RE:French Policy not working in FG.

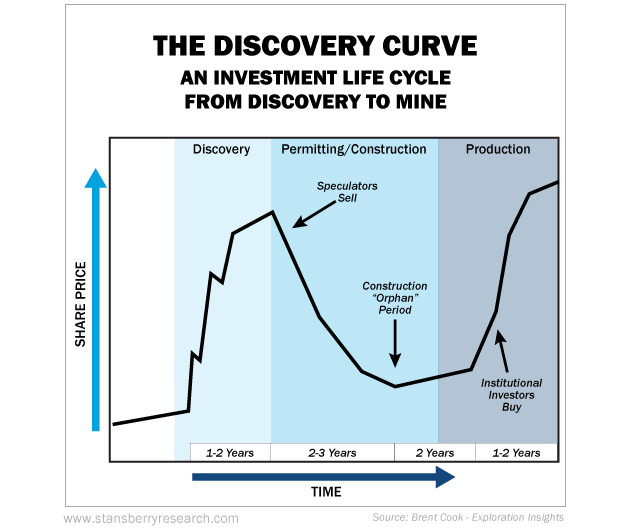

I think this chart while simplified still captures what we are looking at with regard to CBGDF re., FG and Nevada. I hope that it helps to support my reasoning in calling for Guistra splitting this company into two and sooner rather than later. Nevada is very much in that explosive discovery stage while FG is in the permitting/construction. However, what is not shown on the chart is the price of gold and its impact on SP. If we have a bull gold market and if Nevada over the next 2 years adds 1- 2 mill ozs + to the already 1.6 mill + (note - Guistra said at the announcement of the maiden resource that 50% of the discovered gold 720,000 ozs was not even included in the resource estimate; it being outside the delineated pit) then we have a potentially explosive project. Andy Wallace knows Nevada and he knows all the majors there too – more importantly they all know him. He also has royalty agreements on all these Cordex claims including Eastside so he is motivated (he is not getting any younger) to drill, to define and too sell! Nevada CBGDF has real SP potential; especially, unencumbered (suitors don't want any 'politicised' project hanging around their project of interest) and in a rising gold price market driven by renowned mining leadership.

FG as shown by the chart will, on being given the go ahead, start to reflect that SP production phase but that is well off (several years?) and will with environmental opposition take even more time. From a shareholder perspective this is bad re., an increasing stock price based on time to production. However, this is also good for those with a longer term view because it means extra time to explore the area (which is huge) for resource ozs and to infill more ozs to reserve. We will eventually a much stronger SP longer term with CBGDF FG who already have an approx., 3.85 mill oz M&I and 1 mill oz Inferred . Could they add several mill oz., more over time - quite possible as ozs in reserve/resource are in part how majors are judged and NG has always been 'greedy.' With all FG challenges overcome you will have Newmont who are right next door in Suriname (1 mine) and in FG (2 sites) along with Nordgold (maybe IAG) salivating even for CBGDF's FG 45 – 15% and no need to even worry about a complicating Nevada project.

Therefore, this company split works both for CBGDF and stockholders and should reward both re the near term and long. However, failure to split will I believe see Nevada severly damaged re potential SP, while minimally impacting the CBGDF SP because of FG which suffers - 1) due to the middle phase (of the chart) that FG is in - 2) the opposition that is coming to FG and perceptual impact that will have on both potential suitors and retail/commercial investors. 3) flight of investment dollars to other explorers who are in the chart’s first phase and drilling in areas deemed less volatile than FG, while the gold price moves upward (remember gold thrives or dies on news, emotions and volatility).

Yes, correct, way too much speculation and I need to get life, so I will not be writing again until we have some serious news re., Nevada = latest 12 drill holes; FG = 36 drill holes; ESIA; NG re building $$, CBGDF re FG building $$; something out of left field.

GLTA