Feature article May 25, 2017:

Vertical Growth Trajectory in Sight for DIAGNOS Inc.

Applying artificial intelligence in the diabetes market, a robust healthcare business has emerged.

| DIAGNOS Inc.

(TSX-V: ADK) (US: DGNOF) (Frankfurt: 4D4) |

Share data, Capitalization, & Corporate info

Shares Outstanding: 140,619,786

Fully Diluted: 196.8M (9.14M warrants, 10M options, 37M convertible)

Recently Traded: ~CDN$0.13/share (TSX-V: ADK)

52 Week High/Low: $0.20 / 0.035

Current Market Capitalization: ~$18.3 million Canadian

Corporate Website: www.DIAGNOS.ca

DIAGNOS' share price is poised for significant upside revaluation as its vision loss prevention Computer Assisted Retinal Analysis (CARA) business targeting diabetics has, as of this fiscal Q3 (ending December-2016), turned profitable and its revenue growth curve is rapidly accelerating with no stop in sight.

- Able to cost effectively screen millions of diabetics; proprietary algorithms are capable of automatic detection of pathology in retinal images and lesion classification.

- Big Pharma now converting pilot programs to lucrative growing contracts for ADK.V (Novartis & Bayer are customers).

- ADK.V now positioned to target hospitals and clinics in USA.

- Governments are now starting to see the value in having ADK.V screen diabetic populations in order to contain costs.

| |

DIAGNOS Inc. (TSX-V: ADK) (US Listing: DGNOF) (Frankfurt: 4D4) is a Canadian-based healthcare software technology company, its 'Computer Assisted Retinal Analysis' (CARA) business applies artificial intelligence in the diabetes market which non-invasively identify patients at risk of vision loss. The announcement this April-2017 of new operations in Bangladesh brings to 15 countries in total of installations for DIAGNOS' CARA technology platform worldwide, this number and related metrics are only just getting started with the company in the early stages of a vertical growth trajectory.

Fig. 1 Retinal image enhanced with DIAGNOS software, prepped for A.I. auto-detection of pathology & lesion classification.

Valuation Commentary: DIAGNOS Inc. is expanding globally as a first-mover in this sector with proprietary disruptive technology whose adoption is quickly gaining momentum, doctors and specialists strongly endorse it as large numbers are non-invasively screened that would otherwise not be seen. ADK.V's revenue growth curve is rapidly accelerating with topline >100% Y/Y. Swiss pharmaceutical giant Novartis has become the Company's biggest customer, initially engaging ADK.V for a series of pilot 'wellness' programs over the last couple years in various countries, paying DIAGNOS to screen patients. Recently Novartis has begun converting pilot programs into contracts, with more on the way due to the overwhelming success in identifying patients that could benefit from Novartis' treatment. German pharmaceutical company Bayer has only recently engaged ADK.V with similar intentions. DIAGNOS recently signed a contract with an unnamed pharmaceutical company targeting the US, the world's largest healthcare market. ADK.V has also started to sell its solutions to governments on a cost-reduction approach, recently signing its first government contract in Mexico. Supported by a strong growth and recurring revenue model, and a low cost growth associated with its artificial intelligence software, we expect shares of ADK.V to rise several multiples higher than its current price near-term.

DIAGNOS' current market cap of ~$18.3 million Canadian (recently trading at ~$0.13/share) is minuscule compared to where it appears headed based on contracts in hand, momentum, and potential. As the reality of the accomplishments and potential are understood by the marketplace we anticipate the share price of ADK.V will move nearer to 50 cents to better reflect its current inherent value. Further below we document compelling projected transaction and revenue numbers; Further below is document compelling projected transaction and revenue numbers, important to note is that the Company's fiscal Q3 (ending December-2016) showed profitability, and the Company is expected to experience increasingly robust financials going forward. Patient tests per month were ~22,000 this October, are expected to be ~26,000 for November, and are expected to increase to between 60,000 - 70,000 patients per month in 2017. As impressive as those increases in patient tests are, it is only just the beginning. How big will this get? The answer is 'we just don't know', but there are numerous indicators ADK.V is going on a massive run; experts believe there are ~500 million diabetic individuals worldwide (source: WHO) and the Company's adoption growth curve for its technology is very early stage. The Company negotiates its pilots with Pharma so that upfront costs are covered, ensuring it has a big enough commitment so that DIAGNOS rarely needs to spend money up front on incremental business. With four deployment options for its technology, all running at least 55% margin per transaction, ADK.V has impressive revenue projections based on committed contracts alone. Future projections are certain to improve as the level of new inquiries now coming into the Company and discussions regarding new business from big Pharma, governments, hospitals, and clinics world-wide now are off the chart. Often there is lag for new business from initial pilot (dipping their toe) to commitment (full plunge into larger contract), but as DIAGNOS has proved with Novartis and the Government of Mexico (see February 14, 2017 news entitled "DIAGNOS announces contract extension with the Mexican government and an update for a two-year potential national coverage program") -- it's a win-win for everyone to be in business with DIAGNOS. Where this is headed is truly exciting, the long-term strategy for the Company is to eventually shift more toward standalone deployment of its technology (which has highest margins for the Company), with others/partners carrying the operating costs, and DIAGNOS acting as a centralized world-wide cloud-based database/processing center (a secure state-of-the-art facility in Montreal where its software enhances and analyzes retinal images of patients) handling large volumes of transactions. DIAGNOS' current market cap of ~$18.3 million Canadian (recently trading at ~$0.13/share) is minuscule compared to where it appears headed based on contracts in hand, momentum, and potential. As the reality of the accomplishments and potential are understood by the marketplace we anticipate the share price of ADK.V will move nearer to 50 cents to better reflect its current inherent value. Further below we document compelling projected transaction and revenue numbers; Further below is document compelling projected transaction and revenue numbers, important to note is that the Company's fiscal Q3 (ending December-2016) showed profitability, and the Company is expected to experience increasingly robust financials going forward. Patient tests per month were ~22,000 this October, are expected to be ~26,000 for November, and are expected to increase to between 60,000 - 70,000 patients per month in 2017. As impressive as those increases in patient tests are, it is only just the beginning. How big will this get? The answer is 'we just don't know', but there are numerous indicators ADK.V is going on a massive run; experts believe there are ~500 million diabetic individuals worldwide (source: WHO) and the Company's adoption growth curve for its technology is very early stage. The Company negotiates its pilots with Pharma so that upfront costs are covered, ensuring it has a big enough commitment so that DIAGNOS rarely needs to spend money up front on incremental business. With four deployment options for its technology, all running at least 55% margin per transaction, ADK.V has impressive revenue projections based on committed contracts alone. Future projections are certain to improve as the level of new inquiries now coming into the Company and discussions regarding new business from big Pharma, governments, hospitals, and clinics world-wide now are off the chart. Often there is lag for new business from initial pilot (dipping their toe) to commitment (full plunge into larger contract), but as DIAGNOS has proved with Novartis and the Government of Mexico (see February 14, 2017 news entitled "DIAGNOS announces contract extension with the Mexican government and an update for a two-year potential national coverage program") -- it's a win-win for everyone to be in business with DIAGNOS. Where this is headed is truly exciting, the long-term strategy for the Company is to eventually shift more toward standalone deployment of its technology (which has highest margins for the Company), with others/partners carrying the operating costs, and DIAGNOS acting as a centralized world-wide cloud-based database/processing center (a secure state-of-the-art facility in Montreal where its software enhances and analyzes retinal images of patients) handling large volumes of transactions. |

The CARA Platform is currently being utilized in multiple countries & gaining momentum.

| The Company's retinal analysis business was incepted in the wake of the downturn in the mining sector a few years back, DIAGNOS was focused on data analysis in that sector and made the decision to springboard off its platform and expertise in artificial intelligence to build the application it has now in order to fill the gap between doctors and specialists. ~Four years ago the Company launched with zero clients, proved its concept in 2015 and 2016, and is in 12 countries with pharmaceutical companies today (10 countries with Novartis). DIAGNOS just became operational with wellness programs in three new countries (Nigeria, Kenya, and Malaysia) this November-2016.

Besides Novartis and Bayer investing increasingly more capital towards DIAGNOS, the contacts and introductions that have been made by pharmaceutical companies in all those countries to date have themselves created a flurry of new interest in DIAGNOS that is expected to translate to additional opportunity for the Company to expand and gain additional momentum.

Once DIAGNOS is in a country it gets introduced to all the government departments, hospitals, and clinics; DIAGNOS develops its own contact with them. The first major government deal with the Mexican government was recently signed for ADK.V to screen up to 106,000 diabetics by year end. DIAGNOS can now rely on larger monthly revenues. The Latin America market is one of the largest market for this kind of automated analysis of medical images. |

Saving vision by reducing congestion at specialists

DIAGNOS sells an automated system to screen patients for eye diseases. Its system takes a pictures of a person's eyes, and then uses an artificial intelligence image-recognition algorithm to assess the patient's risk of over 20 eye diseases. If it detects a risk, it refers the patient to a retinal specialist doctor, who prescribes the appropriate medication or treatment. Because the images can be sent over the internet, the doctor can be in a different physical location confirming the diagnostic.

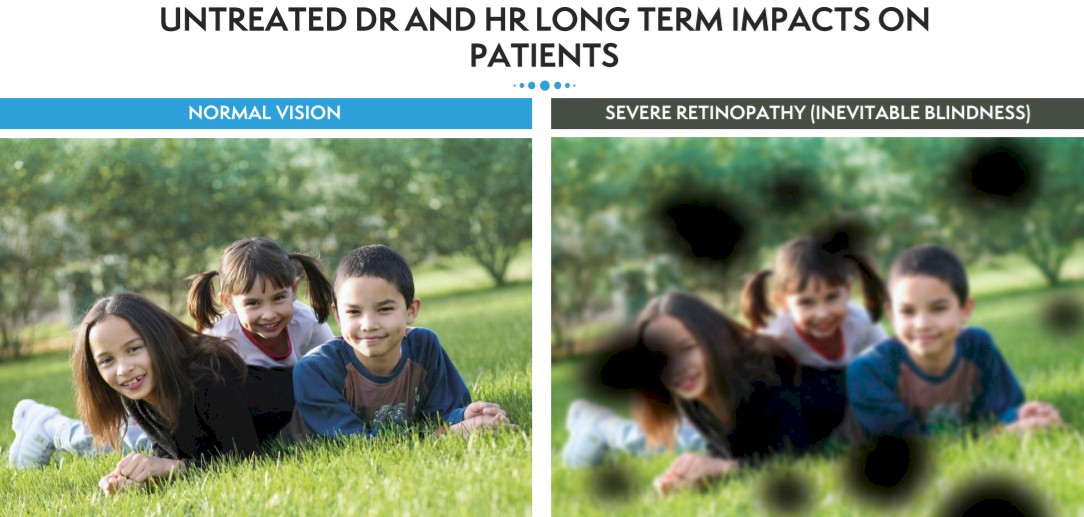

The diseases targeted by the algorithm include the leading causes of blindness among adults, such as diabetic retinopathy and aged-muscular degeneration. According to the World Health Organization, 347 million people have diabetes worldwide (many experts believe that number is low and actually closer to 500M), of that number 0.1% of people with diabetes will lose their vision completely per year if not screened, that translates to 347,000 people per year that will go blind from a curable disease if they are not screened. These diseases are treatable with existing medicine but only if caught in the early stage. However, people at risk are not getting their eyes checked regularly, and therefore going blind unnecessarily, for the following reasons:

A). There is a shortage of retina specialist doctors. There are just ~1,800 retina specialists in the US versus ~42 million diabetics. Clinical guidelines suggest that every diabetic be screened for diabetic retinopathy once a year, obviously impractical for such a large number to be screened under traditional methods by so few specialists. In less developed countries the ratio of specialists to diabetic population is even worse compared to the US and Canada. By using an algorithm to screen patients, DIAGNOS ensures that only those at risk see a doctor, which relieves congestion in the healthcare system, while improving access to healthcare.

B). Seeing a doctor is expensive. Retina specialists can charge $300 per visit, but DIAGNOS' software driven procedure charges out at only say ~$20 per visit, and this fee can be paid by the pharmaceutical company rather than the patient.

C). Seeing a doctor is inconvenient. Retina specialists tend to be located in urban areas, and therefore may be inaccessible for rural populations. However, DIAGNOS' system could be installed in Primary Care Facilities, or stores such as Walgreens and Wal-Mart, which are beginning to provide low-cost healthcare services, further improving access to basic healthcare. Theranos Inc., an American privately held health technology company which developed a simple blood test that could be deployed in a similar manner, had signed a partnership agreement with Walgreens and ramped up to ~$9 billion valuation (Theranos has since had tech issues and pulled back, unlike Theranos tough DIAGNOS' technology has been able to withstand rigorous vetting). Often there is also a general lack of advertising targeting diabetics as to where they can be tested. Additionally, specialists in some countries are caped by quotas.

| Diabetic Retinopathy is a Treatable Disease

- Early detection and treatment can prevent 85% to 95% of blindness cases.

- The patient may experience no symptoms until the condition is severe.

- People who are unscreened are more likely to:

- Present in the ER.

- Become blind.

- Have other complications. - People who are screened tend to take better care of their diabetes.

|

The Solution: Early screening using artificial intelligence software

DIAGNOS' Computer Assisted Retinal Analysis (CARA) Platform - DIAGNOS already has FDA approval as a medical device. The DIAGNOS solution fills the gap between the doctors and the specialist. Making the general practitioner able to manage vision lost for all diabetic patients by having access to this technology.

Regulatory Compliance:

| ISO 9001:2008 | Certified | | ISO 13485:2003 | Certified | | Canadian Medical Devices Conformity Assessment System | Certified | | Health Canada | Approved - Class 2 Medical Device | | FDA | Approved - Class 2 Medical Device | | CE Mark | Approved |

Fig. 4 CARA screening. |

DIAGNOS' test is painless and quick, generally taking 2 - 3 minutes maximum, its one flash, the company takes the original image and enhances it to make it easier to read and then the algorithms do the interpretation.

Having artificial intelligence in the loop to take care of a very demanding interpretation task that requires a high degree of proficiency, consistency, and accuracy 24/7 is a great benefit to specialists. DIAGNOS' software can operate at the same high level all day long, where as traditional methods rely upon alertness of humans.

Automatic Detection and Triage

DIAGNOS' algorithms are capable of:

• Automatic detection of pathology in retinal photographs.

• Lesion classification.

• Pre-triaging patients in order of severity.

Figure 5 (above) Automated triage can help reduce healthcare labor requirements while increasing patient access to quality care and reducing healthcare expenditure.

DIAGNOS ends its patient screening session by returning to the patient a copy of the image of their own eye, either by email, or smart phone, or a printed copy. That way they can see inside their own eyes, it makes an impression on the client to be more conscientious of their health. From the patient's perspective screening gives a visual representation of how well someone is managing their diabetes, leading to increased awareness, and increased compliance with diabetes management.

Economics

Because people are not being screened regularly, they are losing their vision unnecessarily. This is also a problem for pharmaceutical companies, since they are missing out on drug sales. It is estimated that only 30% of people at risk have their eyes checked on an annual basis. Increasing that rate to 90% would triple the drug sales, while reducing the number of individuals who go blind by 85%. This creates a win-win situation for patients and drug companies. The pharmaceutical companies pay DIAGNOS to screen people, but make their money back through higher sales of their patented drugs.

Value Propositions:

| Patient | • Convenient non-invasive test.

• Trip to specialist only if necessary.

------ ------ ------ ------ ------ ------ | | Diabetologist/ GP / Endo | • Higher patient compliance.

• Additional pertinent patient information.

DIAGNOS is aiming to target hospitals and clinics. Putting a camera in a clinic with say 12 doctors operating out of it makes sense; it would allow the doctors to get results on the spot and provide a higher level of care for their patients.

------ ------ ------ ------ ------ ------ | | Retina Specialist | • Increased focus on treatable cases.

• Increased revenue.

DIAGNOS does not compete with specialist as the Company's algos do not diagnose, they flag patients most at risk with indicators to see the specialist.

------ ------ ------ ------ ------ ------ | | Pharmaceutical Company | • Increased drug sales volume.

Novartis' main Dibetic Retinopathy drug is Lucentis, Bayer's is EYLEA, specialists inject the drug into the eye. The relationship DIAGNOS has had with Pharma has been developing over the last 2 - 3 years but has only now begun to bloom.

[Note: In Canada the drug companies charge ~C$1,800 for a dose, and once a patient gets under the drug its 4 to 7 times per year and treatment averages for ~4 years.]

------ ------ ------ ------ ------ ------ | | Insurance Company | • Increased patient compliance.

• Decreased health plan expenditure.

------ ------ ------ ------ ------ ------ |

Government | • Significant cost avoidance mid/long term.

• Positive political optics.

The old saying "A stitch in time saves nine" rings true. The cost of managing diabetic populations that have not been getting screened properly is exploding. In the case of Mexico, for example, ~7 years ago diabetics took up ~6% of the country's medical budget, now it is ~27% of their medical budget. Fact is, there is not enough money and it is endangering the quality of patient care. Health Services is the largest ministry in Mexico, they take care of >8M diabetics.

DIAGNOS has spreadsheets with analysts in the US, at Medicaid and Medicare, that show the savings simply from preventing diabetics going blind, forget everything else that DIAGNOS can help combat, the Company can save in the state of Florida alone over $6 billion over the next 20 years (Note: DIAGNOS is in proposal stage with Florida at the moment). It is expected that in 2018 Medicaid and Medicare will be establishing new guidelines for screening and are expected to be spending substantial amounts on screening programs. Government involvement with DIAGNOS is the big prize for shareholders; when key news is announced, we anticipate it will act as a major catalyst that will supplant all current projections and cause a dramatic upside revaluation in share price, well above what is being discussed here today.

------ ------ ------ ------ ------ ------ |

Additional value propositions stem from interaction with a largely uneducated market; retina screening can be used as an opportunity to educate, important since less than 10% of people diagnosed with diabetes are given diabetes self-management training.

Medical Software Has the Mechanics of a Great Business

When mature, DIAGNOS promises to provide investors with a steady stream of recurring revenues, with minimal maintenance capex requirements, three hallmarks of a robust business. The revenues are recurring since people must have their eyes checked annually. Those at risk, such as diabetics and seniors, are stuck with their condition for the rest of their lives, which means decades of repeat sales for DIAGNOS. The sales are reliable because healthcare providers rarely change application software once it becomes ingrained in the system, due to high switching costs. Another strength of DIAGNOS' business model it is scalable and a low marginal cost of growth, a feature common to other application software companies. Since the software is developed upfront, the marginal cost of growth is miniscule, allowing the additional revenue to fall to the bottom line.

Sunny Macro Supports DIAGNOS

A number of macro tailwinds support the technology's adoption. The diabetic population is growing at 10% to 12% per year. The population of seniors and diabetics, two demographics at risk of blindness-causing eye diseases, continue to grow. These two demographics also vote, which incentivizes politicians to see the technology adopted. Companies such as Walgreens and Wal-Mart are looking to offer low-cost healthcare services in their stores, which could be the perfect location for a DIAGNOS' system.

With the number of seniors in the world expected to hit one billion by the end of the decade, charging each $10 to scan the eyes of every senior means the market will be worth $10 billion per year. DIAGNOS generated annualized sales of less than $1 million last year, meaning less than 0.01% of the market has been penetrated. But the company is growing sales at 300% per year, and the rate of test per month is increasing, as shown in the table below.

Company growth on a test basis

Table 1. (Below) Patient tests month over month. Source: Company disclosures.

Note the recent dramatic increases in patient tests month over month; it took a while but all those Pharma pilots are now converting to contracts and growing fast. Patient tests per month were ~22,000 this October, are expected to be ~26,000 for November, and are expected to increase to between 60,000 - 70,000 patients per month in 2017.

Company growth this fiscal year

Table 2. (Below) Revenue 2017 fiscal year. Source: Company disclosures.

The quarterly sales growth rate has increased from the past three quarters. Furthermore, DIAGNOS recently signed a contract with an unnamed pharmaceutical company targeting the US, the world's largest healthcare market. The company also signed its first government contract in Mexico and is looking at Latin America as a large potential market. This suggests the company's sales could be hitting an inflection point, which could see its congestion-relieving software gain the critical mass to be globally adopted.

[*FYI: CARDS stands for 'Computer Aided Resources Detection System', CARDS revenue comes from the remnants of DIAGNOS' mining data analysis business which it is phasing out.]

Company growth year over year including 2018 forecast

Table 3. (Below) Revenue 2015 - 2018. Source: Company disclosures.

DIAGNOS' fiscal year end is in March. DIAGNOS believes it will hit at least $6.6M in CARA revenue for next year, that is a conservative low figure, as depending on what it does in this Q4 the revenues for next year could very easily become $10M or $12M. The growth curve is NOT going to stop as the diabetic population keeps growing and DIAGNOS is so effective at early screening it is quickly now developing a reputation as the best option out there.

NOTE: Right now Bayer is going to be doing a pilot in Canada with DIAGNOS starting in January 2017, they are going to pay DIAGNOS to screen a small population of diabetics to see if what has been observed in other parts of the world are occurring in Canada too. DIAGNOS is confident the results are going to be the same. DIAGNOS currently has a program running with Bayer in Columbia right now. What happens with Bayer is not reflected in the financial projections, however if what occurred with Novatris' pilots is any indication of what to expect then 2018 projections will have yet another revision upwards.

------ ------ ------ ------ ------ ------

Qualitative Points that Support DIAGNOS' Business

While DIAGNOS has a disruptive healthcare technology that looks poised to become a robust business, valuing the Company at such an early stage of adoption for its technology and business model is challenging, especially with the Company only this fiscal Q3 (ending December-2016) demonstrating a turn to profitability. An analysis of qualitative factors provides further support that the shares are due for significant upward revaluation:

1. FDA approval and growing sales to Pharmaceutical imply the technology is effective.

The fact that the FDA has approved the product, and Novartis + Bayer are paying to use it (and are upping their capital investments), confirms that it works.

2. Smart money investors already own a large block of the shares.

Management and friendly shareholders (including Dundee: ~18%, Renauld Family: ~8%, Investment partners NJ: ~8%) own more than 40% of the outstanding shares.

3. No competitors have contracts with pharmaceutical companies and governments.

While some other companies are developing similar software systems, DIAGNOS is the first-to-market and the only one to have a contract with a major pharmaceutical companies and government. The presence of competitors can actually help the adoption of the technology, as other firms will share the cost of developing the market. Since buyers would compare systems anyways, competitors could prove to be advantageous for DIAGNOS.

Note: Competitors have not managed to do what DIAGNOS can do. For example in the US only one other competitor has FDA approval on part of their platform, but they don't have any algorithms to automatically detect the lesions on the retinas (that artificial intelligence is the important piece).

4. First solution for government cost control over diabetes.

By providing an economic model that demonstrates clearly the saving of wellness program or prevention programs, to insure patients don’t go blind and carry the expensive treatment that follows. DIAGNOS has put together the first economic model to help governments curve the cost burden of diabetes. |

In contrast to some other names in the healthcare sector, DIAGNOS' management has been more interested in running the business than promoting the stock. With the Company's turn to profitability closing out 2016 and a ramp-up of patient tests on tap, more attention is headed the Company's way, and we expect management will dedicate more resources on responsibly relaying its story to potential investors.

As the company continues to penetrate the >$10Billion dollar market and revenue explodes to the upside, the company will undoubtedly attract more attention from the Pharma companies that sell into that market. ADK.V could be a great tuck-in acquisition for large Pharma companies already selling into the market. Earlier this year, Welch Allyn, an American medical device maker, bought a competitor to DIAGNOS for an undisclosed sum. The acquired company, called Hubble Telemedical, was developing a similar software, but Hubble was a few years behind DIAGNOS (the clear advantage ADK.V has over competition is its proprietary artificial intelligence algorithms).

------ ------ ------ ------ ------ ------

Fig. 6 Eyes tell volumes about cardio vascular health. | DIAGNOS' R&D team is focused on innovation and evolving the platform.

DIAGNOS is working at a new application that will evaluate the risk of cardiovascular issues using the same images as for the retina evaluation.

Future - Cardiovascular: DIAGNOS is working at a new application that will evaluate the risk of cardiovascular issues using the same images as for the retina evaluation. The company is focusing on using its technology to help general doctors in the world by providing real technology tools based on its artificial intelligence platform. Cardiovascular issues are affecting most of the population worldwide. The total market size is $187B in drugs and services.

[FYI: Already 10% of the market for DIAGNOS that is screened now are people that are at risk of being diabetic mainly because they have high blood pressure. If you have high blood pressure and are 60 years old and over, then you are at risk of developing retinopathy.] |

Valuation Points to $1.00/share

The combination of variables we could input on assumptions are infinitesimal in projections, however simply extrapolating conservatively off of contracts in hand, continuation of current growth penetration rates Y/Y, rate of conversions, the fact revenues are expected to conservatively hit an annualized rate of $6.8 million next year, and assuming a continuation of straight-line adoption (it actually appears that ADK.V is way early in the adoption curve and the curve is more likely to be parabolic or hyperbolic), we project the following minimums:

Straight-line adoption:

| Total Market: | $10B | $11B | $12B | $13B | $14B | | Year-end Mar. 31: | 2017 | 2018 | 2019 | 2020 | 2021 | | Share of market: | 0.035% | 0.063% | 0.115% | 0.23% | .28% | | Revenue for ADK: | $3.5 M | $7 M | $18M | $30M | $40M | | Net Profit : | $,7 M | $1.4M | $3.6M | $6.0M | $8.0M | | Value Share Target Price (minimum): | $.20 | $.40 | $.60 | $1.00 | $1.33 |

Parabolic/hyperbolic adoption (as is more likely the case) will yield significantly higher numbers. With a disruptive technology targeting a >$10 billion+ market, a robust business model, and attractive macro and qualitative factors, ADK.V is a hidden gem at its current trading price. Based on forward discounting metrics a share price closer to 50 cents Canadian in the near-term for ADK.V is appropriate.

------ ------ ------ ------ ------ ------ ------ ------

Below is expanded insight on DIAGNOS Inc. and its technology. | | |