- ACB released its Annual Information Form on 31-Mar-17 in relation to its financial year-ended 30-Jun-16

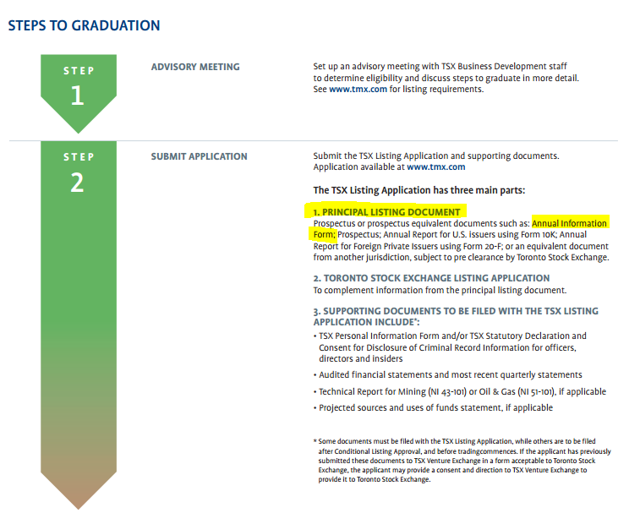

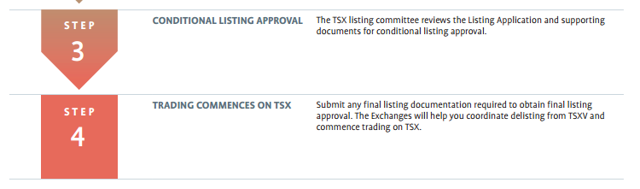

- What's interesting here is that ACB is not obligated to release an AIF (source) as a venture issuer (ACB trades on TSXV). Is this ACB's "prospectus equivalent" document to apply for graduation to TSX? More on that below

- I have scanned the AIF and I will summarize findings that I found valuable and were not covered in detail in my last blogpost here

Findings

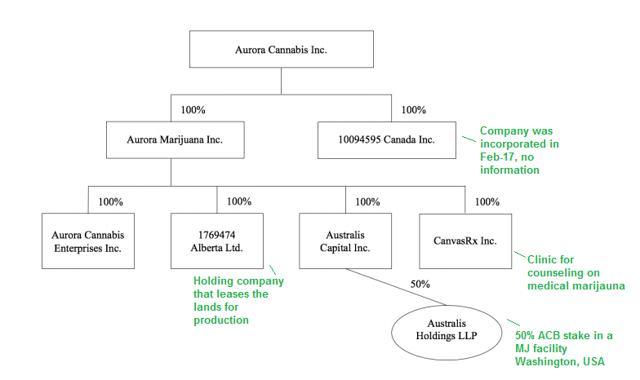

Organizational Chart

- Easy to forget with all the activities in Canada that ACB loaned $1M into Australis Holdings LLP to acquire 24.5 acres of land worth $2.3M US in Washington. At the moment ACB has focused its expansion projects in Canada, no news on Washington project

Loans from Management to help ACB Survive the last 3 Years

- 29-Aug-14: $1.5M loan received from company controlled by Booth and Dobler. Entire loan eventually converted into shares by Sep-15

- 1-Apr-15: $2.5M loan received from company controlled by Booth and Dobler. Loan was repaid in full by Aug-16

- 26-Jun-15 and 1-Oct-15: $3M loan received from company controlled by Booth and Dobler. Loan repaid in full

Over the years, the company controlled by Booth and Dobler (Superior) lent $7M to sustain ACB operations.

For the last $3M loan, the AIF specified the loan was repaid following year-end with no specified dates. This was strange given that all other loans had a payoff date.

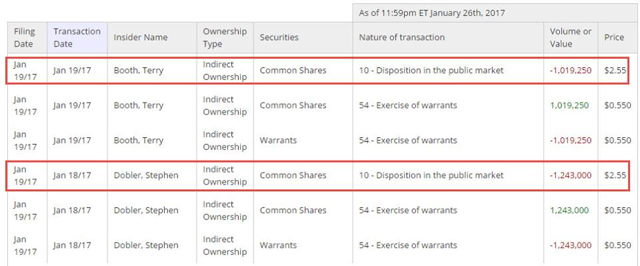

Based on discussions with management, I suspect the $3M loan was repaid when Booth and Dobler exercised their grants and sold shares on the market in Jan-17.

When I enquired with Cam Battley about the above insider sale, he told me it was to repay the loan to Superior, a company that needed the cash for its own projects. This could all be coincidental, but seems reasonable.

Roughly 1 year in the Game

- ACB received license to produce and sell medical cannabis on Feb-15 and Nov-15 respectively

- ACB received license to produce and sell cannabis oil on Feb-16 and Jan-17 respectively. Oils are not available for sale, company did make note of stockpiling for sales

- Per AIF, $8/g average price, $5/g compassionate price

- 79 employees as of Jun-16, 140 employees as of Mar-17

- As of AIF date (31-Mar-17), 344M shares are outstanding or 396M fully diluted

Competent Management and Board of Directors

I was quite pleased learning about the history of management and directors. I'll mention the ones I found noteworthy.

- Booth (C.E.O): Part owner of Superior Safety Codes (SSC)

- Dobler (President): Engineer + part owner of SSC

- Szweras (Director): Lawyer, Partner at Fogler, Rubinoff LLP

- Rifici (Director): CPA, CEO of Nesta (Oct-15), previously CEO of Tweed (2 years) now Canopy Growth

- Singer (Director): CPA, CFO of Clementia Pharmaceuticals (May-15) and CFO of Bedrocan (1 year)

- Fishman (Director): CEO of Teva Canada Limited

- Moral (Director): CEO of Canadian Cannabis Clinics

- Stephenson (NASDAQ:CFO): CFO of Bedrocan until Apr-16

- Belot (Chief Brand Officer): Executive Director of Canadian Medical Cannabis Industry Association

- Battley (Executive VP): President of Health Strategy Group Inc.

Management currently owns 40M shares, representing 11.7% of total outstanding common shares (344M).

- Of the 40M, 13M is owned by Booth and 16M by Dobler

- Booth also has 112k of purchase warrants to purchase at $3 by Mar-2019, 350k incentive options to purchase at $2.25 until Aug-2021, and 1.2M incentive options at $2.26 until Mar-2022

- Dobler also has 350k incentive options at $2.25 until Aug-2021, 1.2M incentive options at $2.26 until Mar-2022

Cease Trade Orders, Bankruptcies, Penalties, Sanctions

- Declaration was made that no director or executive officer of the company, for the last 10 years, has been subject to cease trader order, worked in a company that went bankrupt/insolvent/compromise with creditors, or subject to penalties or sanctions

Legal Proceedings

- ACB settled all claims and is no longer subject to any legal proceedings

- One settled claim of interest, is the one that initially commenced on Dec-15, and was finally settled on Jan-17

- The claim was for 9M warrants at $0.02 per common share prior to the RTO (dating back 2 1/4 years) and 3M performance warrants at $0.02

- The settlement was 8M warrants were allowed to be exercised at $0.02, and remaining 4M cancelled. What a victory for the plaintiff. #8M x ($2.25 - $0.02) = $17.8M settlement if they exercised the warrants and sold the shares

Why Release an AIF?

- Why did ACB issue an AIF? If someone can provide guidance for venture issuers that I have missed, please comment below.

- Based on Ontario Securities Commission website, Non-Venture Issuers (TSX) are required to release AIF within 90 days of their year-end (source). Venture issuers (TSXV) are not required

Is ACB Gearing up for Graduation to the TSX?

- Based on above graduation steps from TSXV to TSX(source), it appears the key principal listing document is a "prospectus or prospectus equivalent" such as an ANNUAL INFORMATION FORM

- As I mentioned before, there is no requirement for venture issuer to release an AIF (as far as I know), especially more than 8 months since its year-end.

- Food for thought: ACB has never issued an AIF in the past

Disclosure: I am/we are long ACBFF, APHQF, HYYDF, TWMJF.