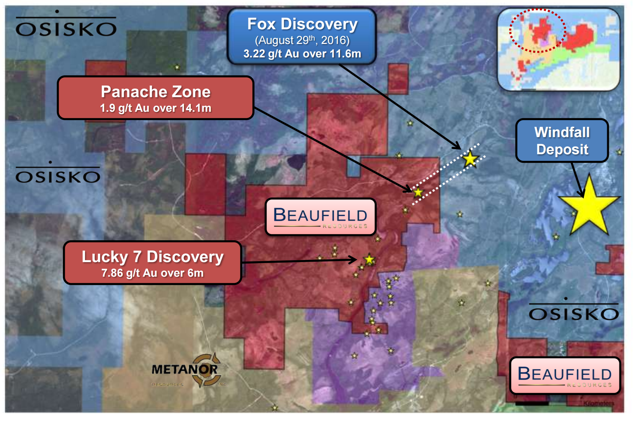

Additionally, Beaufield also owns property west of Windfall close to Osisko's Fox discovery.

Source: Beaufield Resources Corporate Presentation

As investors can see, is very close to some of Osisko's drilling at its Fox discovery.

While we think Osisko's team is clearly very adept at creating value and finding high-quality deposits (it was only two years ago that they sold out the Canadian Malartic mine to Agnico-Eagle and Yamana Gold), we do not know if we get that confidence from the Beaufield team. If anything, they seem to be building their company off the coat-tails/discoveries of others.

But that is OK with us because what they do have is a very strategic land package. They do not need to find a deposit and build a mine - they just need to either get some quality drill holes that could potentially extend some of the mineralization that Osisko is finding. If that happens, then this $30 million-dollar company could double overnight.

This hasn't gone unnoticed by Osisko Mining either. Earlier this year through their wholly owned subsidiary O3 Investments Inc, they purchased a bought-deal offering of 31.7 million shares or a 16.4% position in Beaufield Resources. Clearly Osisko Mining is hedging its bets here as they don't want to be building a massive Windfall discovery and find that they are missing some valuable resources that lie on Beaufield's side of the property line.

Financial Review

When looking at explorers we like to focus on the burn rate and how much money the explorer has in the bank to conduct exploration activities (the way to add value for investors) and, at the very least, to maintain existing assets.

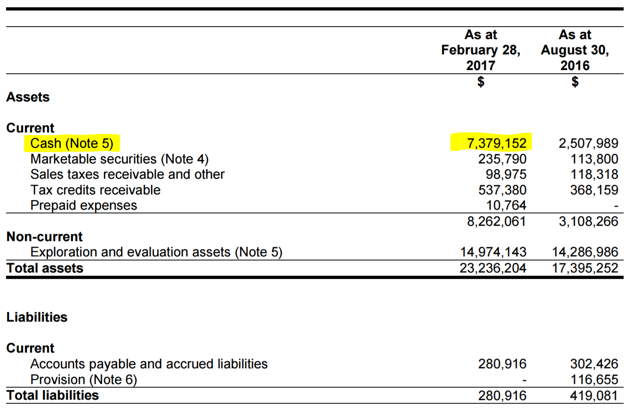

In Beaufield's case, the balance sheet looks very good - which shouldn't be a surprise after their recent financing from Osisko.

Source: Beaufield Resources

Taking a look at the cash position, Beaufield has C$8.3 million in current assets, with the vast majority of it being liquid cash (C$7.4 million) - which is again not surprising as they just funded themselves in February with C$6 million. But for our purposes as investors what this means is that the company has plenty of cash to drill, and for the "FT shares" they will have to use that money for qualified exploration purposes.

Source: Beaufield Resources

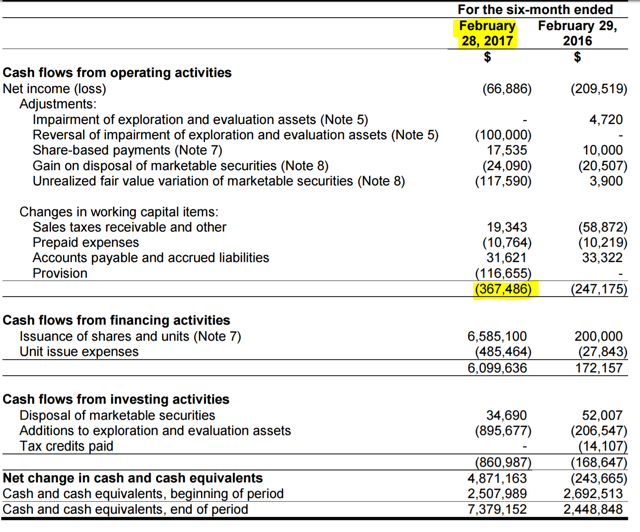

Of course cash is one side of the equation, the other side is how much is flowing out from operating activities - which is (outside of financings) almost always negative when it comes to explorers. What we are looking at here is the burn rate - how fast are they spending their on-balance sheet cash? How long will they have until they need more cash?

In Beaufield's case, the company has been fairly tight with expenditures as they have only spent C$367,000 over the past six months, which annualizes to a little under C$800,000 per year. We know expenses are going to rise as the company drills, but it looks like the core operating expenses are affordable based on the current assets.

What this means to investors is the company doesn't have to worry about financing soon - that is unless they hit some interesting drill holes. In that case, they will probably have to expand the exploration program, but of course that would be very good news for investors.

In summary, the risk for Beaufield Resources is all the exploration program as they are very well-funded and have plenty of cash to maintain operations.

Conclusion for Investors

For investors looking for high-risk and high-reward investment, Beaufield Resources provides a company with a very strategic land package next to one of the most exciting Canadian gold projects. While Beaufield has limited upcoming drilling, it seems they are staking out some important future targets that we hope will be announced soon (and followed by drilling).

These targets are not only in close proximity to some high-quality drilling results by Osisko Mining, they share some similar characteristics to the nearby Windfall deposit - with Osisko already taking notice by acquiring 16.4% of the company. In our view, that is either a vote of confidence in Beaufield's property potential or a vote of fear that Beaufield might discover something. Either way its positive for Beaufield Resources.

For investors, Beaufield Resources provides a highly-focused play based on the quality of Osisko's results at Windfall and the potential of that mineralization continuing onto Beaufield land. This is a bet to ride on the coat-tails of Osisko's Windfall discovery - which we feel can be justified for the high-risk, exploration portion of a mining portfolio.

Disclosure: I am/we are long BFDRF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.